AUTHOR : ISTELLA ISSO

DATE : 80/12/2023

Introduction

In the fast-paced world of business, the need for efficient payment processing[1] is more crucial than ever. As businesses in India strive to stay ahead in the digital[2] age, the selection of the right payment processor becomes a strategic decision. This article delves into the realm of Payment Processor Match-Making Services[3], exploring how they navigate the complex landscape of payment processors in India.

The Landscape of Payment Processors in India

India boasts a diverse array of payment processors, from traditional banks to innovative fintech companies. With the rise of e-commerce and digital transactions[4], businesses are confronted with the challenge of choosing from a plethora of options. The demand for diverse payment[5] options further complicates the decision-making process.

Challenges Faced by Businesses in Selecting Payment Processors

The decision-making process is fraught with challenges. Technical compatibility issues, varying transaction fees, and hidden costs create a perplexing situation for businesses. Navigating these challenges requires expertise and a comprehensive understanding of the payment processing landscape.

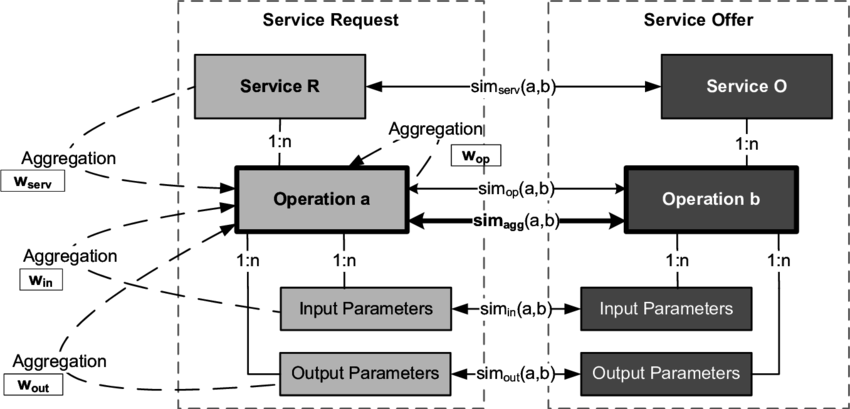

Role of Payment Processor Match-Making Services

Enter Payment Processor Match-Making Services. These services act as a guiding light, simplifying the selection process for businesses. By leveraging advanced algorithms and industry expertise, they address the challenges faced by businesses and streamline the journey to finding the perfect payment processor.

Benefits for Businesses

The benefits of using payment processor match-making services are multifaceted. Businesses not only save time but also ensure cost-effectiveness in their payment processing. The streamlined selection process allows them to focus on their core operations without the burden of navigating the complexities of the payment industry.

How Payment Processor Match-Making Works

Behind the scenes, these match-making services employ sophisticated algorithms that consider various factors. The criteria used in the selection process are customizable, ensuring that the solutions provided are tailored to the specific needs of each business. This bespoke approach sets them apart in the industry.

Key Players in the Indian Market

Several match-making services have emerged as key players in the Indian market. Reviews of their services, along with success stories and testimonials, provide valuable insights for businesses seeking reliable payment processors.

Perplexity in Payment Processor Selection

Perplexity in payment processor selection arises from the multitude of options and technical specifications. Here, the importance[1] of expert guidance becomes evident. Payment processor match-making services bridge the knowledge gap, offering businesses the expertise needed to make informed decisions.

Burstiness in Payment Processor Trends

The payment processing industry[2] is marked by rapid changes and evolving trends. Match-making services showcase their adaptability by staying ahead of these trends, ensuring that the businesses they serve are always equipped with the latest and most effective payment solutions.

Ensuring Specificity in Service Selection

One size does not fit all. Match-making services understand the importance of tailoring solution[3] for different industries. Whether it’s a retail business or a tech startup, these services ensure that the selected payment processor aligns with the unique needs of each business.

Contextualizing Payment Processor Solutions

Industry trends and regulatory considerations[4] play a pivotal role in the selection process. Payment processor match-making services contextualize solutions within the broader industry landscape, ensuring that businesses comply with regulations and stay competitive in their respective sectors.

Engaging the Reader with Real-World Examples

Real-world examples, in the form of case studies, provide tangible evidence of the benefits of using match-making services. Businesses can draw lessons from successful implementation[5], gaining insights that go beyond theoretical considerations.

Active Voice in Payment Processor Decision-Making

Encouraging businesses to take an active role in the decision-making process is a recurring theme. Payment processor match-making services empower businesses to make proactive decisions, aligning their payment processing strategies with their overall business objectives.

