AUTHOR: RUBBY PATEL

DATE: 04/01/24

Introduction

In the dynamic landscape of e-commerce, payment gateways play a pivotal role in facilitating online transactions securely However, there’s more to these gateways than just processing payments This article explores the realm of payment gateway cross-selling in India, shedding light on its significance, benefits, challenges, and best practice

Understanding Payment Gateways

Definition and Functionality

Payment access. serves as an intermediary that authorizes and facilitates transactions between merchants and customers. They ensure that sensitive information, such as credit card details, remains secure during the payment process.

Types of Payment Gateways

There are various types of payment access, ranging from hosted gateways to self-hosted solutions. Each type caters to different business needs, offering a diverse array of features and functionalities.

The importance of Cross-Selling

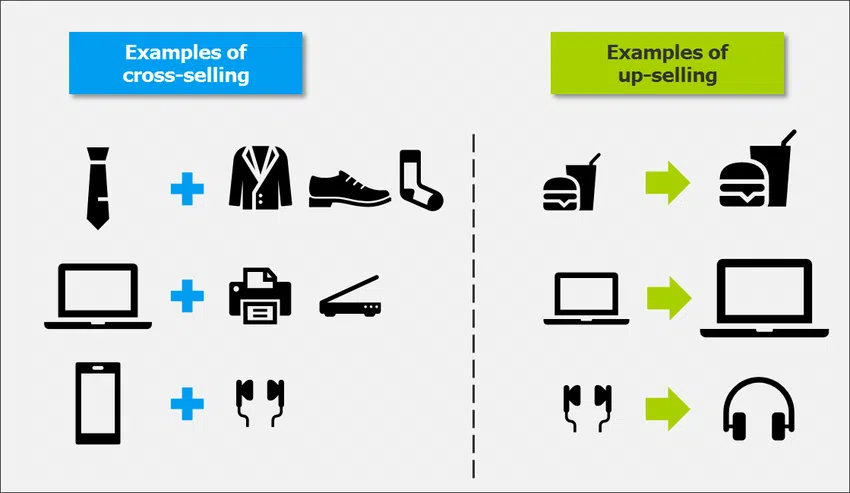

Definition of Cross-Selling

Cross-selling [1] involves promoting additional products or services to a customer during or after their purchase. It’s a strategy aimed at maximizing the value of each transaction by encouraging customers to explore complementary offerings.

Significance in E-commerce

In the competitive e-commerce landscape,Effective cross-selling[2] has become a game-changer. It not only boosts revenue but also fosters a more personalized shopping experience, leading to increased customer satisfaction and loyalty.

Payment Gateway Cross-Selling in India

Current Market Scenario

India’s e-commerce[3] market is witnessing unprecedented growth, and payment gateway providers are capitalizing on this trend. Cross-selling has become a strategic focus for these providers, aiming to offer a one-stop solution for merchants.

Key Players

Several payment gateway [4] providers in India are actively involved in cross-selling initiatives. Understanding their strategies and market share is crucial for businesses looking to leverage these opportunities.

