AUTHOR : PUMPKIN KORE

DATE : 13/12/2023

In today’s dynamic business landscape, choosing the right payment provider[1] is a critical decision that can significantly impact the success of a business. With the plethora of options available in the Indian market[2], businesses often find themselves grappling with the perplexity [3]of making the right choice. This is where payment provider match-making services [4]come into play, offering a streamlined and efficient solution to this complex decision[5]–making process.

The Landscape of Payment Providers in India

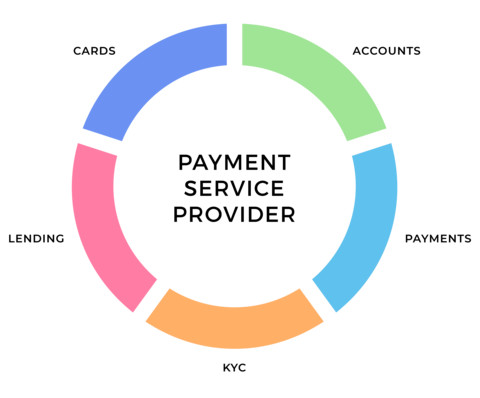

India boasts a diverse payment ecosystem,[1] with various players offering a range of services from traditional[2] banking solutions to modern digital wallets.[3] Payment Provider Match Making Services in India From established financial institutions to innovative fintech startups, the choices are vast, creating a burst of options for businesses.[4]

Challenges in Selecting a Payment Provider

Businesses face unique challenges when selecting a payment provider, ranging from understanding the specific needs of their industry to navigating the complexities[5] of various fee structures. Payment Provider Match Making Services in India Making the wrong choice can result in operational disruptions and financial setbacks.

Role of Payment Provider Match-Making Services

Payment provider match-making services act as facilitators in the decision-making process. They employ sophisticated algorithms to match businesses with payment providers that align with their requirements, simplifying the otherwise daunting task of selecting the right partner.

Benefits of Using Match-Making Services

The advantages of using match-making services extend beyond time and cost savings. Businesses experience increased efficiency, finding a payment provider that not only meets their current needs but also aligns with their future growth strategies.

How Payment Provider Match-Making Works

The process involves a step-by-step evaluation of the business’s requirements, preferences, and goals. Factors such as transaction volume, industry type, and desired features are considered in the matchmaking algorithm, ensuring a tailored selection.

Case Studies: Success Stories

Real-world examples showcase the tangible benefits of using match-making services. Businesses share their success stories, detailing the positive impact on their operations and financial health after switching to a better-suited payment provider.

Features to Look for in a Payment Provider

To make an informed decision, businesses need to consider essential features such as security, transaction speed, and customer support. Tailoring the choice to meet specific business needs ensures a seamless payment process.

Common Mistakes to Avoid in Selecting a Payment Provider

Common pitfalls, such as overlooking hidden fees or neglecting scalability, can be avoided with careful consideration. Tips provided help businesses navigate the decision-making process with confidence.

Future Trends in Payment Provider Match Making

Emerging technologies, such as blockchain and artificial intelligence, are expected to shape the future of payment provider match-making services. Businesses are encouraged to stay informed about industry developments for long-term success.

Regulatory Considerations

Navigating the regulatory landscape is crucial. Payment provider match-making services provide insights into the regulatory environment, ensuring businesses choose providers that comply with relevant laws.

Feedback Mechanism in Match-Making Services

Continuous improvement is facilitated through user feedback. Match-making services actively seek and analyze feedback to enhance their algorithms, providing businesses with an ever-improving selection process.

Integration and Migration Process

A smooth transition is essential when switching payment providers. Understanding the integration and migration process ensures minimal disruption to business operations.

Scalability of Payment Solutions

Evaluating the scalability of selected providers is vital for accommodating future business growth. Businesses should choose payment solutions that can adapt to their evolving needs.

Conclusion

In conclusion, the right payment provider is a cornerstone of a successful business. Payment provider match-making services offer an efficient solution to the perplexity of making this crucial decision. By leveraging these services, businesses can not only save time and costs but also ensure they have a payment partner that aligns with their unique needs and goals.

FAQs

- How do payment provider match-making services ensure the security of transactions?

- Match-making services prioritize security by partnering with providers that adhere to strict security standards and protocols.

- Can businesses switch payment providers easily using match-making services?

- Yes, match-making services guide businesses through a smooth integration and migration process for a seamless transition.

- What are the key regulatory considerations when selecting a payment provider in India?

- Businesses should ensure that selected providers comply with the regulatory framework set by the Reserve Bank of India and other relevant authorities.

- How often should businesses reevaluate their choice of payment provider?

- It is advisable for businesses to periodically reassess their payment provider to ensure it continues to meet their evolving needs.

- Are there any hidden fees that businesses should be aware of when choosing a payment provider?

- Match-making services help businesses identify and avoid hidden fees by providing transparent information about the cost structure of each provider.