Author : Sweetie

Date : 20/12/2023

Introduction

In today’s rapidly evolving business landscape, the fusion of payment gateways and corporate synergy has become a focal point for businesses in India. This dynamic integration not only facilitates seamless transactions but also opens up new avenues for growth and collaboration. Let’s delve into the intricacies of payment gateway corporate synergy and explore its impact on the Indian market.

Definition of Payment Gateway

A payment gateway[1] is a digital tool that enables online transactions by securely connecting the merchant, buyer, and financial institutions. It acts as a bridge between the Collaborative Commerce platform and the payment processor Engaging with collaborative commerce means coming together with your suppliers, distributors, partners, even your competitors.

Significance of Corporate Synergy

Corporate Synergy in India involves the collaboration of multiple entities to achieve a common goal, fostering efficiency and innovation. Digital Payments When applied to payment[2] gateways, this synergy amplifies the effectiveness of online transactions and business operations.

Overview of the Payment Gateway Corporate Synergy in India

The amalgamation of Payment Gateway Corporate Collaborative commerce refers to the digitally-enabled business interactions within a company between its internal employees holds immense potential for streamlining financial transactions, reducing costs, and enhancing the overall efficiency of businesses.

Evolution of Payment Gateways

Historical Background

The journey of payment Synergy in India traces back to the early 2000s when the e-commerce industry began gaining traction. Initially simple, these gateways[3] have evolved into sophisticated platforms with advanced security features.

Technological Advancements

Advancements in technology, including the adoption of artificial intelligence and blockchain, have transformed payment gateways into robust systems capable of handling diverse payment methods and ensuring data security Collaborative Payment Portals.

Importance of Corporate Synergy

Benefits in the Indian Business Landscape

The Indian business landscape benefits significantly from corporate synergy[4] in payment gateways, leading to increased operational efficiency, reduced transaction costs, and improved customer satisfaction business partners and customers. Payment Analysis Collaborative commerce can take place in an industry or industry segment,

Key Players in Payment Gateway Corporate Synergy

Analysis of Leading Companies

Major players in the Indian market, such as Paytm, Razorpay, and others, are actively engaging in corporate[5] synergy initiatives to strengthen their positions and offer comprehensive payment solutions. The unstructured supplementary service data (USSD) was launched for those sections of India’s population which do not have access to proper banking and internet facilities

Collaborations and Partnerships

The unstructured supplementary service data (USSD) was launched for those sections of India’s population which do not have access to proper banking and internet facilities Strategic collaborations and partnerships between payment gateway providers and businesses contribute to the development of innovative payment solutions.

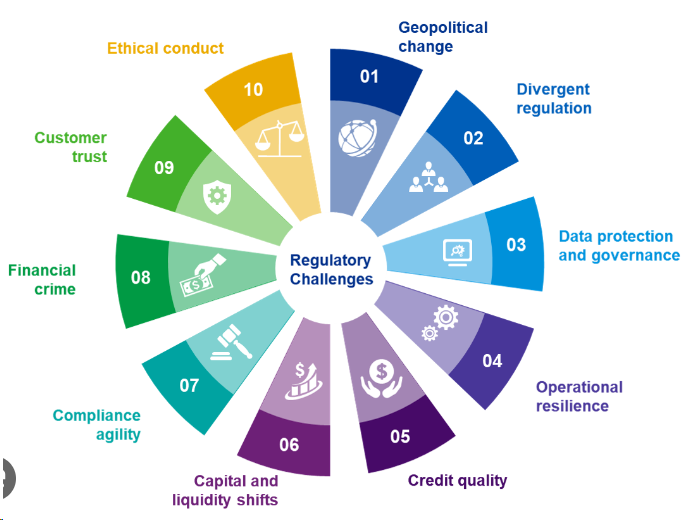

Challenges Faced in the Integration

Regulatory Issues

Navigating the complex regulatory landscape poses challenges for businesses and payment gateway providers, requiring careful compliance to ensure seamless integration.

