AUTHOR : SAYYED NUZAT

DATE : May 31, 2024

Online gambling in India operates in a complex legal and regulatory environment, particularly when it comes to payment processing. Here are key points to consider:

Legal Landscape

- Legality: Online gambling payment processing in India is governed by a mix of central and state laws. While the Public Gambling Act of 1867 prohibits operating or visiting a gambling house, it does not explicitly mention online gambling.This creates a gray area that is exploited by many online gambling operators.

- State Regulations: States like Sikkim and Nagaland have issued licenses to online gambling operators, whereas others like Maharashtra explicitly prohibit online gambling The legal status can differ significantly across various states.

Payment Processing Challenges

- Regulatory Scrutiny: Payment processors in India must comply with guidelines set by the Reserve Bank of India (RBI) and other regulatory bodies. This includes adhering to anti-money laundering (AML) and know your customer (KYC) norms.

- Transaction Bans: Banks and payment gateways are often reluctant to process transactions related to online gambling due to the unclear legal status and potential regulatory repercussions. The RBI has, in the past, instructed banks to block transactions related to online gambling.

Common Payment Methods

- E-Wallets: E-wallets like Paytm, PhonePe, and Google Pay are popular as they offer a degree of anonymity and are widely accepted.

- Cryptocurrencies: Bitcoin and other cryptocurrencies are used due to their decentralized nature and the relative anonymity they provide. However, the legal status of cryptocurrencies in India is also uncertain.

- International Payment Processors: Some Indian players use international payment processors like Skrill and Neteller, which are more accustomed to dealing with gambling transactions.

- Prepaid Cards and Vouchers: These are also used to circumvent direct banking restrictions.

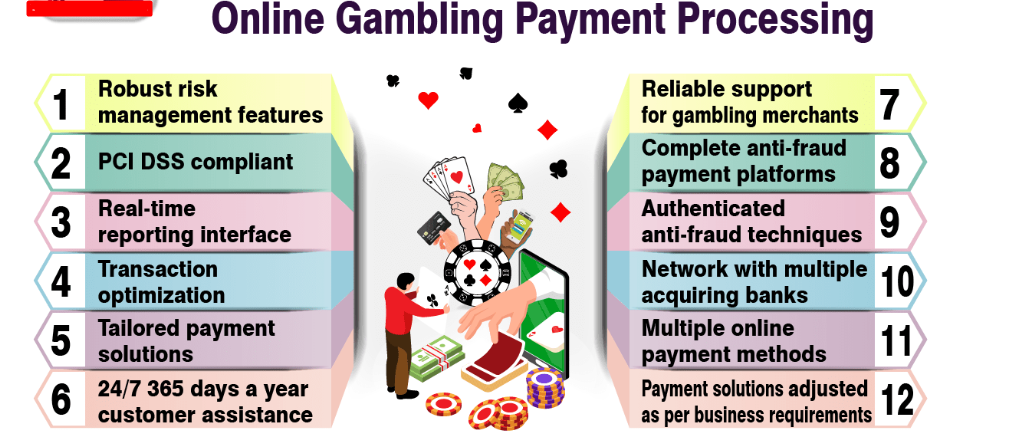

Compliance and Risk Management

- AML and KYC: Payment processors need to implement robust AML and KYC measures to detect and prevent fraudulent activities.

- Fraud Prevention: Advanced fraud detection systems are essential to minimize chargebacks and ensure the integrity of transactions.

- Data Security: Compliance with data protection laws, such as the Personal Data Protection Bill in India, is crucial to safeguard user information.

Future Trends

- Legislative Changes: There is ongoing debate about regulating and legalizing online gambling to generate revenue and provide a clear legal framework.

- Technological Advancements: Innovations in fintech and blockchain [1] technology may offer new, more secure ways to process payments for online gambling.

- Increased Adoption of Cryptocurrencies: As cryptocurrency adoption grows, it may become a more prominent method for online gambling transactions[2], provided regulatory hurdles are cleared.

