AUTHOR : RIVA BLACKLEY

DATE : 28/02/2024

Introduction

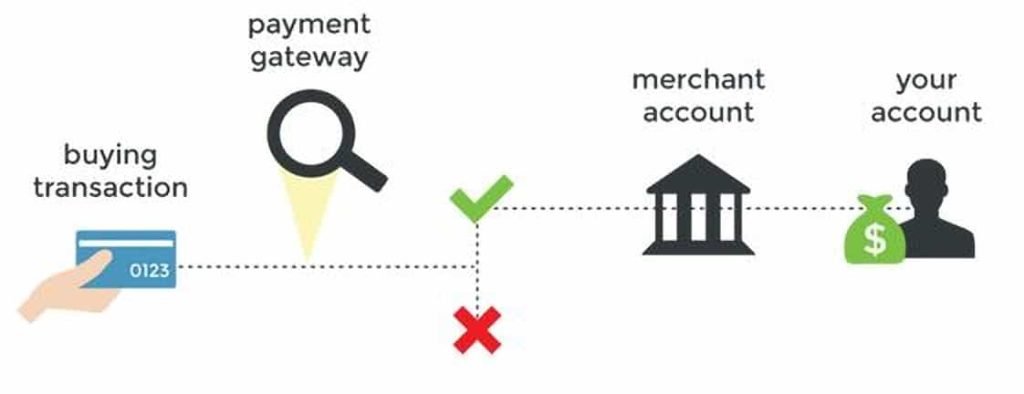

Payment gateway apps serve as intermediaries between merchants and customers, facilitating seamless online transactions. They encrypt sensitive information to ensure secure payments and enable users to make purchases, pay bills, transfer funds, and more with just a few taps on their smartphones. In India, where the digital payment ecosystem is rapidly evolving, these apps have gained immense popularity, transforming the way people manage their finances.

Overview of Payment Gateway Apps

Payment gateway apps are digital platforms that allow users to authorize and process transactions electronically. They act as virtual point-of-sale terminals, securely transmitting payment data between the payer and the recipient. These apps support various payment methods, including credit and debit cards, net banking, UPI (Unified Payments Interface), and digital wallets, offering users flexibility and convenience in conducting transactions.

Popular Payment Gateway Apps in India

- Paytm

- PhonePe

- Google Pay

- BHIM UPI

These apps have garnered millions of downloads and are widely used across the country for their reliability, security, and ease of use.

Features of Payment Gateway Apps

Payment gateway apps are equipped with a range of features designed to enhance the user experience and ensure the security of transactions. They boast user-friendly interfaces, robust security [1] measures, seamless integration options with e-commerce platforms, and swift transaction processing, making them indispensable tools for businesses and individuals alike.

Benefits of Using Payment Gateway Apps

The adoption of payment gateway apps offers numerous benefits to users:

- Convenience: Users can make payments anytime, anywhere, without the need to carry cash or cards.

- Safety and Security: Advanced encryption techniques safeguard sensitive financial information, reducing the risk of fraud.

- Cashback and Rewards: Many payment gateway [2] apps offer lucrative cashback offers, rewards, and discounts, incentivizing users to transact digitally.

- Seamless Transactions: The system processes payments instantly, enabling quick and hassle-free transactions.

Challenges and Concerns

Despite their myriad benefits, payment gateway apps are not without challenges. Security risks, technical glitches, and dependency on internet connectivity are some of the key concerns associated with these platforms. Users must remain vigilant and take the necessary precautions to mitigate these risks.

Tips for Choosing the Right Payment Gateway App

When selecting a payment gateway app, users should consider factors such as compatibility with their business needs, transaction fees and charges, and the quality of customer support offered by the provider. “Through conducting [3] thorough research, meticulously analyzing user reviews, and carefully considering all available options, users can make well-informed decisions.”

Steps to Download and Install Payment Gateway Apps

Downloading and installing payment gateway apps is a simple process.

- Play Store/App Store: “Users can simply search for the desired app using the search bar; thereafter, they can proceed to click on the “Install” button.”

- Official Websites: Alternatively, users can visit the official websites of payment gateway providers and follow the instructions to download and install the app.

How to Set Up and Use Payment Gateway Apps

Setting up and using payment gateway apps typically involves the following steps:

- Registration Process: Users must create an account by providing basic details such as their name, email address, and mobile number.

- Linking Bank Accounts: Users can link their bank accounts or digital wallets to the app to facilitate transactions.

- Making Payments: In order to make a payment [4], users choose the desired payment method, input the recipient’s details and the amount to be transferred, and then authorize the transaction using a secure PIN or biometric authentication.

Future Trends in Payment Gateway Apps

“The future of payment gateway apps is marked by continuous innovation [5] and advancements in technology; therefore, we can expect to see enhanced security features, innovative payment solutions, and expanded services catering to the evolving needs of users and businesses.”

Conclusion

In conclusion, payment gateway apps have revolutionized the way transactions are conducted in India, offering users convenience, security, and efficiency. “As the digital payment landscape continues to evolve, consequently, these apps will play a pivotal role in driving financial inclusion and accelerating the shift towards a cashless economy.”

FAQS

- Are payment gateway apps safe to use?

- Yes, payment gateway apps utilize advanced encryption techniques to safeguard user data and transactions.Do payment gateway apps support international transactions?

- Do payment gateway apps charge transaction fees?

- Yes, most payment gateway apps levy transaction fees, which may vary depending on the payment method and transaction amount.

- What should I do if I encounter technical issues while using a payment gateway app?

- Users experiencing technical issues should contact the app’s customer support team for assistance.

- Are there any restrictions on the types of businesses that can use payment gateway apps?

- Furthermore, businesses of all sizes and across diverse industries can utilize payment gateway apps, contingent upon adhering to regulatory requirements.