Author : Shin hari

Introduction to Consumer Electronics in India

Overview of the Market

India’s consumer electronics market has grown exponentially over the last decade. Driven by rapid urbanization, rising disposable incomes, and increasing digital penetration, this sector encompasses products like smartphones, TVs, refrigerators, and other gadgets. As one of the largest electronics markets globally, India provides immense opportunities for businesses to thrive. However, the backbone of this booming market is an efficient payment infrastructure that ensures seamless transactions[1].

Role of Payment Gateways in the Electronics Market

With the shift toward e-commerce and digital-first retail experiences, payment gateways have become essential tools for consumer electronics businesses. They facilitate quick, secure, and error-free transactions while boosting customer trust. For products with high price points, such as smartphones or laptops, customers demand smooth and secure checkout processes, making payment gateway[2] indispensable for any retailer.

India’s Consumer Electronics Industry: A Snapshot

Key Growth Drivers

- Digital Transformation: With initiatives like “Digital India,” consumers are more inclined to shop online, fueling demand for digital payment solutions[3].

- Urbanization: India’s urban population has significantly embraced technology, resulting in higher purchases of electronics.

- Youth Dominance: The younger generation, being early adopters of new technologies, drives demand for gadgets and tech-focused solutions.

- Government Policies: Initiatives like “Make in India” have boosted domestic electronics production, further spurring industry growth.

Major Trends in Consumer Electronics

- Smart Devices: From smart TVs to AI-driven home assistants, tech-savvy consumers are leaning toward smart products.

- E-Commerce Domination: Platforms like Flipkart, Amazon, and Tata CLiQ dominate electronics sales, requiring robust digital payment integrations.

- Demand for Financing Options: High-value products lead to increased demand for EMIs (Equated Monthly Installments) and Buy Now Pay Later (BNPL) solutions.

Why Payment Gateways Are Crucial in the Consumer Electronics Market

Building Customer Trust

For high-value electronics purchases, customers need assurance that their financial information is secure. Payment gateways use encryption and other security protocols to safeguard sensitive data, ensuring trust in every transaction.

Facilitating Large-Value Transactions

Electronics are often expensive, with purchases ranging from INR 5,000 to over INR 1,00,000. A reliable payment gateway processes these high-value transactions efficiently, reducing errors or failed payments.

Expanding Customer Base with Digital Wallets and UPI

India’s digital payment ecosystem, including UPI, Paytm, and Google Pay, has become a major force in retail. Electronics businesses that integrate these methods cater to a wider audience, especially in semi-urban and rural areas.

Enabling EMI and BNPL Options

Payment gateways partnered with financial institutions and fintech companies allow businesses to offer EMI and BNPL solutions. This makes high-value products more accessible, encouraging more customers to make purchases.

