AUTHOR : SAYYED NUZAT

DATE : JUNE 1, 2024

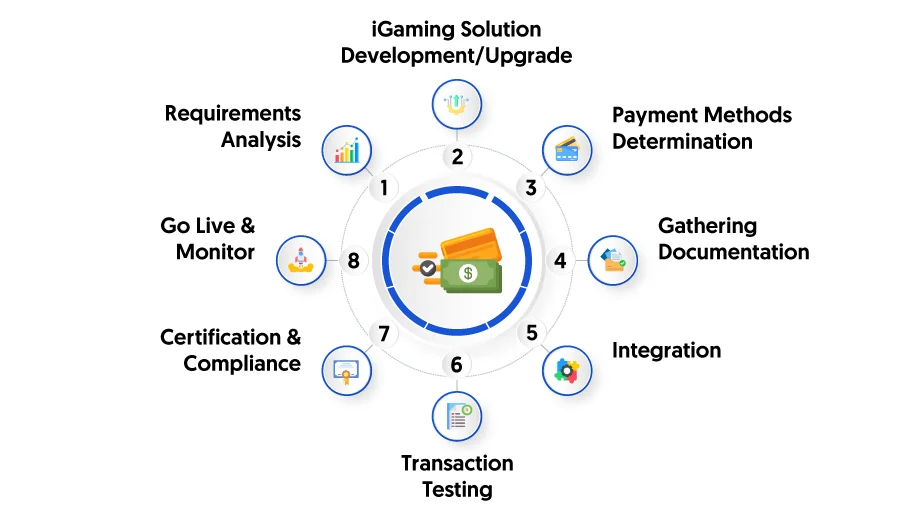

The iGaming industry in India is experiencing significant growth, driven by increasing internet penetration, the proliferation of smartphones, and a growing interest in online gaming and betting. One of the critical components of a successful iGaming platform is the integration of reliable, secure, and convenient payment solutions. Here’s an overview of the key payment solutions available for the iGaming industry in India.

1. UPI (Unified Payments Interface)

UPI is a real-time payment system developed by the National Payments Corporation of India (NPCI). It allows users to link multiple bank accounts into a single mobile application, facilitating seamless transfers. UPI is widely used due to its ease of use, instant processing, and high security.

Advantages:

- Instantaneous transactions.

- High security with two-factor authentication.

- No transaction fees for users.

2. E-Wallets

Digital wallets or e-wallets, have become increasingly popular for online transactions, including iGaming. Some of the popular e-wallets in India include Paytm, PhonePe, Google Pay, and MobiKwik.

Advantages:

- Quick and easy transactions.

- Secure, as they don’t require sharing bank details directly.

- Often linked with promotions and cashback offers.

3. Credit and Debit Cards

Credit and debit cards are traditional and widely accepted payment methods in the iGaming industry. Major card networks like Visa, MasterCard, and RuPay are commonly used.

Advantages:

- Widely accepted.

- Secure with multiple layers of authentication.

- Suitable for larger transactions.

4. Net Banking

Net banking allows users to make direct transfers from their bank accounts to their iGaming accounts. It is a secure and trusted method, especially for users who prefer not to use third-party applications.

Advantages:

- Direct bank-to-bank transfers.

- Secure with high levels of encryption.

- Supports large transactions.

5. Cryptocurrencies

Cryptocurrencies like Bitcoin, Ethereum[1], and Litecoin are gaining traction in the iGaming industry. They offer anonymity and security, which are appealing to many users.

Advantages:

- High level of anonymity.

- Secure and difficult to hack.

- Lower transaction fees compared to traditional banking.

6. Prepaid Cards and Vouchers

Prepaid cards and vouchers, such as Paysafecard[2], provide a way for users to make deposits without linking to their bank accounts. These are especially useful for users concerned about privacy[3] and security.

Advantages:

- No need to share personal bank details.

- Easy to use and widely accepted.

- Fixed amounts help with budgeting.

7. Bank Transfers

Direct bank transfers are another traditional payment method that some users prefer for their simplicity and security.

Advantages:

- Secure and straightforward.

- Suitable for larger transactions.

- Direct interaction with banking institutions.

Key Considerations for iGaming Payment Solutions

**1. Security and Compliance: Ensuring the security of transactions is paramount. Payment solutions must comply with regulatory standards like PCI-DSS[4] (Payment Card Industry Data Security Standard) and local regulations.

**2. User Experience: A smooth, hassle-free payment experience is crucial for retaining users. Payment gateways should offer quick processing times and minimal downtime.

