AUTHOR : LISA WEBB

DATE : DECEMBER 21, 2023

The landscape of payment service providers (PSPs) operating in India has witnessed a significant evolution, particularly in the realm of high-risk payment services. In this article, we explore the intricacies of this domain, shedding light on the role of industry collaborations in fostering growth, addressing challenges, and ensuring secure and efficient transactions.

Introduction to High-Risk Payment Service Providers (PSPs)

High-risk payment services cater to industries that typically encounter higher instances of chargebacks, fraud, or regulatory complexities. These sectors include online gaming, adult entertainment, pharmaceuticals, etc. Collaborations In India, the demand for such services has increased, but it comes with a unique set of challenges.

Challenges Faced by High-Risk PSPs in India

Regulatory Framework

Navigating through India’s regulatory landscape can be complex for PSPs operating in high-risk sectors. Striking a balance between compliance and operational efficiency is crucial PSP Industry Collaborations.

Transaction Security Concerns

Collaborations in the payment industry are fundamental for fostering innovation and ensuring the sustainability Ensuring the security of transactions is a top priority. High-risk PSPs Industry need robust security measures to safeguard sensitive financial information and prevent fraudulent activities.

Market Competition

The highly competitive nature of the payment industry poses a challenge for high-risk Collaborations to carve a niche while ensuring sustainable growth. high-risk payment service providers (PSPs). These partnerships create an environment where expertise is shared, resources are pooled, and also synergies are formed to address the challenges unique to this sector.

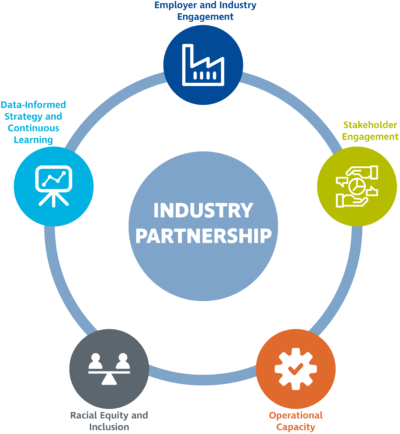

Role of Collaborations in Mitigating Risks

High Risk PSP Industry Collaborations In India ,Collaborations among industry players have emerged as a strategic approach to mitigate risks associated with high-risk payment services in India. By pooling resources and also expertise, High-Risk Payment Processor[1] collaborations offer an avenue to strengthen compliance measures and enhance fraud prevention strategies.

Successful Collaborative Efforts in India’s Payment Industry

High-Risk Merchant Account[2] Several successful collaborative initiatives have showcased the effectiveness of unified efforts in this sector. Case studies or examples highlight how partnerships have bolstered security measures, streamlined processes, and also improved customer experiences.

Future Prospects and Growth Opportunities

High Risk PSP Industry Collaborations In India The future of high-risk PSPs in India[4] is intertwined with technological innovations and also evolving market dynamics. Leveraging advancements in technology, coupled with proactive strategies, can unlock growth opportunities and reshape the landscape of payment services[3].

Collaborations in the payment industry are fundamental for fostering innovation and ensuring the sustainability of high-risk payment service providers (PSPs). These partnerships create an environment where expertise is shared, resources are pooled, and also synergies are formed to address the challenges unique to this sector.

Leveraging Collaborative Intelligence

The success of collaborations lies in harnessing collaborative intelligence. This intelligence amalgamates the collective knowledge, Payments risk management tools[4] skills, and also experiences of diverse entities within the industry. By working together, PSPs can anticipate market trends, adapt to regulatory changes, and innovate solutions that benefit the entire ecosystem.

Embracing Technological Advancements

The future of high-risk PSPs heavily relies on technological advancements. Collaborative efforts often center around leveraging emerging technologies like AI, blockchain, Risk Assessment[5] and biometrics to fortify security measures, streamline processes, and enhance user experiences.

Addressing Regulatory Hurdles Through Unity

Regulatory challenges pose significant hurdles for high-risk PSPs. Collaborations enable industry players to voice concerns collectively, engage with regulatory bodies, and work towards frameworks that balance compliance requirements without stifling innovation.

Enhancing Customer Trust and Experience

Collaborations foster a competitive advantage by ensuring a more seamless and secure payment experience for customers. Trust is built through combined efforts to combat fraud, protect sensitive data, and offer reliable services, enhancing overall customer satisfaction.

Conclusion

Collaborations among high-risk payment service providers in India stand as a beacon of hope amid regulatory complexities and market challenges. These partnerships not only fortify the industry against risks but also pave the way for innovation and sustainable growth.

FAQs

- What defines a high-risk payment service provider?

- High-risk PSPs cater to industries with higher chargeback rates, regulatory complexities, or fraud risks, such as online gaming or adult entertainment.

- How do collaborations benefit high-risk PSPs?

- Collaborations enable pooling of resources and expertise, enhancing compliance measures, and strengthening fraud prevention strategies.

- Are there specific regulatory challenges faced by high-risk PSPs in India?

- Yes, navigating India’s regulatory landscape can be intricate, requiring a delicate balance between compliance and operational efficiency.

- What role do technological innovations play in the future of high-risk PSPs?

- Innovations in technology can unlock growth opportunities, improving security measures and reshaping the payment services landscape.

- Why are collaborations essential in the payment industry?

- Collaborations foster a collective approach to address challenges, ensuring sustainable growth and enhanced security measures.