AUTHOR :HAANA TINE

DATE :22/12/2023

Introduction

the dynamic landscape of self employment in India, understanding the nuances of high-risk payment service providers (PSPs) is pivotal. This article aims to unravel the complexities associated with high-risk PSPs and their implications for individuals exploring self-employment opportunities.

Understanding the Indian Market

Overview of Self-Employment Trends

PsP Self-employment is on the rise in India, witnessing a notable surge as more individuals embark on entrepreneurial journeys. This section explores the current trends, the driving forces behind the growth of self-employment, and its significance in the Indian market.

Unique Challenges in India

Navigating the Indian High risk market presents distinctive challenges for self-employed individuals. This article delves into the specific hurdles they face, setting them apart from their traditionally employed counterparts.

Emerging Sectors

Identifying sectors with optimal self-employment potential is crucial for aspiring entrepreneurs. High Risk PSP for Self-Employment Options in India This section sheds light on emerging industries offering lucrative opportunities and potential growth for those venturing into self-employment.

High-Risk PSPs Explained

Definition and Characteristics

High-risk PSPs are financial entities that, due to various factors, pose a greater risk to acquiring banks. and In the context of Entrepreneur, these providers offer payment processing services but may involve elevated risks. This section provides a comprehensive definition and outlines the key characteristics of these payment service providers[1].

Examples in Self-Employment

To illustrate the practical side, real-world examples are examined to showcase how self-employed Person[2] leverage high-risk PSPs in also their businesses. Case studies offer practical insights into the application of these services within a Entrepreneur framework.

Pros and Cons

Advantages of High-Risk PSPs

High-risk PSPs come with their unique set of advantages. This section outlines the benefits that Entrepreneur individuals can derive from opting for these services. Self Employment Ideas[3] These may include faster approval processes, broader market reach, and flexibility in transaction types.

Potential Pitfalls for Self-Employed Individuals

Despite the advantages, potential pitfalls are associated with high-risk PSPs. This article discusses the risks involved, such as higher transaction fees, self-employment[4]In India potential fund holds, and the possibility of account termination. It provides guidance on how entrepreneurs can effectively mitigate these challenges.

Regulatory Environment

Legal Framework for High-Risk PSPs in India

Understanding the regulatory landscape is crucial for any Entrepreneur individual considering high-risk PSPs. This section provides insights into the legal high risk framework[5] surrounding these providers in India. It covers licensing requirements, compliance standards, and potential changes in regulations affecting Entrepreneur individuals.

Compliance Challenges for Self-Employed Individuals

Compliance can be a significant challenge in the dynamic regulatory environment. This part of the article addresses the specific compliance challenges Entrepreneur individuals might face when using high-risk PSPs. It offers strategies to stay compliant, including regular audits, adherence to industry standards, and staying informed about regulatory updates.

Navigating the Risks

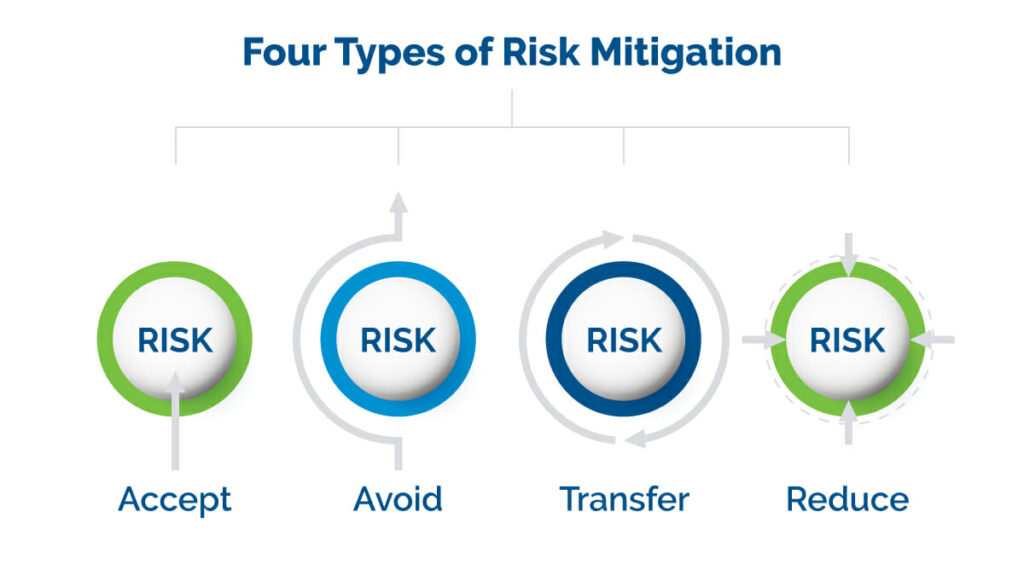

Risk Mitigation Strategies

Entrepreneurs need to be proactive in mitigating risks associated with high-risk PSPs. This section offers practical strategies to minimize potential downsides and navigate these services effectively. Strategies may include diversifying payment methods maintaining a financial buffer, and having contingency plans in place.

Best Practices for Self-Employed Individuals

What are the best practices for self-employed individuals utilizing high-risk PSPs? This part of the article explores proven methods that successful entrepreneurs employ to manage and thrive in such environments. This includes thorough research before choosing a provider, negotiating terms, and maintaining transparent communication.

Success Stories

Case Studies of Self-Employed Individuals Managing High-Risk PSPs

Inspiring success stories of Entrepreneur individuals effectively managing high-risk PSPs are showcased in this section. Readers gain valuable insights and learn from practical experiences. These stories highlight innovative approaches, challenges overcome, and the growth achieved by entrepreneurs in self-employment using high-risk PSPs.

Lessons Learned

Drawing lessons from success stories, this article distills key takeaways that aspiring entrepreneurs can apply to their ventures in self-employment with high-risk PSPs[5]. Lessons may include the importance of adaptability, continuous learning, and building strong relationships with payment service providers.

Conclusion

In conclusion, navigating high-risk PSPs in the context of Entrepreneur demands a nuanced understanding. High Risk PSP for Self-Employment Options in India This article has provided insights, strategies, and real-world examples to empower entrepreneurs in making informed decisions. By embracing the advantages, mitigating risks, and staying abreast of regulatory changes, Entrepreneur individuals can leverage high-risk PSPs as a tool for business growth and success.

FAQs

- Are high-risk PSPs suitable for all types of Entrepreneur businesses?

PSPs may be suitable for certain businesses, but not all. It depends on the nature of the business and its risk profile. Conduct thorough research and consider consulting with financial experts to determine suitability. - What are the common challenges faced by Entrepreneur individuals using high-risk PSPs?

Common challenges include higher transaction fees, potential fund holds, and compliance complexities. Self-employed individuals should be aware of these challenges and develop strategies to address them. - How can Entrepreneur individuals stay compliant with changing regulations?

Staying compliant involves regular audits, staying informed about regulatory updates, and partnering with high-risk PSPs that prioritize compliance. Seeking legal advice can also be beneficial. - Are there alternative payment solutions for Entrepreneur individuals apart from high-risk PSPs?

Yes, there are alternative payment solutions, including traditional PSPs, e-wallets, and other emerging financial technologies. The choice depends on the specific needs and risk of the self-employed individual. - What role does technology play in the future of high-risk PSPs for Entrepreneur ?

Technology is expected to play a crucial role in enhancing security measures, improving transaction efficiency, and introducing innovative features. Self-employed individual,s should stay updated on technological advancements to leverage them for business growth.