**3. Integration and Compatibility: Payment solutions should be easily integrated with existing iGaming platforms and compatible with various devices and operating systems.

**4. Cost: Transaction fees can impact both the platform and the users. Solutions that offer lower fees without compromising on security are preferred.

**5. Support for Multiple Currencies: Given the global nature of iGaming, supporting multiple currencies can attract a broader user base.

Future Trends in iGaming Payment Solutions in India

The iGaming industry in India is poised for continuous evolution, and the payment solutions landscape will adapt accordingly. Here are some future trends that could shape the industry:

1. Increased Adoption of Cryptocurrencies

As cryptocurrencies become more mainstream, their adoption in the iGaming sector is expected to rise. Cryptocurrencies offer several advantages, including anonymity, lower transaction fees, and faster processing times. However, regulatory clarity and user education will be critical to their widespread adoption.

2. Integration of AI and Machine Learning

Artificial intelligence (AI) and Machine Learning[5] (ML) can enhance the payment process by providing advanced fraud detection, personalized user experiences, and efficient transaction processing. AI can analyze user behavior to detect suspicious activities, while ML algorithms can optimize payment processing for faster and more accurate transactions.

3. Biometric Authentication

Biometric authentication methods such as fingerprint scanning, facial recognition, and voice recognition are becoming more prevalent. These technologies provide an additional layer of security, making it harder for unauthorized users to access accounts or conduct fraudulent transactions.

4. Blockchain Technology

Blockchain technology offers transparent and secure transaction processing. Its decentralized nature can reduce the risk of fraud and provide a clear audit trail for all transactions. As blockchain technology matures, it could become a standard in the iGaming payment infrastructure.

5. Open Banking

Open Banking allows third-party developers to build applications and services around financial institutions. This can lead to the creation of innovative payment solutions that offer more seamless and personalized experiences for iGaming users. Open Banking can also facilitate better data sharing and collaboration between different financial entities.

6. Real-Time Payments

The demand for real-time payments is growing, and the infrastructure to support instant transactions is expanding. Real-time payment systems can enhance the user experience by providing immediate confirmation and access to funds, which is particularly important in the fast-paced iGaming environment.

Challenges and Considerations

While the future of iGaming payment solutions in India looks promising, several challenges need to be addressed:

1. Regulatory Environment

The regulatory landscape for iGaming and digital payments in India is complex and continually evolving. Companies must stay abreast of changes in regulations to ensure compliance and avoid legal issues. This includes understanding and adhering to anti-money laundering (AML) and knowing your customer’s KYC requirements.

2. Security Concerns

As cyber threats become more sophisticated, ensuring the security of payment solutions is paramount. Companies must invest in advanced security measures, including encryption, tokenization, and multi-factor authentication, to protect user data and transactions.

3. User Trust

Building and maintaining user trust is crucial for the success of iGaming platforms. Transparent communication about security measures, privacy policies, and the handling of user data can help build confidence among users.

4. Technological Integration

Integrating new payment technologies with existing iGaming platforms can be challenging. Companies need to ensure that new solutions are compatible with their current infrastructure and do not disrupt the user experience.

5. Market Competition

The iGaming market in India is becoming increasingly competitive, with new players entering the market regularly. To stand out, companies need to offer innovative and user-friendly payment solutions that enhance the overall gaming experience.

Conclusion

The iGaming industry in India requires robust and versatile payment solutions to cater to its diverse user base. By leveraging a mix of traditional and modern payment methods, platforms can provide a secure, efficient, and user-friendly experience. As the industry continues to grow, staying updated with the latest payment technologies and regulatory requirements will be essential for sustained success.

FAQs on iGaming Payment Solutions in India

1. What are the most popular payment methods for iGaming in India?

The most popular payment methods include UPI, e-wallets (like Paytm and PhonePe), credit and debit cards, net banking, and cryptocurrencies.

2. Is UPI a safe option for iGaming transactions?

Yes, UPI is highly secure with two-factor authentication and real-time transaction processing.

3. Can I use cryptocurrencies for iGaming in India?

Yes, cryptocurrencies like Bitcoin and Ethereum are increasingly accepted for iGaming, offering anonymity and lower transaction fees.

4. What are the benefits of using e-wallets for iGaming?

E-wallets provide quick, secure transactions without the need to share bank details, and they often offer promotions and cashback.

5. Are there any transaction fees for using credit/debit cards?

Some platforms may charge a small transaction fee for using credit or debit cards, but many offer fee-free options.