AUTHOR : RUBBY PATEL

DATE : 20/12/23

Introduction

In today’s fast-paced business environment, where time is of the essence, the need for seamless payment solutions is more critical than ever. Payment gateways act as intermediaries that authorize and facilitate electronic transactions between businesses, ensuring the smooth flow of funds Business-to-business .

Evolution of Payment Gateways

The evolution of payment gateways Business traces back to the need for secure and convenient digital transactions. Over the years, technological advancements have transformed these gateways connections in India, making them more sophisticated and user-friendly.

Payment Gateway Landscape in India

India’s payment gateway B2B connections in India landscape has witnessed significant growth, with various players donate to a competitive market. Companies such as [Company A], [Company B], and [Company C] have emerged as leaders, offering diverse solutions tailored to the unique needs of businesses.

Challenges in B2B Transactions

B2B transactions often involve complex processes, SaaS payment platforms[1] including invoicing, approvals, and multiple Investors. Security concerns related to sensitive financial information add another layer of complexity to these transactions B2B payment automation[2].

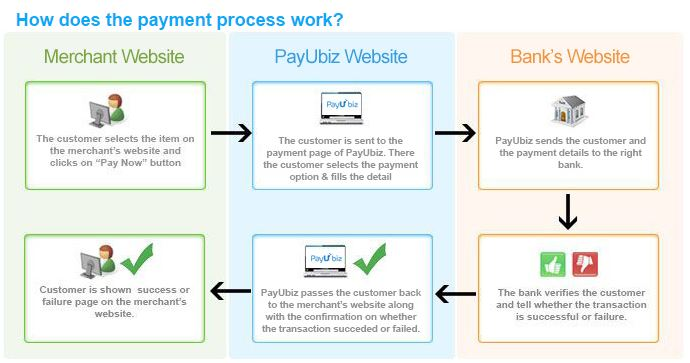

Role of Payment Gateways in B2B Connections

Merchant payment solution[3] play a pivotal role in streamline. B2B transactions. By providing a secure and efficient platform, these gateways enable businesses to focus on their core operations without the burden of intricate financial processes.

Popular B2B Payment Gateways in India

Several Cross-border payments [4] cater specifically to the B2B segment in India. [Company X], known for its robust security features, competes with [Company Y], which focuses on user-friendly interfaces. Each platform brings its unique strengths to the table, ensuring distinct advantages for businesses engaged in B2B integration[5]

Benefits of Using Payment Gateways in B2B

The adoption of payment gateways in B2B connections offers numerous benefits. From saving time and reducing costs to minimizing manual errors, businesses can experience improve. efficiency in their financial transactions Cross-border payments are financial transactions where the payer and the recipient are based in separate countries. They cover both wholesale and retail payments, including remittances.

Security Measures in B2B Transactions

Ensuring the security of sensitive information is paramount in B2B transactions. Payment entrance implement advanced encryption and verification. measures, Obey with industry standards to · escort ·businesses from potential risks.payments can be made in several different ways. Bank transfers, credit card payments and alternative payment methods such as e-money wallets and mobile payments are currently the most prevalent

Adoption of Digital Payments in B2B

The increasing trend of digital payments in India has swayed.B2B transactions positively. Businesses are transitioning from traditional methods to digital platforms, resulting in improved speed and accuracy in financial dealings.

Case Studies

Real-world examples of successful B2B connections through payment gateways illustrate the practical benefits of these platforms. [Case Study 1] and [Case Study 2] showcase how businesses have overcome challenges and achieved efficiency.

Future Trends in B2B Payment Gateways

Looking ahead, the integration of payment gateways with emerging technologies like blockchain and artificial intelligence is expected to shape the future of B2B transactions. Predictions suggest a more interconnected and automated financial ecosystem.

Best Practices for B2B Transactions

To ensure smooth B2B transactions, businesses should adhere to certain best practices. Guidelines for invoicing, approvals, and timely payments contribute to a payment process, business relationships.payments can be made in several different ways. Bank transfers, credit card payments and alternative payment methods such as e-money wallets and mobile payments are currently the most prevalent

User Experience in B2B Payments

payments can be made in several different ways. Bank transfers, credit card payments and alternative payment methods such as e-money wallets and mobile payments are currently the most prevalent The user experience is a crucial aspect of B2B payments. A user-friendly interface and positive customer feedback contribute to the overall satisfaction of businesses utilizing payment gateways for their financial transactions.

Blockchain Integration

The integration of blockchain technology is revolutionizing B2B transactions. Blockchain ensures transparency, security, and real-time tracking, offering a decentralized and ledger for financial interactions.

Artificial Intelligence and Machine Learning

The application of artificial intelligence (AI) and machine learning (ML) in B2B payment gateways enhances fraud detection, risk management, and . This leads to more accurate decision-making processes and improved security.

Conclusion

In conclusion, payment gateways have become indispensable in cultivate. efficient B2B connections in India. Their role in simplifying complex transactions, security, and to the scanning of businesses cannot be overstated.

FAQs

- Are payment gateways secure for B2B transactions?

- Yes, payment gateways implement robust security measures tobulwark · sensitive information during B2B transactions.

- Which payment gateway is best for B2B transactions in India?

- The choice depends on specific business needs. Platforms like [Company X] and [Company Y] offer tailored solutions.

- How do payment gateways contribute to time efficiency in B2B transactions?

- Payment gateways automate processes, reducing the time required for approvals and financial dealings.

- Can small businesses benefit from B2B payment gateways?

- Absolutely. B2B payment gateways cater to businesses of all sizes, providing scalable solutions.

- What is the future outlook for B2B payment gateways?

- The future involves integration with emerging technologies, creating a more advanced and interconnected financial ecosystem.