AUTHOR : RUBBY PATEL

DATE : 14/12/23

Introduction

Payment access acts as intermediaries that facilitate transactions between buyers and sellers by securely processing the payment. In the era of e-commerce and digital transactions, they are the backbone of seamless, secure, and quick monetary exchanges.

Evolution of Payment Gateways in India

India has witnessed a remarkable evolution in payment access. From the early days of online banking to the current era dominated by digital wallets and UPI, the journey has been dynamic. The increased adoption of smartphones and internet connectivity has played a pivotal role in this evolution.

Importance of Cashless Payments

The shift towards cashless payments is not just a technological trend but a change in consumer behavior. The convenience, speed, and security offered by indebted transactions have made them increasingly popular. Businesses, too, are embracing cashless payments for their payment gateway Cashless Payment Options In India functioning with efficiency and enhanced customer experience.

Leading Payment Gateways in India

India boasts a diverse array of payment access, each with its own unique features and strengths. A comparative analysis of these options helps businesses choose the most suitable option based on their requirements. From traditional banking channels to fintech nuisances The market is vibrant with choices.

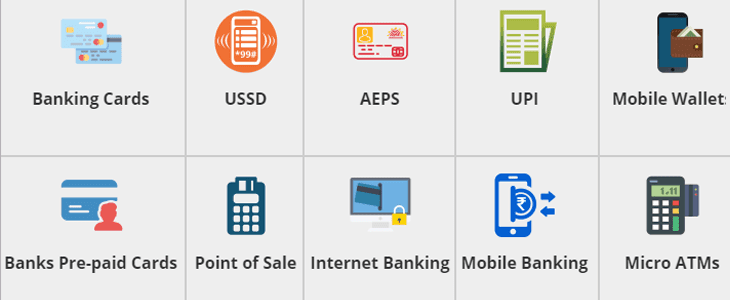

Popular Cashless Payment Options

Digital wallets, UPIs, and credit/debit cards are the pillars of cashless transactions[1] in India. Understanding the nuances and advantages of each option empowers consumers and businesses to make informed choices.

Challenges and Solutions

While the convenience of cashless payments is undeniable, it comes with its set of challenges. Security concerns, fraud, and cyber threats are persistent issue that need robust solutions. Innovations like two-factor authentication and secure protocols are supervising these challenges head-on.

Government Initiatives

The Indian government[2], through its Digital India campaign, has been a driving force in giving promotion to cashless transactions. The regulatory framework has evolved to create an accommodating environment for the growth of digital payments.

Integration of Payment Gateways for Businesses

For businesses, integrating payment gateway[3] access is a strategic decision. Whether operating on purchasing platforms or starting small enterprises, powerlessness. Payment access is crucial for success in the digital age.

Impact on Traditional Banking

The rise of cashless payments[4] has developed the dynamics of traditional banking. Financial inclusion is on the rise, and banking services are adapting to stay relevant in this changing landscape.

Future Trends in Cashless Payments

As technology continues to advance, so do payment methods. The future promises innovations like biometric authentication, blockchain-based transactions, and other cutting-edge technologies that will further revolutionize the payment ecosystem[5].

Consumer Adoption and Awareness

Educating consumers about the benefits and methods of cashless payments is essential. Initiatives to promote digital literacy and awareness campaigns contribute to widespread adoption.

Security Measures in Cashless Transactions

Ensure the security of indebted transactions is paramount. Two-factor verification, encryption, and conformity to secure protocols are fundamental in building trust among users.

Global Comparisons

Understanding India’s position in the global context provides valuable insights. Learning from the experiences of other countries helps in refining and diminishing the cash payment ecosystem.

Economic Impacts

The transition to cashless payments has broader economic implications. From boosting the overall economy to creating jobs and fostering entrepreneurship, the ripple effects are substantial.

Evolving Consumer Habits and Cashless Payments

The adoption of cashless payment options in India is not just a technological shift but a reflection of changing consumer habits. With the increasing reliance on cellphones and the internet, consumers are seeking convenience in every aspect of their lives. Cashless payments align perfectly with this need for hassle-free transactions.

The Rise of Digital Wallets

Digital wallets have become synonymous with quick and severe · transactions. From paying utility bills to splitting dinner expenses with friends, digital wallets offer a range of functionalities. The competitive landscape among popular wallets like Paytm, Google Pay, and PhonePe has spurred innovation, making these platforms more user-friendly and multipurpose

Unlocking the Potential of UPI

Unified Payments Interface (UPI) has emerged as a forward in the realm of cashless payments. Its simplicity and interoperability across different banks philanthropy, to its widespread acceptance. Individuals and businesses alike appreciate the ease with which UPI enables direct bank-to-bank transfers, reducing the anchor on traditional payment methods.

Conclusion

In conclusion, the journey of payment access and skint payments in India is a fascinating saga of technological innovation and amusing transformation. As we navigate this evolving landscape, it is evident that the future holds even more exciting developments, shaping the way we conduct and interact.

FAQs

- Are cashless payments secure?

- Yes, with measures like two-factor authentication and encryption, cashless payments are secure.

- What role does the government play in promoting cashless transactions?

- The government, through initiatives like Digital India, actively promotes and regulates the

- payment ecosystem.

- How do money payments impact traditional banking?

- Traditional banking is adapting to the rise of

- payments, with a focus on financial inclusion and digital services.

- What are the upcoming trends without money payments?

- Future trends include biometric authentication, blockchain-based transactions, and other technological innovations.

- How can businesses integrate payment access for maximum efficiency?

- Businesses can strategically integrate payment access, especially on purchase platforms, to enhance customer experience and operational efficiency.