AUTHOR NAME : JASMIN

DATE : 18/12/2023

Introduction

Investing can be a thrilling venture, especially when combining the high-risk realm of Payment Service Providers (PSPs) with the timeless allure of rare stamps. In this exploration, we’ll unravel the complexities of high-risk PSPs, delve into the fascinating world of rare stamps in India, and navigate the risks and rewards associated with this unique blend of financial and philatelic investment.

Defining High-Risk PSP

High-risk PSPs operate in a financial landscape where challenges like fraud and chargebacks are prevalent. Understanding the intricacies of such providers is crucial for investors looking to harness their potential while mitigating risks.

Rare Stamps as an Investment Avenue

Historical Significance

Rare stamps aren’t just pieces of paper; they’re windows to history. Exploring the historical significance of rare stamps enhances our appreciation of their value beyond the financial realm.

Rarity and Value Factors

Understanding what makes a stamp rare is fundamental to stamp collecting as an investment. Factors like limited print runs, historical context, and design intricacies play pivotal roles in determining a stamp’s value.

Growing Interest in Alternative Investments

In a world where traditional investments can be volatile, there’s a growing interest in alternative assets. Rare stamps, with their unique combination of history and scarcity, are gaining attention from investors seeking diversification.

Navigating the Indian Stamp Market

Stamp Collecting Scene in India

India boasts a rich tradition of stamp collecting[1]. Exploring the vibrant community and events in the Indian stamp market provides insights into the country’s literary landscape.

Notable Rare Stamps in Indian Philately

From the iconic “Inverted Head Four Annas” to the rare “Scinde Dawk,” India has produced stamps that are not only prized possessions for collectors but also valuable investment assets.

Trends and Dynamics in the Indian Stamp Market

The stamp market in India is dynamic, influenced by trends like thematic collecting, online auctions[2], and the emergence of new collectors. Staying tuned for high-risk PSP rare stamps in India.

Risks and Rewards: High Stakes in High-Risk PSP and Rare Stamps

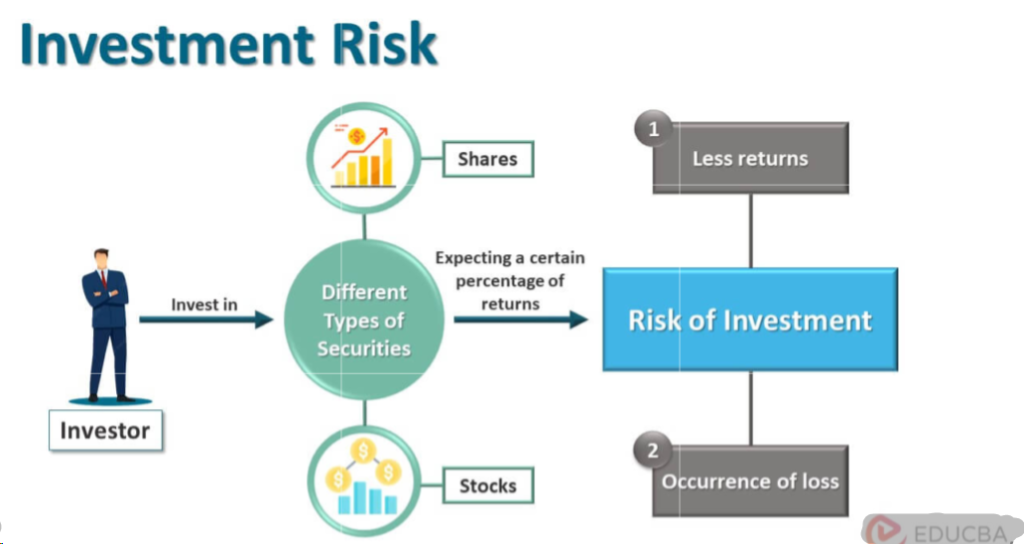

Linking Risks with Investments

Drawing parallels between the risks associated[3] with high-risk PSPs and rare stamp investments provides a comprehensive view of the challenges investors might encounter.

