AUTHOR: JIVI SCOTT

DATE: 26/12/2024

Introduction

In the rapidly evolving digital world, cashless payments have become a norm in nearly every industry, and the jewelry sector in India is no exception. With increasing technological advancements and the demand for convenience, jewelry retailers and buyers are embracing payment gateway solutions for seamless transactions. This article explores the growing trend of payment gateway[1] cashless payments for jewelry in India, examining its benefits, trends, and how businesses can leverage these systems to enhance customer experience and drive growth Payment Gateway Cashless Payments[2] For Jewelry In India.

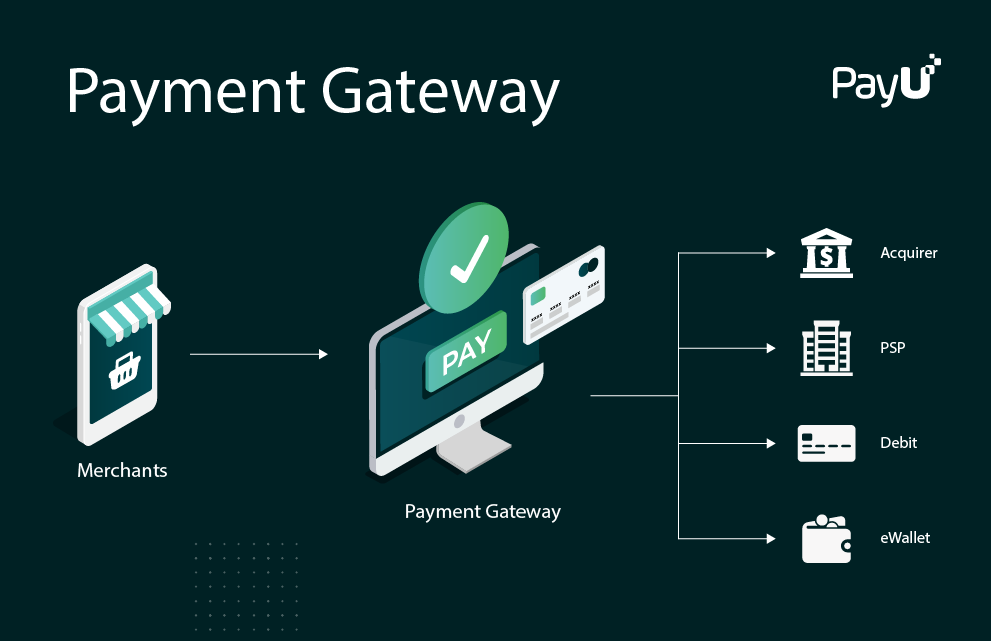

What is a Payment Gateway?

A payment gateway is a technology that processes electronic payments[3] for online and offline transactions. It acts as a bridge between the buyer’s bank and the seller’s bank, ensuring secure and smooth processing of funds. Payment gateways are essential for businesses that want to offer cashless options to customers. In the context of jewelry stores in India, this technology allows customers to make purchases through credit cards, debit cards, e-wallets, UPI, or even cryptocurrencies, making it easier to shop without the need for Payment Gateway Cashless Payments For Jewelry In India.

The Growing Importance of Cashless Payments in Jewelry

India is witnessing a shift towards digital payment[4] systems, and the jewelry industry is embracing this change. Over the past few years, there has been a significant increase in the use of cashless payments in the country. Jewelry businesses are increasingly adopting payment gateway solutions[5] to cater to the growing demand for secure, fast, and convenient payment methods. With India’s rapidly digitizing economy, both urban and rural consumers are seeking the convenience of making jewelry purchases without the hassle of handling physical currency.

Key Benefits of Payment Gateway Cashless Payments in Jewelry

- Increased Convenience for Customers One of the primary advantages of integrating a payment gateway into a jewelry business is the convenience it offers to customers. By providing options such as credit/debit card payments, UPI, or digital wallets, jewelry stores enable their customers to make quick and easy payments. This encourages more customers to purchase high-value items such as gold, diamonds, and gemstones, enhancing the overall shopping experience.

- Improved Security Security is a critical concern for both consumers and businesses when it comes to making payments. Payment gateways utilize advanced encryption technologies to ensure that all transactions are secure and protected against fraud. This level of security is especially important in the jewelry industry, where transactions often involve large sums of money. By offering cashless payment solutions, jewelry retailers can build trust and gain customer confidence.

- Faster Transactions Cashless payments through a payment gateway significantly reduce transaction time, enabling quicker purchases. Whether it’s a physical jewelry store or an online platform, customers can complete transactions in seconds. This speed benefits both the customer and the retailer, increasing overall sales and efficiency.

- Reduced Risk of Theft and Fraud Handling large amounts of cash presents significant risks, especially in high-end jewelry stores. Cashless payments reduce these risks by eliminating the need for physical money exchanges. Payment gateways use sophisticated fraud detection systems that help prevent fraudulent transactions, offering a higher level of protection than cash payments.

- Wider Market Reach Adopting cashless payment systems allows jewelry businesses to expand their customer base beyond their local area. With online payments, customers from across India (and even globally) can purchase jewelry from any store that supports payment gateway. This global reach enhances business growth and provides access to a larger pool of potential buyers.

