AUTHOR : NORA

DATE : 28-12-23

Introduction to Payment Gateways for E-Goods

In a digital era where everything is just a click away, e-goods have emerged as a convenient and instant way for consumers to access products and services From e-books and software to online courses and digital subscriptions, e-goods have become integral part of the online marketplace. However, ensuring secure and seamless transactions is crucial for the success of this digital economy[1] and this is where payment gateways play a pivotal role.

Payment Gateway Landscape in India

India boasts a diverse market of payment gateway[2] providers, each offering unique features and services. From industry giants to innovative startups, the competition is fierce, driving continuous improvements in technology and user experience. The trends in payment gateways reflect the dynamic nature of the e-commerce landscape, adapting to the evolving needs of businesses and consumers

Understanding E-Goods Transactions

E-goods transactions encompass a wide range of digital products[3] and services. Whether it’s a one-time purchase of software or a recurring subscription to a streaming service, these transactions differ from traditional retail in their intangible nature. Understanding the nuances of e-good transactions is crucial for both merchants and consumers to navigate the digital marketplace effectively.

Challenges in E-Goods Transactions

Despite the convenience of e-goods transactions, challenges such as security concerns and fraud prevention loom large. The intangible nature of digital products makes them susceptible to unauthorized access and fraudulent activities. Merchants and payment gateway providers must implement robust security measures to protect both the buyers and sellers in this virtual marketplace.