Balancing Potential Returns

Investors must strike a delicate balance between potential returns and the uncertainties inherent in both high-risk financial ventures and the Philippine market.

Stamp Authentication: Ensure Legitimacy in the Collection

Counterfeiting Issues

The stamp market[4] isn’t immune to counterfeiting. Understanding the risks associated with fake stamps underscores the importance of robust authentication measures.

Importance of Authentication

Authentication is the bedrock of a genuine rare stamp collection. Investors must prioritize authentication to safeguard their investments and maintain the integrity of their collections.

Reliable Authentication Methods and Services

Exploring the tools and services available for stamp authentication[5] equips investors with the knowledge needed to make informed decisions about their collections.

Case Studies: Success Stories and Cautionary Tales

Successful Rare Stamp Investments

Delving into success stories provides inspiration for investors. Examining how others navigated the challenges of rare stamp investment can offer valuable insights.

Analyzing Cautionary Tales

Learning from cautionary tales is equally important. Understanding the mistakes and challenges faced by others helps investors avoid potential pitfalls.

Lessons for PSP Selection and Stamp Investment

Extracting lessons from both successful and cautionary tales provides a nuanced perspective on the intricate dance between selecting a high-risk PSP and investing in rare stamps.

Diversification Strategies for Investors

Spreading Risks

Diversification is a key strategy for mitigating risks. Investors can spread their risks by allocating funds to different asset classes, balancing the high-stakes nature of high-risk PSPs with more stable investments.

Strategies for Building a Resilient Portfolio

Developing strategies to build resilience involves a thoughtful approach to risk management. Crafting a portfolio that can weather uncertainties is a crucial aspect of successful investing.

Regulatory Framework: Navigating Compliance Challenges

Overview of Regulatory Landscape

Understanding the regulatory framework for PSPs in India provides clarity on compliance requirements. Investors must navigate these regulations to ensure legal and ethical practices.

Compliance Requirements for Rare Stamp Investors

Rare stamp investors must also adhere to regulatory requirements. Complying with these regulations adds a layer of legitimacy to the investment process. Rare stamps In India.

Balancing Risk-Taking with Adherence to Regulations

Striking a balance between taking calculated risks and adhering to regulations is a delicate dance. Successful investors understand how to navigate this terrain without compromising on compliance.

The Future of Rare Stamp Investments

Emerging Trends in Stamp Collection

Exploring the evolving trends in stamp collecting sheds light on the future landscape of the market. From digital advancements to changing collector preferences, anticipating these trends is key.

Anticipated Changes in the Rare Stamp Market

Forecasting changes in the rare stamp market requires a keen understanding of the factors shaping its trajectory. Investors who stay ahead of these changes position themselves for success.

Conclusion

In this intricate dance between high-risk PSPs and rare stamps, investors find a unique blend of financial challenge and philatelic allure. High Risk PSP Rare stamps In India Navigating this terrain demands careful consideration, but for those who strike the right balance, the rewards can be truly extraordinary.

FAQs

- Is investing in rare stamps a reliable strategy for long-term financial growth?

- While rare stamps can offer unique investment opportunities, they should be considered as part of a diversified portfolio rather than a sole investment strategy.

- How can investors protect themselves from counterfeit stamps?

- Utilizing reputable authentication services and staying informed about common counterfeiting techniques are crucial for safeguarding investments.

- What factors should be considered when choosing a high-risk PSP?

- Reputation, security measures, compliance with regulations, and transaction costs are key factors to consider when selecting a high-risk PSP.

- Are there any upcoming trends in the rare stamp market that investors should be aware of?

- Emerging trends include digital advancements, online auctions, and the integration of technology, shaping the future of rare stamp collecting.

- How can investors balance the risks associated with high-risk PSPs and rare stamp investments?

- Diversification, careful due diligence, and adherence to regulatory compliance are essential for balancing risks in both high-risk financial ventures and philatelic investments.