- Detailed Transaction Records Payment gateways provide detailed records of every transaction. These records help jewelry businesses with financial accounting and ensure transparency. Additionally, customers also benefit by having access to receipts and transaction histories, which can be useful for warranty claims, returns, or refunds.

The Rising Trend of Payment Gateways in India’s Jewelry Sector

The jewelry industry in India has traditionally been cash-heavy, with many transactions being carried out in physical currency. However, as the digital economy has expanded, payment gateways have played a crucial role in transforming this sector. Here’s a look at the payment gateway trends shaping the future of jewelry retail:

1. Mobile Payments and UPI Integration

India’s push towards a cashless economy has led to the widespread adoption of mobile payment solutions, especially Unified Payments Interface (UPI). Jewelry businesses are increasingly integrating UPI as a payment option, allowing customers to pay directly from their bank accounts through mobile phones. This trend is gaining momentum as UPI continues to grow in popularity due to its ease of use and instant transaction capabilities.

2. E-Wallets and Digital Payment Options

Digital wallets like Paytm, Google Pay, and PhonePe are becoming common payment methods in the jewelry sector. These platforms offer a simple and secure way to make payments, and they are increasingly being adopted by jewelry retailers to cater to tech-savvy consumers. Many jewelry stores also offer exclusive discounts for payments made via these wallets, making them even more attractive to customers.

3. EMI and Buy Now Pay Later (BNPL) Solutions

Jewelry purchases often involve high-ticket items, which can be a financial burden for some customers. Payment gateways are now offering EMI (Equated Monthly Installment) and BNPL options, allowing customers to spread their payments over time. This trend has become particularly popular in India, where consumers are looking for flexible payment options to buy expensive jewelry.

4. Blockchain and Cryptocurrency Payments

As cryptocurrencies gain acceptance in India, the jewelry industry is starting to explore blockchain and cryptocurrency payments. This emerging trend offers customers an alternative payment method that is decentralized, secure, and potentially faster than traditional banking systems. Jewelry businesses that accept crypto payments may appeal to younger, tech-savvy consumers who are keen on exploring the future of digital currencies.

5. Integration with E-Commerce Platforms

As more jewelry retailers move online, integrating payment gateway solutions with e-commerce platforms has become essential. Many online jewelry stores now offer a range of payment methods, from credit cards to e-wallets, ensuring a seamless shopping experience for customers. This trend is likely to continue as more jewelry businesses set up their online stores to reach a wider audience.

How Jewelry Retailers Can Leverage Payment Gateways

Jewelry retailers can maximize the benefits of payment gateway cashless payments by integrating these solutions effectively into their business models. Here are a few strategies for leveraging these systems:

1. Offer Multiple Payment Options

To cater to a broad customer base, jewelry stores should provide various payment options, including credit cards, debit cards, mobile wallets, UPI, and EMI solutions. The more payment options available, the higher the likelihood of completing a sale.

2. Ensure a Secure Payment Process

Security should be a top priority. Jewelry retailers must choose payment gateways that use encryption and fraud detection measures to ensure safe and secure transactions. Offering secure payment options helps build trust with customers and reduces the chances of fraud.

3. Provide Incentives for Digital Payments

Offering discounts or loyalty points for customers who use digital payment methods can incentivize them to go cashless. This not only boosts sales but also encourages customers to embrace digital payments.

4. Stay Updated with Payment Gateway Trends

As technology evolves, payment gateway trends also change. Jewelry businesses must stay informed about the latest developments in payment solutions and continually upgrade their systems to provide the best possible experience for customers.

Conclusion

The rise of payment gateway trends in India is revolutionizing the jewelry industry, offering businesses a chance to tap into a growing customer base while providing an enhanced shopping experience. By embracing cashless payment systems, jewelry retailers can boost sales, improve security, and stay competitive in the fast-changing market. As technology continues to evolve, staying updated with the latest payment gateway trends will ensure that businesses are well-positioned for future growth and success.

FAQs

Q1: What are the benefits of cashless payments for jewelry stores in India?

A1: Cashless payments offer multiple benefits, including increased convenience, enhanced security, faster transactions, reduced risks of theft, and broader market reach. They also streamline financial management with detailed transaction records.

Q2: How do payment gateways ensure secure transactions?

A2: Payment gateways use encryption technologies to protect sensitive customer data during transactions. They also employ fraud detection and risk management systems to prevent unauthorized or fraudulent activities.

Q3: Is it difficult for jewelry businesses to integrate payment gateways?

A3: No, integrating a payment gateway is relatively simple. Most payment providers offer user-friendly tools and support to help businesses set up and maintain their systems. The process usually involves registering with a payment provider and integrating their solution with your website or POS system.

Q4: How do UPI and e-wallet payments benefit jewelry customers?

A4: UPI and e-wallets offer a fast, secure, and convenient way to make payments. These methods allow customers to make transactions directly from their bank accounts or digital wallets, reducing the need for cash and increasing the speed of purchases.

Q5: What is the future of payment gateways in the jewelry industry?

A5: The future of payment gateways in the jewelry industry looks promising with the continued rise of mobile payments, UPI integration, digital wallets, and even cryptocurrency payments. As technology advances, jewelry businesses will adopt even more innovative solutions to meet customer expectations.