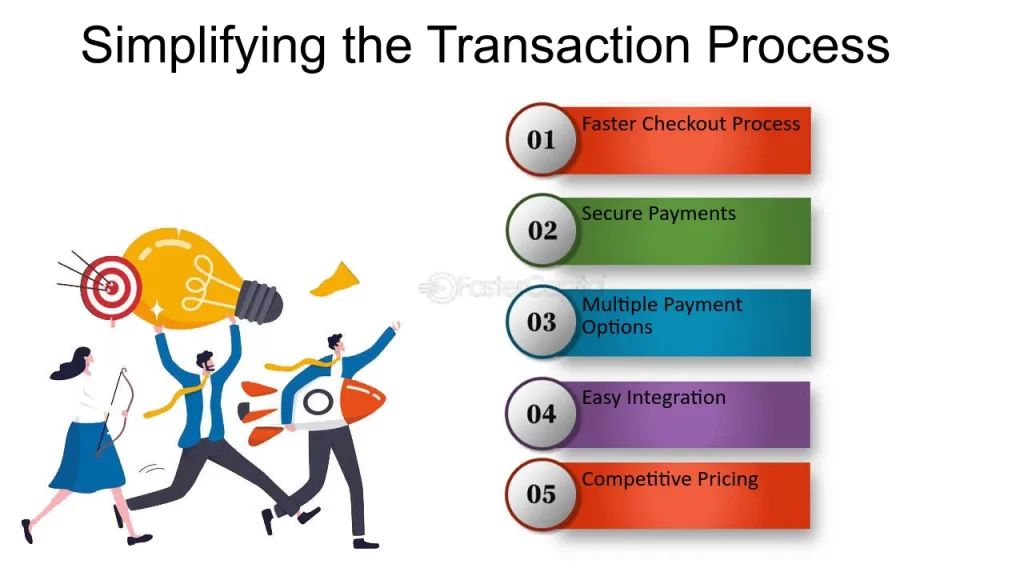

Role of Payment Gateways in the Consumer Electronics Market

Simplifying High-Value Transactions

Payment gateways are designed to handle high-value transactions securely. For expensive electronics like laptops and televisions, customers prefer reliable gateways that ensure error-free and encrypted payments.

Driving E-Commerce Sales

With online platforms[4] like Flipkart, Amazon, and Croma dominating the consumer electronics space, payment gateways have become essential for ensuring smooth digital transactions. They support a variety of payment modes, reducing cart abandonment rates.

Providing Financing Options

Many electronics purchases are facilitated through EMI (Equated Monthly Installment) options or Buy Now Pay Later (BNPL) services. Payment gateways often integrate with banks and NBFCs to enable these services, making high-priced items more affordable.

Building Trust with Security Features

Payment gateways use robust encryption protocols and tools like two-factor authentication (2FA) to protect customers’ financial information, building trust in online shopping.

Challenges in Using Payment Gateways for Electronics

High Transaction Fees

Many gateways charge fees for every transaction. For high-value electronics, these fees can add up, impacting profit margins.

Payment Failures

Technical glitches during transactions can lead to frustration and loss of customers. Ensuring high uptime and fallback mechanisms is essential.

Fraud Risks

Given the high value of electronics, fraudulent transactions are a concern. Gateways must include robust fraud detection and prevention systems.

Integration Complexities

For businesses with limited technical expertise, integrating payment gateways can be challenging. Opting for user-friendly APIs and plugins can simplify this process.

Emerging Payment Trends in Consumer Electronics

Voice-Assisted Payments

Voice commerce is gaining traction, allowing customers to complete transactions through virtual assistants like Alexa or Siri.

AI-Powered Fraud Detection

AI systems analyze transaction data in real-time to detect unusual patterns, minimizing fraud risks.

Biometric Authentication

Fingerprints, facial recognition, and other biometric methods are being integrated into payment systems for enhanced security.

Cryptocurrency Integration

Some businesses are beginning to accept cryptocurrencies, appealing to tech-savvy and international customers.

Future of Payment Gateways in India’s Electronics Market

Open Banking Initiatives

Open banking is transforming the payment landscape, allowing businesses to access financial data securely to create personalized payment solutions.

5G Technology’s Impact

The rollout of 5G networks promises faster transactions and improved reliability, enhancing the overall shopping experience for electronics buyers.

Greater Focus on Rural Markets

With rural India embracing digital payments[5], payment gateways are adapting to cater to these untapped markets. Supporting regional languages and offline payment modes is becoming increasingly important.

Future Prospects

The integration of payment gateways in India’s consumer electronics market is expected to grow with increased digitalization and customer demand for frictionless experiences. With the rise of AI-driven solutions, blockchain security, and real-time payment analytics, businesses can not only enhance customer satisfaction but also optimize their revenue streams.

Conclusion

India’s consumer electronics market is poised for sustained growth, and payment gateways are at the heart of this transformation. From enabling secure transactions to offering innovative solutions like BNPL and instant refunds, payment gateways have become indispensable for businesses. By embracing the latest technologies and catering to diverse customer needs, businesses can thrive in this competitive market.

FAQs

What makes a payment gateway suitable for the electronics market?

Features like secure high-value transactions, multi-payment support, and EMI options are critical for the electronics sector.

How can small electronics businesses manage high transaction fees?

Opt for gateways with tiered pricing or negotiate with providers for volume-based discounts.

Is UPI integration important for electronics retailers?

Yes, UPI integration ensures wider reach and caters to customers across all demographics.

Can payment gateways handle cross-border sales?

Yes, gateways like CCAvenue and Razorpay offer multi-currency support and compliance with international regulations.

What role do EMIs play in electronics sales?

EMIs make expensive electronics affordable, increasing the likelihood of purchases and boosting customer satisfaction.