Technological Challenges

The integration of diverse technological systems among collaborating entities demands careful planning and execution to avoid disruptions and security vulnerabilities. This is the only mode of digital payment that is popular in online and physical transactions.

Success Stories

Case Studies of Successful Corporate Synergy in Payment Gateways

Examining successful case studies highlights the positive impact of corporate synergy, showcasing increased transaction volumes, enhanced security measures, and improved user experiences. Digital payments are transactions that occur via digital or online modes. This means both the payer and the payee use electronic mediums to exchange money.

Positive Impacts on Businesses

Businesses that embrace payment gateway corporate synergy witness increased customer trust, faster transaction processing, and a competitive edge in the market. The meaning of digital payment is equivalent to an electronic payment. Digital payments use a digital device or platform to move money

Future Trends

Emerging Technologies

The integration of emerging technologies like biometrics, contactless payments, and decentralized finance is expected to shape the future of payment gateway corporate synergy in India.

Expected Developments in Corporate Synergy

Anticipated developments include deeper collaborations, enhanced data analytics, and the integration of artificial intelligence to further optimize transaction processes The meaning of digital payment is equivalent to an electronic payment. Digital payments use a digital device or platform to move money .

Strategies for Successful Implementation

Lessons from Successful Integrations

Digital payments can take place through the Internet as well as on physical premises. Some examples of digital payments include buying something from e-commerce Studying successful integrations reveals valuable lessons, emphasizing the importance of clear communication, strategic planning, and a commitment to ongoing collaboration.

Consumer Perspectives

Improved User Experience

Consumers benefit from improved user experiences, with faster and more secure transactions, leading to increased trust in online payment systems. Digital payments can take place through the Internet as well as on physical premises. Some examples of digital payments include buying something from e-commerce

Enhanced Security Measures

The incorporation of advanced security measures assures consumers of the safety of their financial information, fostering confidence in using online payment gateways.

The Role of Government Policies

Impact on Payment Gateway Corporate Synergy

Government policies play a crucial role in shaping the landscape of payment gateway corporate synergy, providing a framework that ensures fair competition and consumer protection. This is the only mode of digital payment that is popular in online and physical transactions.

Supportive Initiatives

Supportive government initiatives, such as promoting digital transactions and providing incentives for innovation, contribute to the growth of payment gateway corporate synergy. Mobile apps and other digital payment agents use biometric verification to authenticate transactions

Risks and Mitigations

Identifying Potential Risks

Identifying potential risks, including cybersecurity threats and operational disruptions, is essential for developing effective risk mitigation strategies. This interoperable solution uses Radio Frequency Identification (RFID) technology to allow individuals to make toll payments while their vehicle is in motion

Strategies to Minimize Risks

Implementing strategies such as regular security audits, employee training programs, and contingency plans minimizes risks associated with payment gateway corporate synergy. This is the only mode of digital payment that is popular in online and physical transactions.

Conclusion

In conclusion, payment gateway corporate synergy in India represents a strategic alliance that enhances the efficiency and security of online transactions, benefiting businesses and consumers alike. This is the only mode of digital payment that is popular in online and physical transactions.

FAQs:

- Q: How does payment gateway corporate synergy benefit businesses in India?

A: Payment gateway corporate synergy enhances operational efficiency, reduces transaction costs, and boosts customer satisfaction for businesses in India. - Q: What are the challenges faced in integrating payment gateways and corporate synergy?

A: Challenges include navigating regulatory issues, addressing technological complexities, and ensuring seamless collaboration among stakeholders. - Q: How can businesses minimize risks associated with payment gateway corporate synergy?

A: Businesses can minimize risks through regular security audits, employee training, and the development of contingency plans. - Q: What role do government policies play in shaping payment gateway corporate synergy?

A: Government policies provide a framework for fair competition and consumer protection, shaping the landscape of payment gateway corporate synergy. - Q: What are the future trends in payment gateway corporate synergy in India?

A: Future trends include the integration of emerging technologies, deeper collaborations, and the use of artificial intelligence to optimize transaction processes.