Opportunities for Growth

- Regulatory Reform: If India moves towards a more regulated online gambling environment, it could open up significant opportunities for growth in the sector. Clear regulations would encourage more banks and payment processors to support gambling transactions.

- Market Potential: India has a large and young population with increasing internet[3] and smartphone penetration, making it a lucrative market for online gambling operators and payment processors alike.

- Innovation in Payment Solutions: The development[4] of specialized payment solutions tailored for online gambling could provide safer, faster, and more reliable transaction methods, benefiting both operators and users.

Strategies for Payment Processors

- Partnerships with Gambling Operators: Forming strategic alliances[5] with online gambling platforms can help payment processors tailor their services to meet the specific needs of the industry, ensuring better integration and user experience.

- Localized Solutions: Developing payment methods that cater to local preferences, such as support for regional languages and localized KYC processes, can enhance user adoption and satisfaction.

- Education and Awareness: Educating users about safe and responsible gambling, as well as the use of secure payment methods, can build trust and reduce the risk of fraud.

Challenges to Overcome

- Regulatory Compliance: Navigating the complex legal landscape requires payment processors to stay abreast of regulatory changes and ensure ongoing compliance with all applicable laws and guidelines.

- Trust and Security: Building trust among users is crucial, especially in an industry where financial transactions are sensitive. Ensuring high standards of security and data protection is paramount.

- Competition: The payment processing market is highly competitive, with both local and international players vying for a share. Offering unique value propositions and superior service quality can help stand out.

Case Studies and Examples

- Success in Regulated Markets: Examining how payment processors have successfully operated in regulated markets, such as the UK or Malta, can provide valuable insights. These regions have well-established frameworks that support secure and compliant payment processing for online gambling.

- Innovative Solutions: Highlighting examples of innovative payment solutions, such as blockchain-based transactions or AI-driven fraud detection systems, can illustrate potential paths forward for the Indian market.

Ethical Considerations

- Responsible Gambling: Payment processors can play a role in promoting responsible gambling by implementing limits on deposits and monitoring for signs of problem gambling.

- Transparency: Ensuring transparency in fees, transaction times, and data usage can help build user trust and foster a positive reputation in the market.

- User Protection: Implementing robust measures to protect users from fraud and ensuring compliance with data protection regulations is essential to safeguarding user interests.

Conclusion

The payment processing landscape for online gambling in India is marked by regulatory uncertainty and operational challenges. However, as the industry grows and potential legislative changes loom on the horizon, there could be more clarity and streamlined processes in the future. Payment processors must navigate these complexities by staying compliant, employing advanced security measures, and adapting to technological advancements.

FAQs

Is online gambling legal in India?

The legality of online gambling in India differs from state to state. While the Public Gambling Act of 1867 is a central law that prohibits most forms of gambling, it does not explicitly mention online gambling. Some states, like Sikkim and Nagaland, have legalized and regulated online gambling, while others, like Maharashtra, prohibit it. Be sure to review the particular regulations in your state.

What payment methods are commonly used for online gambling in India?

Common payment methods include:

- E-Wallets: Paytm, PhonePe, Google Pay

- Cryptocurrencies: Bitcoin, Ethereum

- International Payment Processors: Skrill, Neteller

- Prepaid Cards and Vouchers

Are transactions for online gambling allowed by Indian banks?

Many Indian banks are hesitant to process transactions related to online gambling due to regulatory concerns. The Reserve Bank of India (RBI) has guidelines that discourage banks from facilitating such transactions, making it challenging to use traditional banking methods.

How can I ensure the safety of my transactions when gambling online?

To ensure safe transactions:

- Use reputable and licensed online gambling sites.

- Opt for secure payment methods like e-wallets or cryptocurrencies.

- Verify that the site uses SSL encryption to protect your data.

- Enable two-factor authentication (2FA) for added security.

What is the role of KYC in online gambling payments?

Know-Your-Customer (KYC) procedures are crucial for:

- Verifying the identity of users is necessary to prevent fraud.

- Complying with anti-money laundering (AML) regulations.

- Ensuring that only eligible users participate in gambling activities.