AUTHOR : JENNY

DATE : FEBRUARY 24, 2024

High-risk Payment Service Providers (PSPs) operating in India face a unique set of challenges, particularly concerning response rate optimization (RRO). In a landscape where trust and security are paramount, it becomes imperative for High Risk PSPs to not only attract potential customers but also to ensure a high response rate. This article delves into the intricacies of optimizing response rates for High Risk PSPs in India, exploring strategies, challenges, and the significance of effective communication.

Understanding high-risk PSPs in the Indian Context

High Risk PSPs definition, engage in transactions that are considered high-risk due to various factors such as chargeback rates, industry reputation, and regulatory considerations. In India, these providers operate in an environment that demands stringent security measures and compliance. The challenges they face are multifaceted, ranging from regulatory hurdles to Optimization In India customer skepticism.

The Significance of Response Rate Optimization

Response Rate Optimization (RRO) is more than just a metric; it’s a key determinant of success for High Risk PSPs. Achieving a high response rate not only enhances the chances of customer acquisition but also contributes to building a robust customer base. In a market where consumer trust is hard-won, a timely and compelling response can make all the difference.

Factors Influencing Response Rates for High Risk PSPs

Several factors influence the response rates employing High Risk paymnet processors[1] Understanding the target audience, tailoring strategies accordingly, and employing effective communication channels are pivotal. In a market saturated with options, the ability to stand out and resonate with potential customers is a game-changer.

Implementing Effective Communication Strategies

The art of effective communication cannot be overstated. High Risk PSPs need to convey their value proposition clearly and concisely. This involves not only the message itself but also the choice of communication channels. Whether through emails, direct calls, or innovative Optimization marketing[2] approaches, the goal is to capture and maintain the attention of potential customers.

Leveraging Technology for Optimization

Technology plays a crucial role in the optimization of response rates. High Risk PSPs can benefit from the use of advanced analytics, AI-driven solutions, and automation tools. These not only streamline processes but also provide valuable insights into customer behavior, enabling providers to refine their strategies continuously.

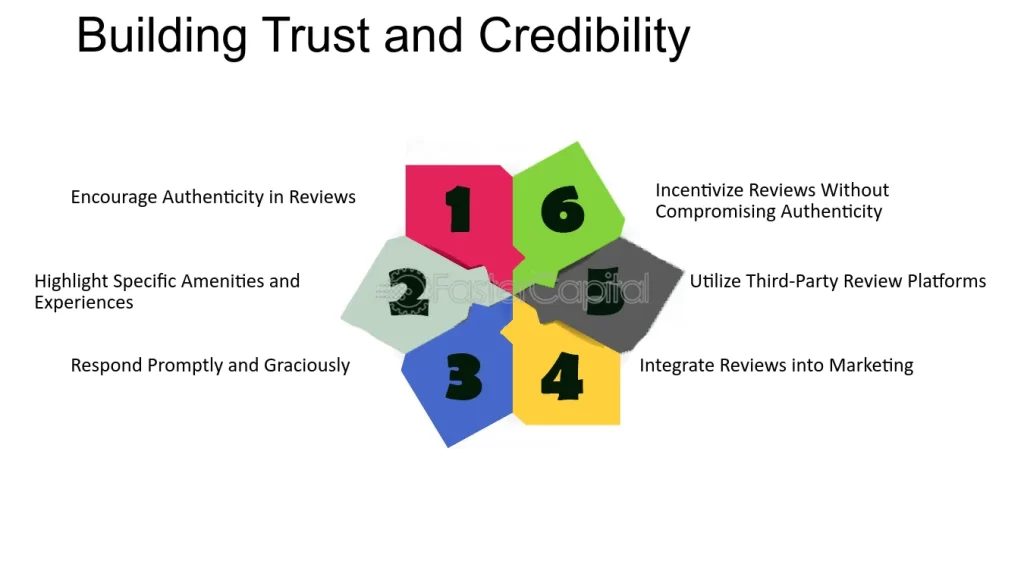

Building Trust and Credibility in High-Risk Transactions

Trust is the currency of high-risk transactions. Establishing credibility is a continuous process that involves transparent communication, secure transactions, and a commitment to customer satisfaction High Risk[3] PSPs must prioritize building trust to foster long-term relationships with their clientele.

Analyzing and Adapting Strategies for Continuous Improvement

Response rate[4] optimization is not a one-time effort but an ongoing process. Regular analysis of data, customer feedback, and industry trends is essential for adapting strategies to changing circumstances. High Risk PSPs should be agile in their approach, ready to refine their methods based on real-time insights.

Navigating Regulatory Compliance Challenges

Operating in the high-risk customer[5] in India requires a meticulous approach to regulatory compliance. Adhering to local and international regulations is not only a legal requirement but also impacts the response rates of High Risk PSPs. Customers are more likely to engage with providers who demonstrate a commitment to compliance and security.

Learning from Case Studies in Response Rate Optimization

Real-world case studies provide valuable insights into successful response rate optimization strategies. High Risk PSPs can learn from the experiences of others, understanding what worked, what didn’t, and how to apply these lessons to their unique challenges.

Tailoring Global Optimization Strategies for the Indian Market

While global best practices provide a foundation, High Risk PSPs must tailor their optimization strategies to the Indian market. Considering cultural nuances, preferences, and specific challenges unique to the region ensures a more targeted and effective approach.

Addressing Customer Concerns to Boost Response Rates

Understanding and addressing customer concerns is a critical aspect of response rate optimization. High Risk PSPs must proactively identify and resolve potential objections, providing clear and compelling answers to instill confidence in their services.

Gaining a Competitive Edge through Optimization

Response rate optimization not only enhances customer acquisition but also provides a competitive edge. High Risk PSPs that consistently optimize their response rates stand out in a crowded market, positioning themselves as reliable and customer-focused providers.

Future Trends in RRO for High Risk PSPs in India

As technology evolves and consumer behavior changes, the future of response rate optimization holds exciting possibilities. High Risk PSPs in India should stay abreast of emerging trends, from AI-driven personalization to innovative communication channels, to stay ahead in the dynamic landscape.

Conclusion

Response rate optimization is a critical aspect of success for High Risk PSPs in India. By understanding the unique challenges, leveraging technology, and prioritizing effective communication, providers can not only survive but thrive in the high-risk landscape. Continuous adaptation, trust-building, and a commitment to regulatory compliance are the pillars of sustained success.

FAQs

What is Response Rate Optimization (RRO) and why is it crucial for High Risk PSPs in India?

- Response Rate Optimization is the process of improving the likelihood of positive responses from potential customers. For High Risk PSPs in India, it’s crucial for building trust and acquiring customers in a competitive and regulated market.

How can High Risk PSPs leverage technology for better response rates?

- High Risk PSPs can utilize advanced analytics, artificial intelligence, and automation tools to streamline processes and gain insights into customer behavior. These technologies enable continuous improvement in response rate optimization.

What role does regulatory compliance play in the success of High Risk PSPs in India?

- Regulatory compliance is essential for High Risk PSPs operating in India. It not only ensures legal adherence but also impacts customer trust. Compliance demonstrates a commitment to security, contributing to higher response rates.

How can High Risk PSPs address customer concerns effectively?

- High Risk PSPs should proactively identify and address common customer concerns. Clear communication, transparent policies, and addressing objections directly contribute to boosting response rates.