AUTHOR : MICKEY JORDAN

DATE : 26/12/2023

Introduction

In the dynamic landscape of personal finance in India, the concept of high-risk PSP personal loans has become increasingly relevant. As individuals grapple with mounting debts, the need for effective debt consolidation solutions is on the rise. High-Risk PSP Personal Loan for Debt Consolidation in India This article delves into the intricacies of high-risk PSP personal loans, their implications, and the vital role they play in debt consolidation strategies.

Understanding High-Risk PSP Personal Loans

High-risk PSP personal loans, also known as high-risk payment service provider loans, cater to individuals facing financial challenges and possessing a higher risk profile. These loans are characterized by their accessibility to those with less-than-perfect credit scores or a history of financial setbacks. Factors such as income, employment stability, and credit history contribute to the high-risk categorization.

Debt Consolidation: A Necessity in India

India, like many other nations, grapples with a significant debt burden among its citizens. The complexities of managing multiple debts with varying interest rates and repayment terms can be overwhelming. Debt consolidation[1] emerges as a necessity, offering a streamlined approach to debt management. By consolidating debts, individuals can benefit from lower interest rates, simplified repayment structures, and the convenience of dealing with a single lender.

Challenges of High-Risk Borrowing in India

While high-risk PSP personal loans open doors for those facing financial adversity, they come with their own set of challenges. Interest rates associated with high-risk borrowing can be notably higher, posing a potential financial strain. Moreover, the impact on credit scores must be considered, as defaults or delays in repayment can further exacerbate the challenges of securing credit in the future.

Choosing the Right Lender

Selecting a reputable lender is paramount when considering high-risk PSP personal loans. Extensive research and comparisons among lenders are essential. Reading terms and conditions carefully is crucial to understanding the obligations and potential pitfalls associated with the loan.

Application Process Simplified

Applying for a personal loan[2] can be a straightforward process when armed with the right information. This section provides a step-by-step guide, outlining the necessary documentation and eligibility criteria. By following these steps, individuals can navigate the application process with confidence.

Managing Debt Effectively

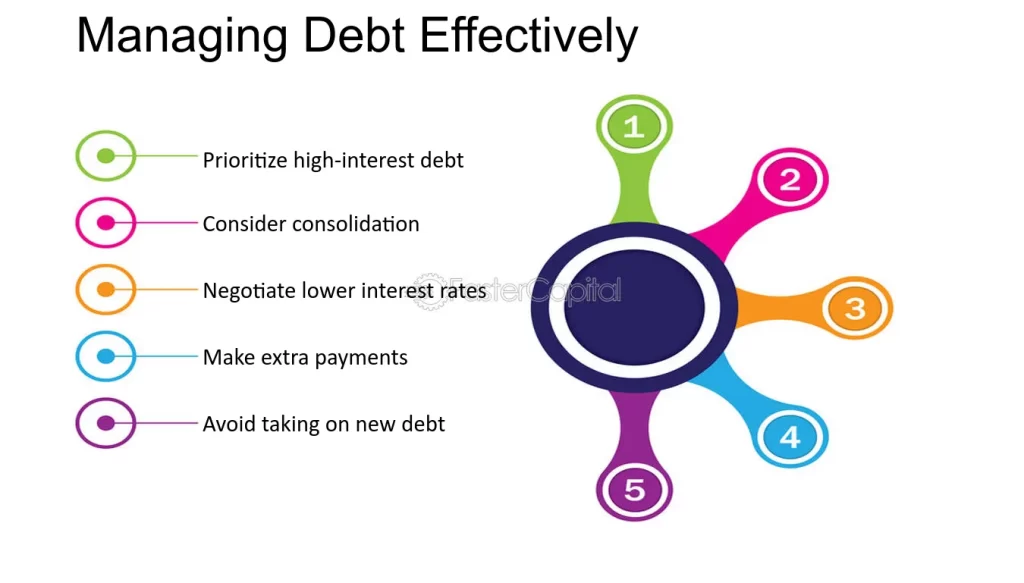

Debt consolidation is not a standalone solution but a part of a broader strategy for effective debt management[3]. Creating a budget, understanding spending patterns, and implementing debt repayment strategies are integral aspects of managing debt successfully.

Risks and Rewards: Weighing Your Options

As with any financial decision, it’s essential to weigh the risks and rewards of high-risk PSP personal loans. This section provides insights into the potential benefits and drawbacks, helping readers make informed decisions aligned with their financial goals[4].

Case Studies: Successful Debt Consolidation Stories

Real-life examples offer tangible evidence of the positive impact of high-risk PSP personal loans on individuals’ financial situations. By exploring these case studies, readers gain valuable insights and inspiration for their debt consolidation journey.

Tips for Responsible Borrowing

Responsible borrowing is a key component of effective debt management. This section emphasizes the importance of financial literacy and provides practical tips for avoiding common pitfalls associated with high-risk borrowing.

Navigating the Regulatory Landscape

Understanding the regulatory environment surrounding high-risk lending is crucial for consumer protection. This section provides an overview of the relevant regulations and measures in place to safeguard the interests of borrowers.

Impact on Credit Scores: Myths vs. Facts

Dispelling common myths surrounding the impact of high-risk loans[5] on credit scores, this section provides clarity on how individuals can minimize negative repercussions and work towards improving their creditworthiness.

Future Outlook of High-Risk PSP Personal Loans in India

Examining trends and also making predictions about the future of high-risk PSP personal loans in India, this section provides readers with a forward-looking perspective on the evolving landscape of personal finance.

Expert Insights: Interview with a Financial Advisor

In this exclusive interview, a financial advisor shares valuable insights and advice on managing high-risk personal loans and the broader aspects of debt consolidation. Readers gain access to expert opinions that can inform their financial decisions.

Conclusion

As we conclude this exploration of high-risk PSP personal loans for debt consolidation in India, it’s essential to recap key points. While these loans offer a lifeline to those facing financial challenges, informed decision-making is crucial. By understanding the intricacies, risks, and rewards, individuals can embark on a debt consolidation journey that aligns with their financial goals.

FAQs

- Can I get a high-risk PSP personal loan with a low credit score?

- Yes, high-risk PSP personal loans are designed to accommodate individuals with less-than-perfect credit scores.

- How can debt consolidation improve my financial situation?

- Debt consolidation can lower interest rates, simplify repayment, and provide a structured approach to managing multiple debts.

- What are the common pitfalls to avoid when considering a high-risk personal loan?

- Common pitfalls include overlooking terms and conditions, borrowing more than needed, and neglecting to create a comprehensive debt repayment strategy.

- Is it possible to improve my credit score after taking a high-risk personal loan?

- Yes, responsible repayment and financial discipline can contribute to improving your credit score over time.

- How do I choose the right lender for a high-risk personal loan?

- Research and compare lenders, read reviews, and carefully examine terms and also conditions to make an informed choice.