AUTHOR : SOFI PARK

DATE : 15/12/2023

Introduction

In the fast-paced digital era, the landscape of financial transactions has undergone a significant transformation. Payment gateways, Payment gateway Contactless Payment Methods In India once a novelty, have become an integral part of our daily lives. Today, we delve into the realm of payment Portals and explore the revolutionary impact of digital payment methods in India.

Evolution of Payment Gateways

The journey of payment Portals dates back to the evolution of digital transactions. From the early days of e-Payment gateway Contactless Payment Methods In India commerce to the present era dominated by mobile apps, the Comfort and efficiency of payment gateways have grown sharply.

Contactless Payment: A Game-Changer

Contactless payments, a subset of digital transactions, have emerged as a game-changer in the financial landscape. Utilizing Near Field Communication (NFC) technology, these transactions offer a seamless and secure alternative to traditional payment methods.

Key Players in the Indian Market

India boasts a dynamic market with several key players Secure Contactless Payment Solutions supportive to the contactless payment ecosystem. From secure banking institutions to innovative fintech companies, the competition has paved the way for diverse and user-friendly options

Technological Advancements

NFC technology plays a pivotal role in enabling contactless payments. The secure and rapid communication between devices ensures a smooth transaction process. Additionally, stringent security measures are in place to safeguard users against potential threats.

Consumer Adoption and Behavior

The shift towards contactless payments is not merely technological; it reflects a change in consumer behavior. Factors such as speed, convenience, and hygiene have driven individuals to embrace digital transactions, especially in the post-pandemic world.

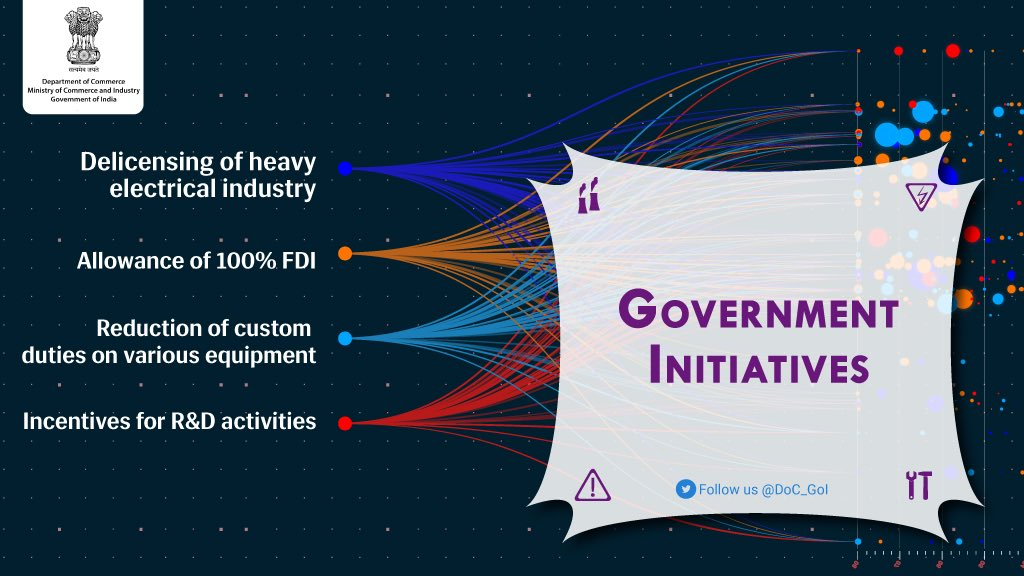

Government Initiatives and Regulations

Recognizing the importance of Digital wallet[1], the Indian government has implemented various initiatives to promote and regulate the use of contactless payment methods. This includes creating a robust regulatory framework to ensure the security and legality of such transactions.

Challenges and Concerns

While contactless payments Digital Payment Gateways[2] offer numerous benefits, challenges and concerns persist. Security and privacy issues remain at the forefront, requiring continuous innovation and collaboration between stakeholders to address these challenges and foster widespread adoption.

Impact on Businesses

Businesses, both small and large, are reaping the benefits of contactless payments. The efficiency, reduced transaction time, and increased customer satisfaction contribute to the success stories of businesses Contactless payment[3] Transaction Processing Systems that have integrated these payment methods into their operations.

Future Trends and Innovations

The future of contactless payments in India holds exciting possibilities. From the integration of biometric authentication to the exploration of blockchain technology[4], the payment industry is on the cusp of groundbreaking innovations that will shape the way we transact.

Comparison with Global Trends

As India embraces contactless payments, it is essential to compare our progress with global trends. Understanding the practices and challenges faced by other countries can provide valuable insights into optimizing our own payment ecosystem[5].

Educational Initiatives

Education plays a vital role in fostering widespread adoption. Companies and government initiatives are focusing on educating the public about the benefits and security features of contactless payments, contributing to a more informed and confident user base.

Societal Impact

The adoption of contactless payment methods extends beyond convenience; it has a profound impact on societal norms and habits. The inclusivity and accessibility of these methods contribute to financial empowerment across diverse segments of the population.

Success Stories

Numerous success stories highlight the transformative power of contactless payments. From local vendors to multinational corporations, businesses have experienced increased efficiency, reduced costs, and improved customer satisfaction by embracing these modern payment methods.

Conclusion

the journey of contactless payments in India is marked by innovation, adaptation, and positive societal changes. As we continue to witness the evolution of financial transactions, embracing contactless payments is not just a convenience but a step towards a more secure, efficient, and inclusive future.

FAQs

- Are contactless payments secure?

- Contactless payments utilize secure technologies like NFC, ensuring a high level of security for transactions.

- How are small businesses benefiting from contactless payments?

- Small businesses experience increased efficiency, reduced transaction time, and improved customer satisfaction by adopting contactless payments.

- What government regulations support contactless payments in India?

- The Indian government has implemented a robust regulatory framework to ensure the security and legality of contactless transactions.

- What is the role of education in promoting contactless payments?

- Education plays a crucial role in creating awareness and building confidence among the public regarding the benefits and security features of contactless payments.

- Can contactless payments bridge societal gaps?

- Yes, the inclusivity and accessibility of contactless payments contribute to financial empowerment across diverse segments of the population.