AUTHOR : ISTELLA ISSO

DATE : 15/12/2023

Introduction

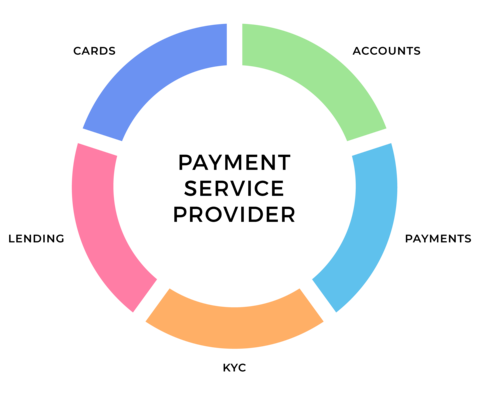

In the fast-paced world of financial technology, Payment Service Providers (PSPs) have become integral to India’s economic fabric. These entities facilitate secure and efficient electronic transactions, making them a cornerstone of the digital payment ecosystem.

The Rise of High-Risk PSPs

Definition and Characteristics

High-risk PSPs , while essential, have been a topic of increasing concern. These entities, often marked by unconventional business models [2] or heightened susceptibility to fraud, pose unique challenges to both regulatory Risk Management Solutions bodies and businesses relying on their services.

Factors Contributing to High-Risk Designation

Several factors contribute to the designation of a PSP as high-risk. These include a higher probability of chargebacks, potential legal issues, and a susceptibility to financial volatility. Understanding these factors is crucial to navigating the complex landscape of high-risk payment services.High-Risk PSP Payment Service Providers In India

Regulatory Landscape for PSPs in India

Overview of Regulatory Bodies

India boasts a robust regulatory framework overseeing financial entities, including the Reserve Bank of India (RBI) and also the Payments and Settlements Systems Act. However, high-risk PSPs face additional scrutiny, requiring a nuanced understanding of compliance expectations.

Compliance Challenges for High-Risk PSPs

Navigating compliance is a significant hurdle for high-risk PSPs. Stringent regulations not only demand a proactive approach but also require continuous oversight, ensuring that these entities consistently meet and even exceed the prescribed standards. This section explores the challenges and potential solutions for maintaining compliance.

Impact on Businesses

Risks Associated with High-Risk PSPs

Businesses relying on high-risk PSPs face inherent risks. These challenges can range not only from potential financial losses due to fraud but also extend to include reputational damage A comprehensive risk assessment is vital for businesses to safeguard their interests.

Mitigation Strategies for Businesses

Mitigating risks involves a combination of due diligence and also strategic planning. Implementing robust fraud prevention measures, ensuring transparent communication with customers, and diversifying payment options are key strategies to safeguard businesses.High Risk PSP Payment Service Providers In India

Case Studies

Notable Examples of High-Risk PSPs

Examining real-world examples provides valuable insights. Case studies highlight instances where high-risk PSPs faced challenges and also the lessons learned from those experiences. Lessons Learned from Past Incidents Understanding the mistakes and successes of others is crucial for the industry’s growth. This section delves into specific incidents, extracting valuable lessons for both PSPs and businesses.

Choosing the Right PSP

Factors to Consider

Due Diligence for Business

Choosing the right PSP is a critical decision for businesses. Factors such as transaction fees, security Payment Gateway Providers[1] features, and also the provider’s reputation must be carefully evaluated to ensure a reliable partnership. Conducting thorough due diligence is non-negotiable. Businesses Chargeback Protection[2] should research prospective PSPs extensively, verifying their compliance, security measures, and past performance.

The Future of PSPs in India

Evolving Regulatory Measures As the landscape evolves, regulatory measures will adapt. Understanding the potential changes and staying ahead of compliance Financial Compliance[3] expectations is key for the sustained success of PSPs.

Technological Advancements and their Role Emerging technologies, such as blockchain and artificial intelligence, will play a pivotal role in shaping the future of PSPs. Adapting to these advancements ensures long-term relevance and efficiency.

Addressing Customer Concerns

Building Trust in High-Risk PSPs Addressing customer concerns is paramount Transaction Security[4]. Transparency, clear communication, and also a commitment to security can build and maintain trust in high-risk PSPs. Communication Strategies

Effective communication strategies are vital for high-risk PSPs. Proactive communication about security Alternative Payment Solutions[5] measures, transaction processes, and potential risks fosters a positive relationship with customers.

Conclusion

In conclusion, navigating the realm of high-risk PSPs in India requires a multifaceted approach. Understanding the regulatory landscape, mitigating risks, and choosing the right PSP are essential steps for businesses aiming to thrive in the digital payment ecosystem.

FAQs

- What defines a high-risk PSP in India?

- High-risk PSPs are typically characterized by factors like a higher likelihood of chargebacks, legal vulnerabilities, and susceptibility to financial volatility.

- How can businesses mitigate the risks associated with high-risk PSPs?

- Mitigation strategies include implementing robust fraud prevention measures, ensuring transparent communication with customers, and diversifying payment options.

- What role do technological advancements play in the future of PSPs in India?

- Technologies like blockchain and artificial intelligence will shape the future of PSPs, offering opportunities for enhanced security and efficiency.

- What are the key factors businesses should consider when choosing a PSP?

- Businesses should consider transaction fees, security features, and the provider’s reputation when selecting a PSP.

- How can high-risk PSPs build trust with their customers?

- Building trust involves transparent communication, a commitment to security, and also measures to address customer concerns.