AUTHOR: AYAKA SHAIKH

DATE: 20/12/2023

Introduction

High Risk In recent years, India has witnessed a surge in Payment Service Providers (PSPs), offering various services to businesses and consumers alike. However, not all PSPs are created equal, and some come with inherent risks, PSP For Transmission especially when dealing with specific industries like the transmission fluid sector

Importance of Transmission Fluid

Before diving deep, let’s address the elephant in the room: Why is transmission Fluid in India? Well, it’s the lifeblood of your vehicle’s transmission system, ensuring smooth gear shifts and preventing wear and tear. High Risk PSP For Transmission Given its significance, the procurement and sale of transmission fluid require secure and reliable payment methods

Risks Associated with High-Risk PSPs

Fraudulent Activities

One of the primary concerns when dealing with High Risk PSP For Transmission Fluid in India is the potential for fraudulent activities. These PSPs may not have robust security measures in place, making them susceptible to cyber-attacks and unauthorized transactions.

Lack of Security Measures

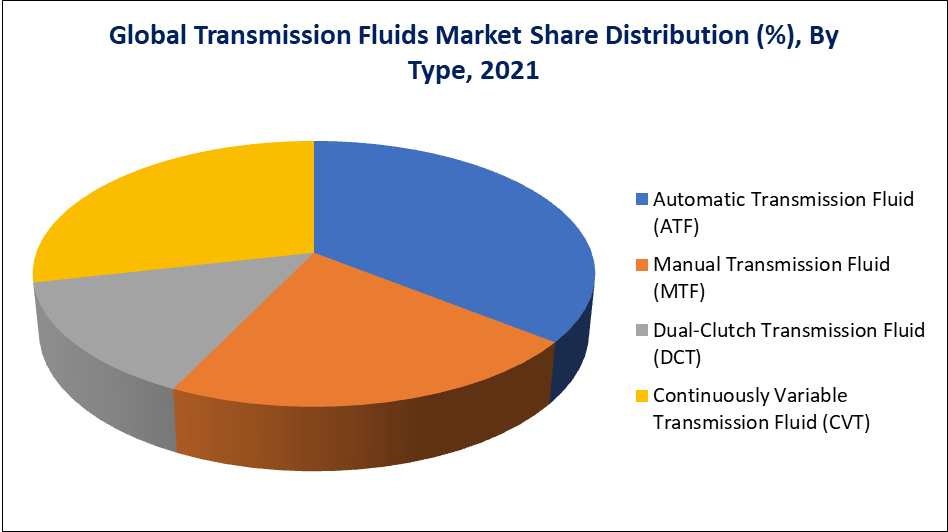

Security should be paramount when selecting a PSP. Unfortunately, some high-risk PSPs compromise on security measures, Automatic Transmission Fluid[1] putting businesses and consumers at risk of data breaches and financial losses. high risk PSP for Transmission fluid in India High Risk PSP For Transmission Fluid in India

Regulatory Concerns

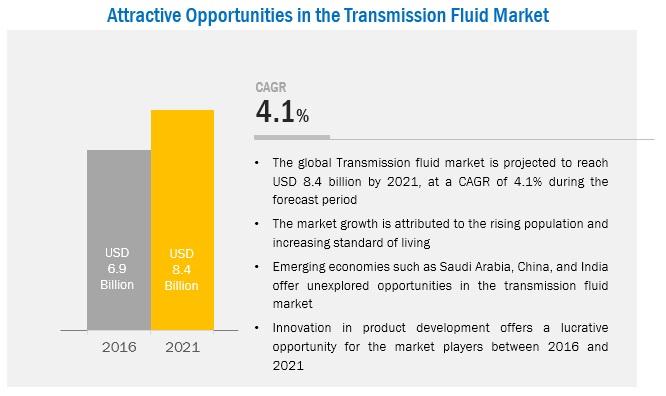

Another critical aspect to consider is regulatory compliance. High-risk PSPs may not adhere to the stringent regulations set forth by governing bodies, Transmission Fluid Market[2] leading to legal complications for businesses.

Common High-Risk PSPs in India

Overview

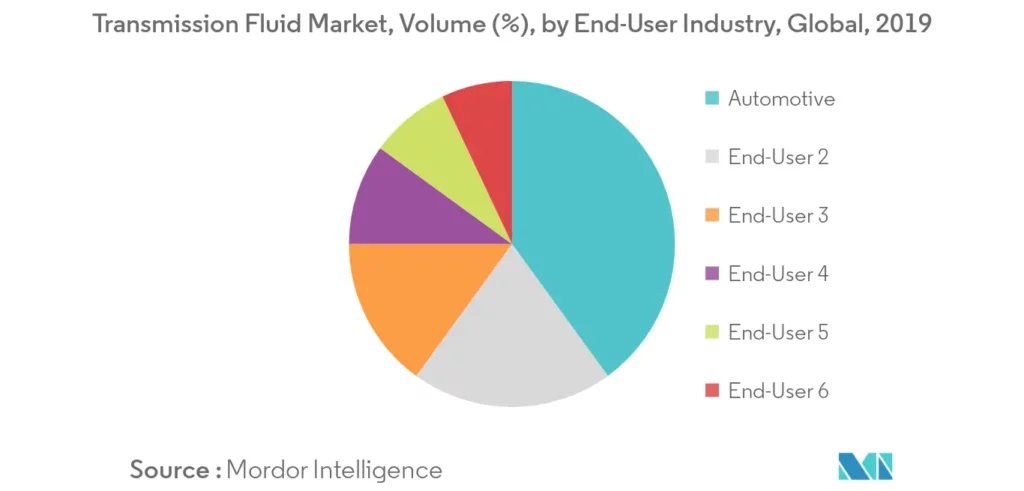

Several PSPs in India fall under the high-risk category[3], primarily due to their questionable practices and lack of transparency. high risk PSP for Transmission fluid in India

Key Features

From exorbitant fees to hidden charges, these PSPs often lure unsuspecting businesses [4] with attractive offers, only to disappoint them with subpar services and support.