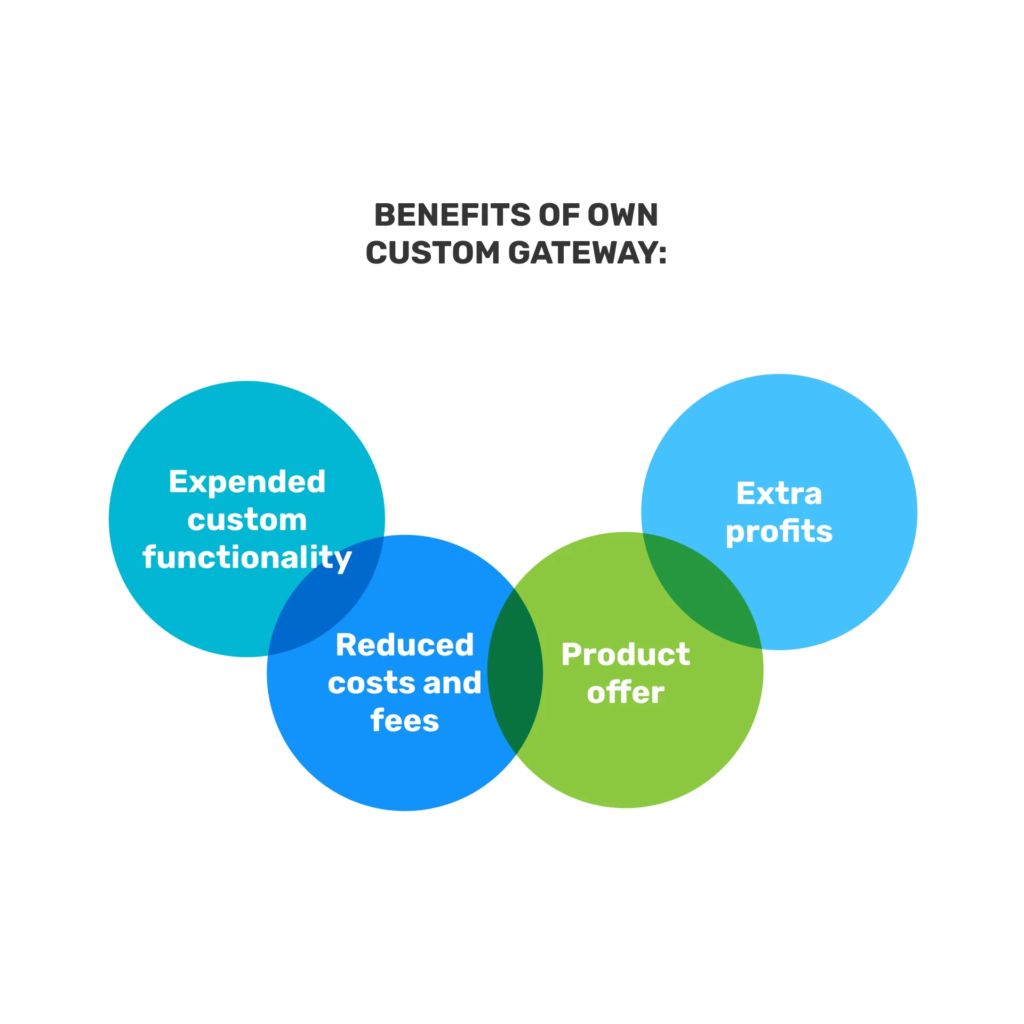

Benefits of Payment Gateway Cross-Selling

Increased Revenue

One of the primary benefits of payment[5] gateway cross-selling is the potential for increased revenue. By showcasing relevant products or services during the checkout process, merchants can capitalize on the customer’s intent to purchase.

Enhanced Customer Experience

Cross-selling, when done right, enhances the overall customer experience. It introduces customers to products they may not have discovered on their own, providing value and convenience.

Challenges and Solutions

Security Concerns

While cross-selling presents lucrative opportunities, concerns about data security and privacy are paramount. Payment gateway providers must implement robust security measures to instill confidence in both merchants and consumers.

Integration Issues

Smooth integration of cross-selling features into existing payment access can pose challenges. Providers need to ensure compatibility and seamless functionality to avoid disruptions in the payment process.

Best Practices for Cross-Selling

Targeted Product Recommendations

Personalization is the key to an effective upsell. Utilizing customer data to make targeted product recommendations increases the likelihood of successful upsells.

Seamless User Experience

Integration should not compromise the user experience. Cross-selling features should seamlessly blend into the payment process without causing friction or confusion.

Case Studies

Successful Examples in India

Examining real-world examples of successful payment gateway upsells in India provides insights into effective strategies and outcomes.

Future Trends

Technological Advancements

As technology evolves, payment access. will likely incorporate advanced features, such as artificial intelligence, for more accurate product recommendations and enhanced user experiences.

Evolving Consumer Behavior

Understanding how consumer behavior evolves is crucial for anticipating trends in payment gateway cross-selling. Adapting strategies to align with changing preferences ensures sustained success.

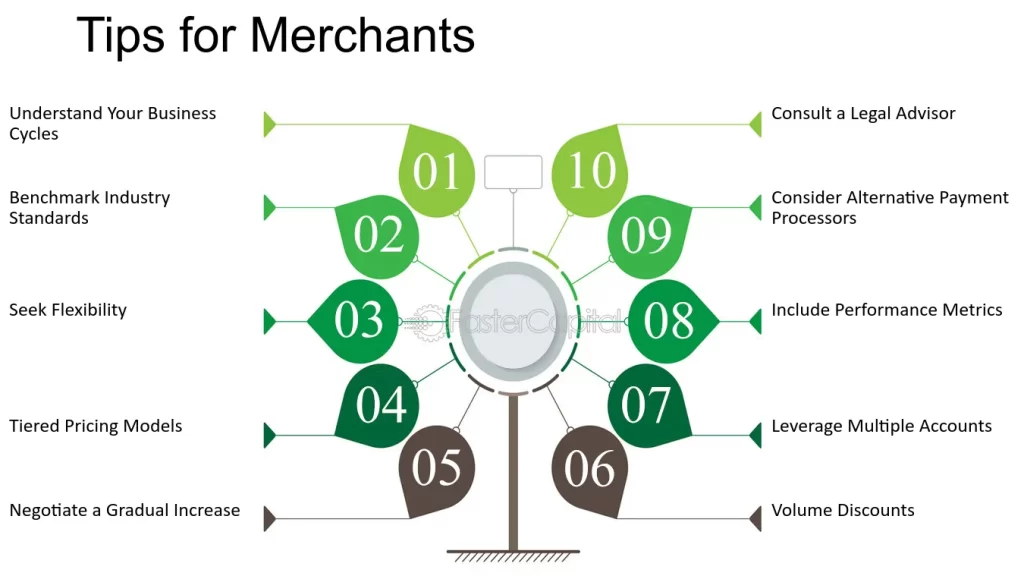

Tips for Merchants

Choosing the Right Payment Gateway

Selecting a payment gateway that aligns with business needs and supports robust upsell features is essential. Merchants should consider scalability, security, and ease of integration.

Implementing Cross-Selling Strategies

Merchants can maximize the benefits of cross-selling by implementing tailored strategies. This involves analyzing customer data, understanding purchasing patterns, and refining approaches based on feedback.

Conclusion

In the ever-expanding landscape of e-commerce, payment gateway cross-selling stands out as a strategy with immense potential. By understanding the market, embracing best practices, and staying ahead of trends, both payment gateway providers and merchants can unlock new avenues of growth.

FAQs

- What is cross-selling? Cross-selling is a strategy where additional products or services are supported. to a customer during or after their purchase, maximizing the value of each transaction.

- How does payment gateway cross-selling work? Payment gateway cross-selling involves showcasing relevant products or services during the checkout process, leveraging the customer’s intent to purchase.

- Are there any security risks involved? While there may be security concerns, payment gateway providers must implement robust measures to ensure data security and privacy.

- Can small businesses benefit from cross-selling? Yes, cross-selling can benefit small businesses by increasing revenue and enhancing the overall customer experience.

- What are the future trends in payment gateway cross-selling? Future trends include technological advancements, such as AI-driven recommendations, and an understanding of evolving consumer behavior.