Author : Sweetie

Date : 15/12/2023

Introduction

In the ever-evolving landscape of mobile payments, High Risk PSP Mobile Payment Apps In India certain platforms are deemed high-risk, often sparking concerns among users and businesses. Let’s delve into the world of High-Risk PSP Mobile Payment Apps in India, Alternative Payment Solutions understanding their characteristics, challenges, and impact on the digital payment ecosystem.

Mobile payment applications have transformed the way we conduct financial transactions, providing convenience at our fingertips. Risk Management Payment Solutions High Risk PSP Mobile Payment Apps In India However, not all platforms are created equal. High-risk payment service providers (PSPs) in India have become a focal point of discussion due to their unique characteristics and associated challenges.

Definition of High-Risk PSP Mobile Payment Apps

High-risk PSPs are those platforms that, due to their nature or operations, pose elevated risks for users, merchants, and regulatory bodies. High Risk PSP Mobile Payment Apps In India These risks often include a higher likelihood of fraud, security breaches, and non-compliance with industry standards.

Significance in the Indian Market

As India embraces the digital revolution, the significance of mobile payment apps cannot be overstated. Understanding the high-risk nature of certain PSPs becomes crucial for users and businesses navigating the vast and dynamic digital payment landscape.

Understanding the High-Risk Nature

Characteristics of High-Risk PSPs

High-risk PSPs exhibit specific characteristics that set them apart from their low-risk counterparts. These may include a higher frequency of chargebacks, a more significant potential for fraudulent activities.

Regulatory Framework for Mobile Payments in India

The Reserve Bank of India (RBI) plays a pivotal role in regulating mobile payment apps. Understanding the regulatory framework is essential to comprehend how high-risk PSPs operate within legal boundaries and how they impact users and merchants.

Popular High-Risk PSPs in India

Overview of Noteworthy Players

Market Share and User Base

Several high-risk PSPs have gained prominence in the Indian market. Examining their market share, user base, and unique features provides valuable insights into the digital payment landscape. Analyzing the market share and user base of these high-risk platforms helps users and businesses make informed decisions. It also sheds light on the competition and the challenges faced by these PSPs.

Risks and Challenges Faced by Users

Security Concerns

One of the primary concerns associated with high-risk PSPs is the security of user data and financial information. Explore the common security risks users may face and how these platforms address or exacerbate these issues.

Fraudulent Activities

The high-risk nature of these platforms often attracts fraudulent activities. Unraveling the types of fraud prevalent in mobile payment apps and their impact on users and businesses is crucial for staying vigilant.

Consumer Protections and Redressal

Understanding the mechanisms in place for consumer protection and dispute resolution is vital. Evaluate the effectiveness of these measures in safeguarding users against potential risks.

Regulatory Measures and Compliance

RBI Guidelines

The RBI has laid down specific guidelines for mobile payment apps to ensure a secure and transparent ecosystem. Delve into these guidelines to understand how high-risk PSPs align with regulatory expectations.

Industry Compliance Standards

Apart from RBI guidelines, industry-wide compliance standards also play a role in shaping the operations of high-risk PSPs. Explore how these platforms adhere to or deviate from established norms.

Impact on E-commerce Businesses

Acceptance and Integration

High-risk PSPs often face challenges in gaining acceptance among e-commerce businesses. Examine the impact on merchants and how these platforms integrate into the digital payment infrastructure.

Managing Risks for Merchants

Merchants partnering with high-risk PSPs must navigate a fine line between convenience and risk. Explore strategies for managing risks and ensuring a smooth payment experience for customers.