How to Identify a High-Risk PSP

So, how can you identify a high-risk PSP? Look for red flags such as poor customer reviews, lack of transparency, and questionable business practices. Perform extensive investigations and seek advice from industry specialists before finalizing your choice.

Impact on Business

Choosing the wrong PSP can have severe repercussions for your business, ranging from financial losses to damage to your reputation. High-Risk Payment Processor[5] It’s crucial to exercise due diligence and select a reputable PSP that aligns with your business needs and values.

Tips for Selecting a Reliable PSP

Navigating the intricate landscape of PSPs can be daunting, but with the right approach, you can identify a reliable partner for your transmission fluid business in India. Here are several pointers to steer you in the right direction.

Conduct Background Checks

Before engaging with a PSP, conduct thorough background checks. Look into their financial stability, client testimonials, and track record. A reputable PSP will have a solid reputation and a proven track record of delivering exceptional service.

Evaluate Security Measures

Security should be a top priority when selecting a PSP. Ensure that they have robust security measures in place, such as encryption technologies, High Risk Merchant Accounts fraud detection systems, and compliance with industry standards. This will help safeguard your business and protect sensitive customer data.

Transparent Pricing Structure

Beware of PSPs that offer too-good-to-be-true pricing structures. Scrutinize their fee schedule, including transaction fees, monthly charges, and any hidden costs. A transparent PSP will provide clear and upfront pricing, allowing you to budget accordingly and avoid unexpected expenses.

Customer Support

High-risk Business Choose a PSP that offers excellent customer support. In the event of technical issues or disputes, you’ll want a responsive and knowledgeable support team to assist you promptly. Test their customer support channels, such as phone, email, and live chat, to ensure timely assistance when needed.

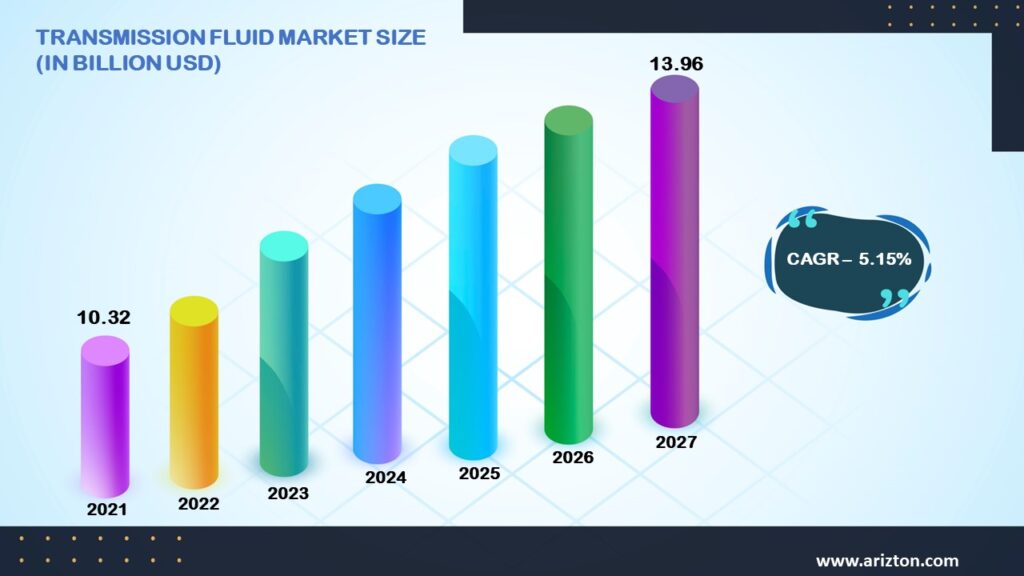

The Future of PSPs in India

As India continues to embrace digital transformation, the role of PSPs will become increasingly vital. With advancements in technology and evolving consumer preferences, PSPs will need to adapt and innovate to meet the changing demands of the market. This includes implementing cutting-edge technologies, enhancing security measures, and providing tailored solutions for specific industries like transmission fluid.

Conclusion

In summary, navigating the world of PSPs, especially when dealing with transmission fluid in India, requires caution and diligence. By understanding the risks associated with high-risk PSPs and taking proactive measures to mitigate them, you can safeguard your business and ensure smooth operations.

FAQs

- What is a High-Risk PSP?

- A High-Risk PSP is a Payment Service Provider that poses significant risks to businesses due to fraudulent activities, lack of security measures, and regulatory concerns.

- How can I identify a High-Risk PSP?

- Look for red flags such as poor customer reviews, lack of transparency, and questionable business practices.

- What are the consequences of choosing a High-Risk PSP?

- Choosing a High-Risk PSP can lead to financial losses, data breaches, and damage to your business reputation.

- Are all PSPs in India high-risk?

- No, not all PSPs in India are high-risk. However, it’s essential to exercise due diligence and research before selecting a PSP.

- How can I safeguard my business from High-Risk PSPs?

- Conduct thorough research, consult with industry experts, and choose a reputable PSP that aligns with your business needs and values.