AUTHOR : SELENA GIL

DATE : 28/12/2023

Introduction

India, known for its intimidating electronic goods market, has witnessed a significant rise in high-risk payment service providers (PSPs) catering to this sector. These PSPs navigate a landscape fraught with challenges, innovations, and regulatory difficulties. Let’s delve into the nuances of this niche and explore its various facets.

Challenges Faced by High-Risk PSPs

Navigating the Indian market poses challenges for high-risk PSPs. Regulatory hurdles, compliance issues, and intense market competition stand as primary roadblocks. The classification of electronic goods as high-risk intensifies these obstacles, demanding stringent measures from PSPs.

Emerging Trends in High-Risk PSP

Despite the challenges, the landscape is developments. Innovations in payment processing technologies, coupled with an in-depth understanding of consumer behavior, are shaping the strategies of these PSPs. Adaptation to these trends becomes pivotal for livable and growth.

Security Concerns and Solutions

Security remains a supreme concern in electronic transactions. High-risk PSPs face the daunting task of confirming robust data security and implementing foolproof fraud prevention measures. Technological advancements play a crucial role in fortifying these safeguards.

Impact on the Indian Economy

The presence of high-risk PSPs contributes significantly to India’s economy. However, the volatility inherent in such PSPs also poses risks. Understanding this delicate balance is crucial for colleague aiming for stability and growth.

Regulatory Framework and Compliance

The regulatory landscape governing PSPs in India is intricate. Compliance requirements demand meticulous attention, with non-compliance posing substantial risks. Navigating these frameworks is vital for the sustained operation of high-risk PSPs.

Case Studies and Success Stories

Examining successful high-risk PSPs offers insights into effective strategies. These case studies emphasize the importance of risk provision and adept handling of challenges. Learning from these success stories becomes instrumental for PSPs aiming to establish a foothold in this domain.

Future Prospects and Predictions

Forecasting the trajectory of high-risk PSPs in India reveals promising opportunities and inherent challenges. Staying abreast of emerging trends and regulatory shifts will be critical for renewables and growth.

Addressing Market Challenges

The landscape for high-risk PSPs in India is multifaceted, demanding solutions for the challenges it confronts. Regulatory compliance, often intricate and evolving, requires continuous adaptation. Moreover, the intense competition within the electronic goods market underlines the need for unique selling propositions and robust service offerings by PSPs.

Innovations Driving the Industry

In the pursuit of success, high-risk PSPs are actively engaging in technological innovations. From increasing payment[1] security through cipher and biometric authentication to abusing artificial intelligence for fraud detection, these advancements are pivotal. Additionally, understanding and providing for the progress preferences of consumers in the digital payment sphere remains a foundation for PSPs.

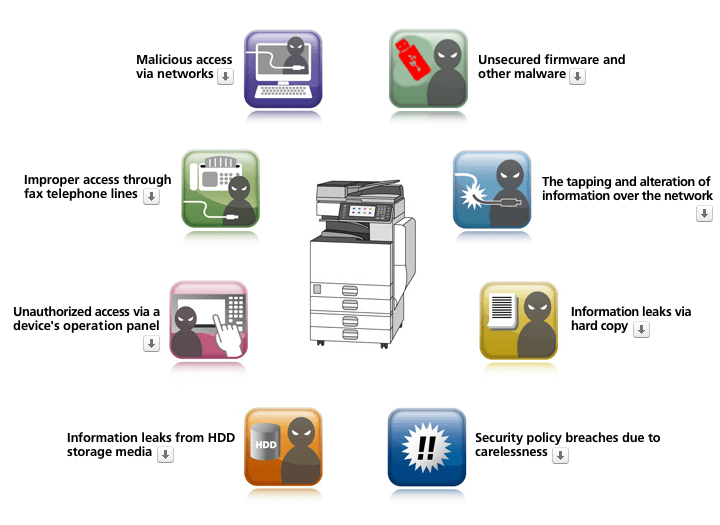

Security Measures and Countermeasures

The high-risk nature of the electronic goods market demands heightened security protocols. Implementing robust data encryption, multi-factor authentication, and real-time monitoring for suspicious activities are crucial strategies. Moreover, collaboration[2] with cybersecurity experts and staying updated with the latest threat intelligence aid in staying ahead of potential risks.

Economic Impact and Opportunities

The presence of high-risk PSPs significantly contributes to India’s economic ecosystem. Their ability to facilitate transactions for electronic[3] goods fuels business growth. However, the inherent instability of some PSPs raises concerns about financial stability and demands a balance between risk-taking and stability.

Navigating Regulatory Landscapes

Compliance with regulations is non-negotiable for high-risk PSPs. Navigating the web of regulatory frameworks necessitates dedicated resources and expertise. Moreover, dynamic measures to anticipate and adapt to regulatory changes are essential to sustain operations.

Learnings from Successful Ventures

Examining successful high-risk PSPs provides critical insights. Their strategies in risk management, customer[4] engagement, and product innovation serve as guiding beacons for emerging PSPs. Case studies shed light on business models in a competitive market.

Future Trends and Forecasts

The future of high-risk PSPs in India is intriguing. Anticipated trends include further advancements in payment technologies, increased collaboration among PSPs and fintech companies, and a shift towards more secure payment methods. However, the regulatory landscape[5]‘s progress [5] remains a significant factor shaping its future.

Conclusion

High-risk PSPs catering to electronic goods in India operate within a dynamic and complex landscape. Navigating challenges, embracing innovations, and compliance are pivotal for their sustenance and success.

FAQs

- Are high-risk PSPs profitable in India’s electronic goods market?High-risk PSPs have the potential for profitability, but it requires adept strategies to overcome challenges.

- What are the key security concerns for high-risk PSPs?Data security and fraud prevention stand as primary concerns for high-risk PSPs in India.

- How do regulatory frameworks impact high-risk PSP operations?Compliance with regulations is crucial; non-compliance can pose significant risks to PSPs.

- What distinguishes successful high-risk PSPs from others in India?Successful PSPs exhibit adept risk management and an ability to innovate in a competitive landscape.

- What future trends can be anticipated for high-risk PSPs in India?Innovations in payment technology and evolving consumer behavior are likely to shape the future of these PSPs.