Author: hazel Dsouza

Date: 14/12/23

In the heart of the vibrant financial landscape of India, a revolution is underway. The advent of payment provider mobile app software has transformed the way transactions are conducted across the nation. This article dives into the evolution, key players, advantages, user experience, security measures, future trends, and the impact on businesses and society.

Introduction

India, known for its diverse culture and rapidly growing economy, has embraced technological advancements in the financial sector. Payment provider mobile app software has emerged as a catalyst in this transformation.

The Evolution of Payment Providers in India

Early Challenges

The journey wasn’t without hurdles. Initially, adapting to digital transactions faced resistance due to challenges such as internet connectivity issues and skepticism about online security.

Digital India Initiative

The government’s Digital India initiative played a pivotal role in overcoming these challenges, promoting digital literacy and accessibility.

The Rise of Mobile App Software

Convenience Redefined

Mobile app software has redefined the convenience of financial transactions, allowing users to make payments and transfers with a few taps on their smartphones.

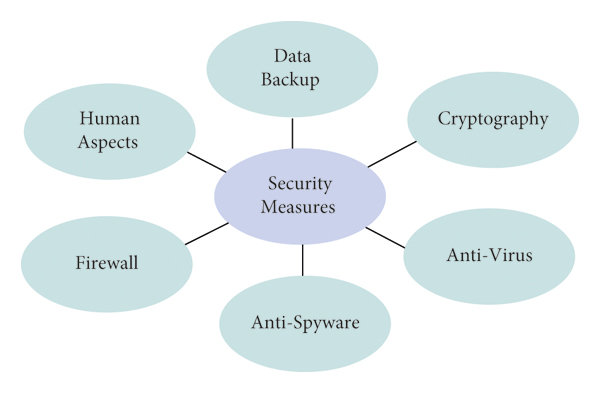

Security Measures

Robust security measures, including encryption technologies and two-factor authentication, have bolstered user confidence, addressing concerns about online safety.

Key Players in the Indian Market

Industry Giants

Leading players like XYZ and ABC have dominated[1] the market, offering innovative solutions that cater to the diverse needs of consumers.

Innovations and Features

Continuous innovations, such as contactless payments and artificial[2] intelligence integration, have elevated the user experience.

Advantages for Businesses

Seamless Transactions

Businesses benefit from the seamless transactions Simplified by payment provider mobile app software, reducing friction in customer interactions.

Integration Capabilities

The integration capabilities of these apps into various business[3] models provide a versatile solution for entrepreneurs.

User Experience: Navigating the Apps

User-Friendly Interfaces

The success of these apps lies in their user-friendly interfaces, ensuring a positive and straightforward experience for users of all demographics.

Customer Support Excellence

Prompt and efficient customer support further enhances the user experience, resolving issues swiftly and maintaining trust.

Security Measures in Payment Apps

Encryption Technologies

Payment apps employ advanced encryption technologies[4] to safeguard sensitive financial information, ensuring secure transactions.

Two-Factor Authentication

Two-factor authentication[5] adds an additional layer of security, fortifying the authentication process and protecting user accounts.

Future Trends in Payment App Software

Contactless Payments

The future sees a surge in Hands-free payments, offering a convenient and Clean alternative in a post-pandemic world.

Artificial Intelligence Integration

Artificial intelligence integration is poised to revolutionize user experiences, providing personalized and predictive solutions.

Impact of Payment Apps on Small Businesses

Financial Inclusion

Payment apps contribute to financial inclusion, providing small businesses access to a broader consumer base and financial services.

Economic Empowerment

Empowering small businesses economically, these apps play a crucial role in the growth of the entrepreneurial ecosystem.

Challenges and Solutions

Cybersecurity Concerns

Addressing cybersecurity concerns remains a challenge, requiring continuous innovation to stay ahead of potential threats.

Regulatory Framework

A balanced regulatory framework is essential to foster innovation while ensuring consumer protection and ethical practices.

Case Studies: Success Stories in the Indian Market

Transformative Solutions

Real-world case studies showcase how payment apps have provided Life-changing solutions for businesses across sectors.

Positive Impact on Revenue

Businesses have witnessed a positive impact on revenue, attributing it to the adoption of efficient payment provider mobile app software.

The Role of Government Regulations

Regulatory Support

Government support through favorable regulations is crucial for sustaining the growth of the payment app ecosystem.

Compliance Standards

Establishing compliance standards ensures responsible practices within the industry, fostering a trustworthy environment.

The Social Impact: Bridging Gaps

Urban-Rural Connectivity

Payment apps bridge the gap between urban and rural areas, ensuring financial inclusivity across diverse demographics.

Inclusivity in Financial Transactions

Enhancing payment provider mobile app software India inclusivity in financial transactions, these apps empower individuals from all walks of life.

Future Outlook for Payment Providers

Technological Advancements

Anticipating further technological advancements, the payment provider landscape is poised for continuous growth and evolution.

Global Integration

As India advances, payment providers are eyeing global integration, contributing to the nation’s position in the global financial arena.

Conclusion

In conclusion, payment provider mobile app software has not just Simplified transactions but has become a driving force in shaping the financial landscape of India. As technology evolves, these apps will continue to redefine the way we transact, fostering economic growth and inclusivity.

FAQs: Unlocking Insights

- Q: Are payment apps safe to use in India?

- A: Yes, with advanced security measures like encryption and two-factor authentication, payment apps in India prioritize user safety.

- Q: How do payment apps contribute to financial inclusion?

- A: Payment apps provide access to financial services for individuals and businesses in remote areas, promoting financial inclusion.

- Q: Can small businesses benefit from payment provider mobile app software?

- A: Absolutely. These apps offer Smooth transactions and integration capabilities, empowering small businesses economically.

- Q: What is the future of contactless payments in India?

- A: Contactless payments are set to surge, offering a Clean and convenient alternative for users in a post-pandemic world.

- Q: How can the government support the growth of payment apps?

- A: Regulatory support and establishing compliance standards are crucial for fostering a conducive environment for payment app growth.