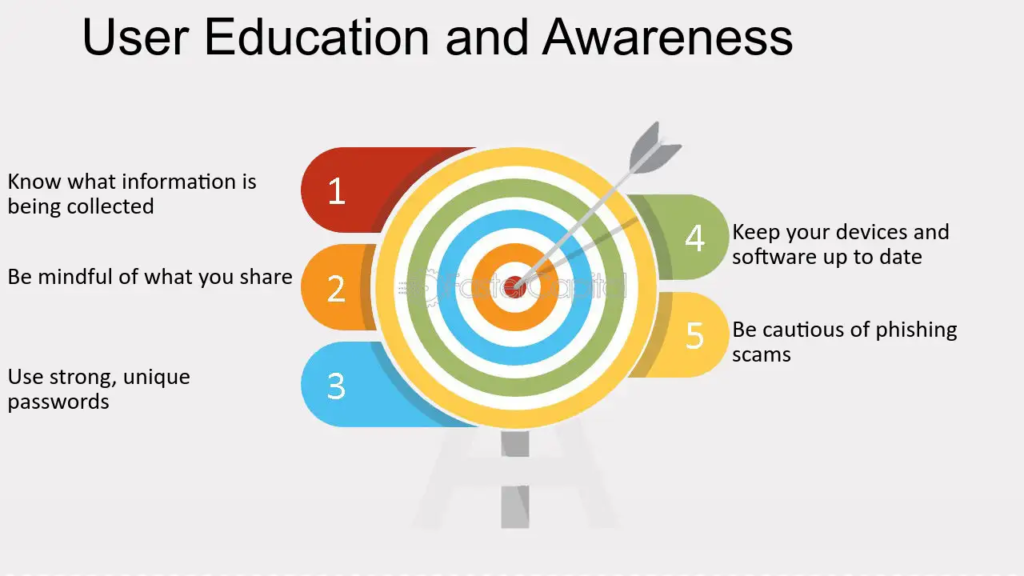

User Education and Awareness

Importance of Educating Users

Empowering users with knowledge about the risks associated with high-risk PSPs is crucial. Understand the role of user education in fostering a secure digital payment environment. Some high-risk PSPs take proactive measures to educate users and enhance security features. Explore the initiatives undertaken by these platforms to mitigate risks and build trust.

Alternatives and Safer Options

Low-Risk PSPs Comparison

Encouraging Safer Transactions

Comparing low-risk alternatives provides users and businesses with options for safer transactions. Evaluate the features and benefits of low-risk PSPs to make informed choices. Promoting safer transactions is a collective effort involving users, merchants, and PSPs. Explore ways to encourage secure payment Mobile Wallet Integration[1] practices and foster a culture of digital responsibility.

Future Trends and Developments

Anticipated Regulatory Changes

The future of high-risk PSPs is closely tied to technological advancements. Explore emerging technologies and their potential impact on the landscape High-Risk Payment Processing[2] of mobile payment apps. As the digital payment ecosystem evolves, regulatory frameworks may undergo changes. Anticipate how these changes could influence the operations and status of high-risk PSPs.

Case Studies

Instances of High-Risk PSP Failures

Success Stories of Secure Mobile Payment Apps

Examining case studies of high-risk PSP failures provides valuable insights into the consequences of operational shortcomings. Learn from past mistakes to navigate the digital payment landscape wisely. Contrast the failures with success stories of secure mobile payment Secure Mobile Payment Gateways[3] apps. Understand the key factors that contribute to their success and user trust.

Balancing Convenience and Security

User Experience vs. Risk Mitigation

Balancing user experience with risk mitigation is a delicate task. Explore how high-risk PSPs can enhance user experience without compromising on security measures. Achieving sustainable growth for high-risk PSPs involves finding the right balance between innovation, user experience, and risk management. Delve into strategies for long-term success.

Industry Experts’ Opinions

Insights from Experts in Fintech

Recommendations for Users and Businesses

Seeking opinions from industry experts in fintech provides a holistic perspective. Understand their views on the challenges and opportunities presented by high-risk PSPs. Industry experts often provide recommendations for users and businesses navigating the digital payment landscape. Summarize key recommendations to guide stakeholders Risk Assessment for PSPs[4].

How to Choose a High-Risk PSP Wisely

Due Diligence for Users and Merchants

For users and businesses considering high-risk PSPs, certain factors should be carefully evaluated. Examine the criteria for choosing a high-risk PSP wisely. The due diligence process is crucial for both users and merchants Mobile Payment[5] Compliance. Understand the steps involved in due diligence to make informed decisions.

Conclusion

In conclusion, the realm of High-Risk PSP Mobile Payment Apps in India is dynamic and multifaceted. Balancing the conveniences of digital transactions with the imperative of security is an ongoing challenge. Users and businesses alike must navigate this landscape with awareness, understanding, and a commitment to digital responsibility.

FAQs

- Are high-risk PSPs illegal in India?

- No, high-risk PSPs are not inherently illegal, but they pose elevated risks that users and businesses should be aware of.

- How can merchants protect themselves from risks associated with high-risk PSPs?

- Merchants can implement robust fraud prevention measures and stay informed about regulatory guidelines to mitigate risks.

- What role does user education play in enhancing digital payment security?

- User education is crucial in fostering awareness about potential risks and encouraging responsible digital payment practices.

- Are there government initiatives to regulate high-risk PSPs more effectively?

- Regulatory bodies like the RBI are continuously updating guidelines to enhance the regulation of high-risk PSPs.

- Can users switch from a high-risk PSP to a low-risk one seamlessly?

- Switching between PSPs may involve some transition steps, but users can generally migrate to low-risk alternatives.