AUTHOR: MICKEY JORDAN

DATE: 21/12/2023

Introduction

In today’s globalized business landscape, companies often rely on Payment Service Providers (PSPs) to facilitate secure financial transactions. However, the rise of High-Risk PSP raises concerns about the potential implications for businesses . Let’s delve into the intricacies of this issue, exploring the landscape , identifying red flags, understanding associated risks, and proposing effective mitigation strategies High-Risk PSP Supplier.

Understanding High-Risk PSP Suppliers

Payment Service Providers, or PSPs, play a crucial role in facilitating financial transactions between businesses and consumers. High-risk Supplier Connections in this domain possess characteristics that elevate the potential for adverse outcomes. These may include inconsistencies in financial records, a lack of transparency, and a history of legal issues. Understanding these traits is vital for businesses looking to safeguard their operations.

The Landscape of PSP Suppliers in India

India has witnessed significant growth in the PSP sector, with numerous players contributing to the market. Supplier Connections in India Understanding the key players, their market share, and the overall landscape is essential for businesses seeking reliable and secure payment solutions.

Identifying Red Flags in Supplier Connections

One of the critical aspects of managing High-Risk PSP Supplier Connections in India is the ability to identify red flags. Lack of transparency, inconsistent financial records, and past legal issues are indicators that warrant careful consideration. Businesses must develop a keen eye for these signs to ensure the stability of their financial transactions.

Risks Associated with High-Risk PSP Suppliers

Engaging with high-risk PSP Supplier Onboarding[1] poses various risks, including operational disruptions, reputational damage, and legal implications. It’s for businesses to evaluate these potential consequences and implement measures to mitigate the associated risks effectively.

Regulatory Framework in India

Understanding Transaction Risk Assessment[2] the regulatory framework for PSP in India is crucial for businesses. We’ll delve into the existing regulations and the role of government bodies in ensuring compliance within the industry.

Due Diligence in Supplier Selection

To mitigate the risks associated with Supplier Risk Management[3] connections, businesses must prioritize due diligence in the supplier selection process. This involves thorough background checks, financial stability, and ensuring compliance with regulatory requirements.

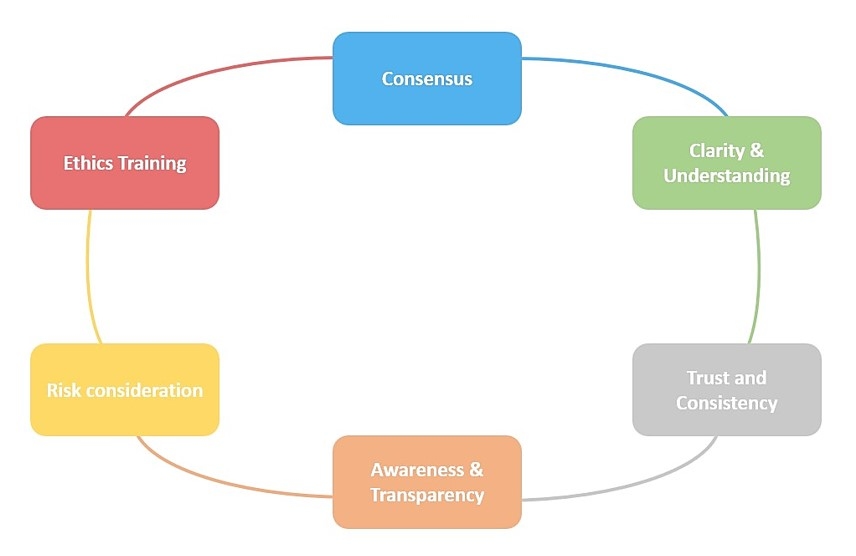

Mitigation Strategies

Developing a robust risk management plan is essential for businesses to navigate the complexities of high-risk PSP Supplier Agreements[4] connections. We’ll explore effective strategies and how businesses can build alternative supplier relationships to enhance resilience.

Industry Best Practices

Learning from successful companies that effectively manage risks is crucial. We’ll highlight industry best practices that businesses can adopt to fortify their supply chain against potential disruptions.

The Role of Technology

High-Risk Merchant Accounts[5] Advanced technology. including AI and data, plays a pivotal role in evaluating supplier connections. We’ll discuss how businesses can use these tools to enhance their risk assessment capabilities.

Collaborative Efforts

Industry collaboration is a powerful tool for mitigating the risks associated with PSP connections. We’ll explore the benefits of these efforts and how businesses can work together to strengthen the overall industry.

Stay Updated: Monitoring Supplier Connections

Ongoing monitoring processes are essential to adapt to changes in the Landscape. We’ll discuss the importance of staying updated on connections and dynamic strategies to address emerging risks.

Case for Ethical Sourcing

With the growing emphasis on ethical business practice, we’ll explore the impact of ethical practices on consumer trust and brand loyalty. Adopting ethical practices in business connections can contribute to long-term business sustainability.

Conclusion

In conclusion, managing PSP connections in India requires a proactive and comprehensive approach. By understanding the landscape, identifying red flags, and implementing effective mitigation strategies, businesses can safeguard their operations and build resilient supply chains.

FAQs

- How can businesses identify red flags in high-risk PSP supplier connections?

- Answer: Businesses should look for signs of a lack of transparency, inconsistent financial records, and past legal issues during the supplier selection process.

- What role does technology play in assessing supplier connections?

- Answer: Advanced technology, such as AI and data analytics, enhances the capability to assess and manage risks associated with supplier connections.

- Why is ongoing monitoring of supplier connections crucial for businesses?

- Answer: Ongoing monitoring allows businesses to adapt to changes in the supplier landscape and address emerging risks promptly.

- How can collaborative efforts within the industry help mitigate risks?

- Answer: Industry collaboration enables the sharing of insights and best practices, strengthening the overall resilience of the sector against potential risks.

- Why is ethical sourcing important in the context of high-risk PSP supplier connections?

- Answer: Adopting ethical practices in supplier connections contributes to consumer trust, brand loyalty, and long-term business sustainability.