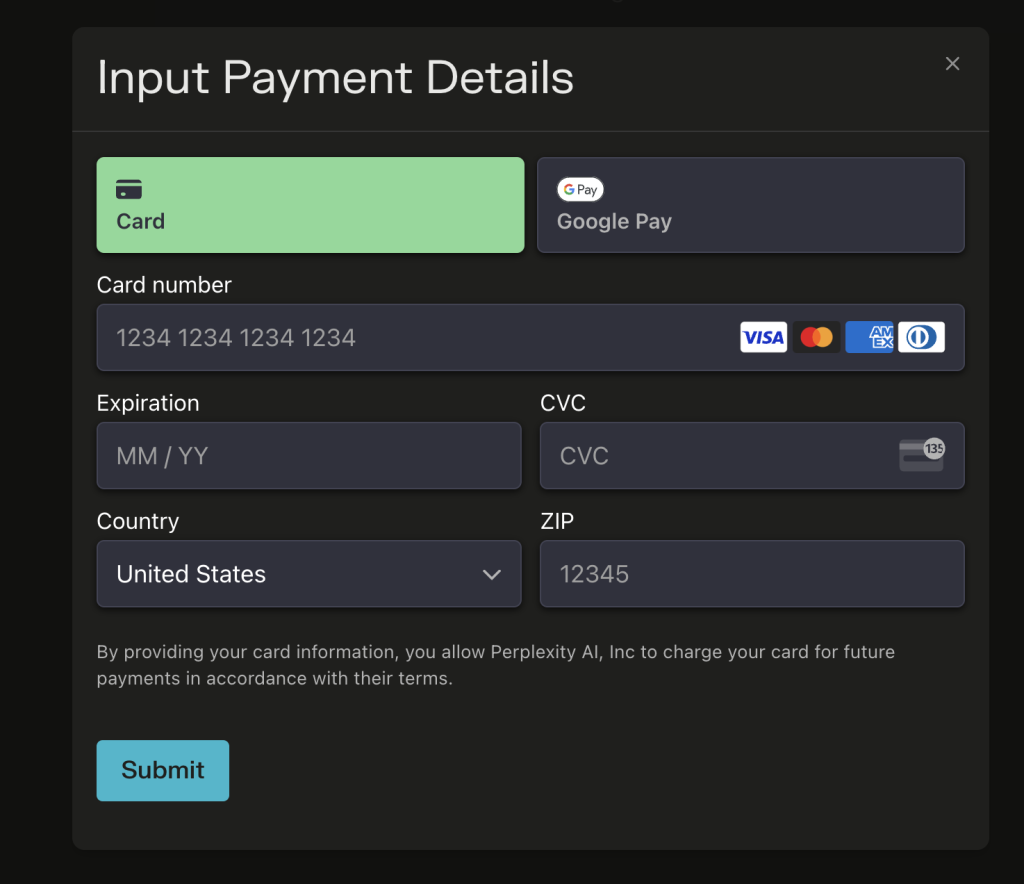

Simplicity in Payment Processor Integration

User-friendly interfaces and comprehensive training provided by match-making services ensure that the integration of payment processors is a straightforward process. Businesses can confidently adopt new payment solutions without the fear of disrupting their operations.

Conclusion

In conclusion, Payment Processor Match-Making Services emerge as indispensable allies for businesses navigating the complex landscape of payment processors in India. Their ability to simplify the selection process, ensure cost-effectiveness, and adapt to industry trends positions them as valuable partners in the journey towards efficient payment processing.

FAQs

- How do payment processor match-making services choose the right processor for a business?

- These services use advanced algorithms that consider factors such as transaction volume, industry type, and technical requirements to match businesses with the most suitable payment processor.

- Are there any hidden costs associated with using payment processor match-making services?

- No, reputable match-making services are transparent about their fees and ensure that businesses are fully aware of the costs involved in the selection process.

- Can small businesses benefit from payment processor match-making services?

- Absolutely. Match-making services cater to businesses of all sizes, offering customized solutions that meet the specific needs of small enterprises.

- How quickly can a business integrate a new payment processor recommended by a match-making service?

- The integration process varies but is generally efficient. User-friendly interfaces and comprehensive training provided by match-making services expedite the integration of new payment processors.

- Are there ongoing support services after the selection and integration process?

- Yes, reputable match-making services offer ongoing support to ensure that businesses can address any issues or updates related to their payment processors