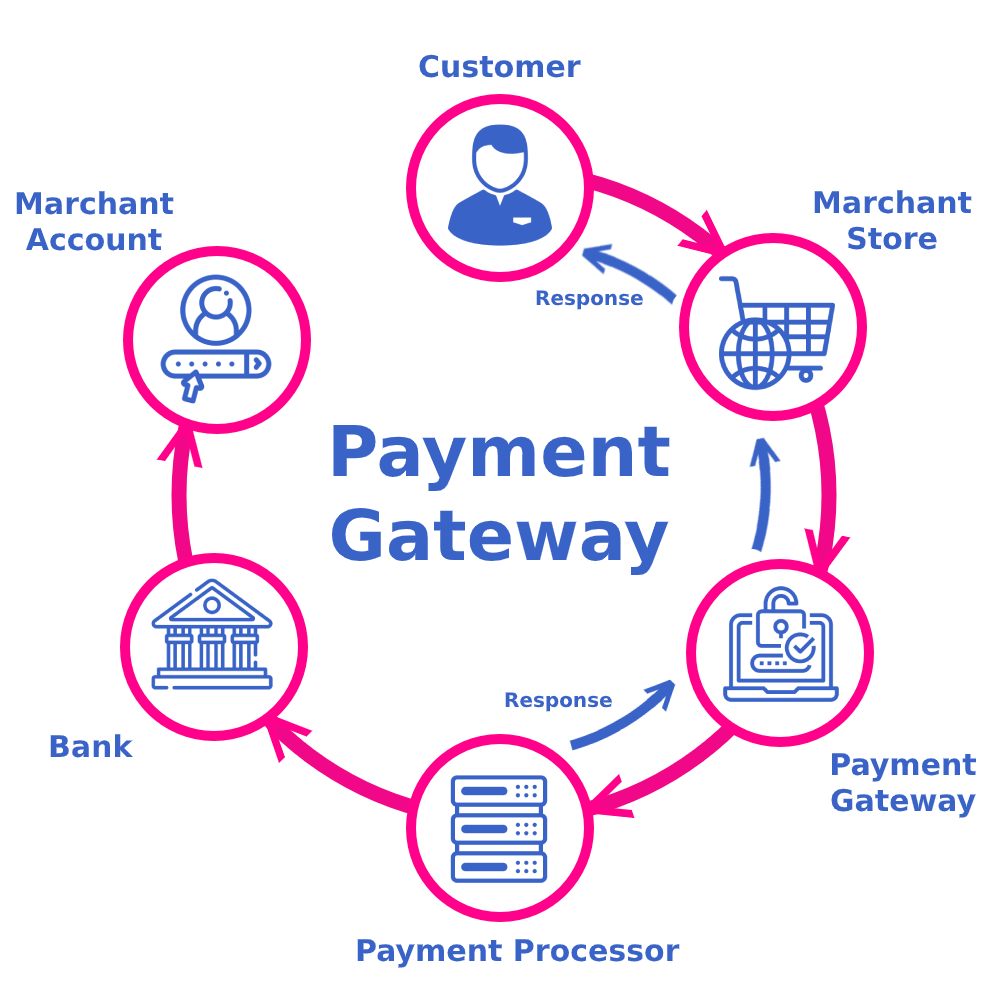

Role of Payment Gateways in E-Goods Security

Payment gateways act as the guardians of secure transactions in the digital realm. Encryption protocols, secure authentication methods, and continuous monitoring are essential components of a payment gateway’s arsenal. Understanding how payment gateways contribute to the security of e-goods transactions is vital for businesses looking to establish trust with their customers.

Popular Payment Gateways for E-Goods in India

In the vast sea of payment gateway options, some names stand out for their reliability, user-friendly interfaces, and wide-ranging features. Comparing these gateways can help merchants choose the right platform for their e-goods transactions, ensuring a smooth and secure payment experience for their customers.

Steps to Integrate Payment Gateways for E-Goods

Integrating a payment gateway seamlessly into an e-commerce platform involves technical considerations and compatibility issues. Merchants must be aware of the specific requirements for their chosen payment gateway and ensure that it aligns with the functionalities of their e-commerce system[4].

Regulatory Framework for E-Goods Payments in India

As the digital landscape expands, so does the need for regulations to safeguard consumers and businesses. Government regulations regarding online transactions[5] and e-goods payments play a crucial role in shaping the legal framework for the digital marketplace.

Benefits of Using Payment Gateways for E-Goods

The advantages of utilizing payment gateways for e-goods transactions are numerous. From the convenience they offer to the streamlined processes for merchants, the adoption of secure payment gateways enhances the overall digital shopping experience.

Case Studies: Successful E-Goods Transactions

Real-world examples showcase the success stories of businesses that have effectively utilized payment gateways for their e-good transactions. These case studies highlight the positive impact on sales, customer satisfaction, and brand reputation.

Future Trends in Payment Gateways for E-Goods

Looking ahead, the future of payment gateways for e-goods is marked by technological advancements and changing consumer behaviors. Staying informed about these trends is essential for businesses to stay competitive in the ever-evolving digital landscape.

Tips for Choosing the Right Payment Gateway

Selecting the right payment gateway involves careful consideration of various factors. From transaction fees to customization options, merchants must weigh their priorities and choose a gateway that aligns with their business goals.

Customer Trust and Satisfaction in E-Goods Transactions

Building trust is paramount in the digital marketplace. Ensuring a seamless and secure experience for customers not only fosters trust but also contributes to customer satisfaction and loyalty.

Educational Resources for E-Goods Merchants

Merchants entering the electronic goods market can benefit from educational resources that provide insights into industry trends, best practices, and technical know-how. Staying educated ensures that businesses are well-prepared to navigate the dynamic landscape of digital transactions.

Conclusion

In conclusion, the realm of payment gateways for e-goods in India is a dynamic and thriving ecosystem. With the right knowledge and tools, businesses can harness the potential of e-goods transactions, offering customers a secure and seamless online shopping experience.

Frequently Asked Questions FAQ

crucial role in ensuring the security and efficiency of e-goods transactions. They act as a bridge between the customer, the merchant, and financial institutions, facilitating seamless and secure monetary exchanges in the digital space.

- How do payment gateways contribute to the security of e-good transactions?

- Payment gateways employ advanced encryption techniques and secure authentication methods to safeguard sensitive information during transactions. These measures help prevent unauthorized access and protect both buyers and sellers from potential fraud.

- Can I trust the popular payment gateways mentioned for e-good transactions?

- Yes, the popular payment gateways mentioned have established reputations for reliability and security. However, it’s essential for merchants to conduct thorough research and choose a gateway that aligns with their specific business needs.

- What are the key factors to consider when choosing a payment gateway for e-goods?

- Factors such as transaction fees, ease of integration, customization options, and scalability are crucial considerations when selecting a payment gateway for e-commerce transactions. Merchants should assess their priorities and choose a gateway that suits their business model.

- How can businesses stay updated on future trends in payment gateways for e-goods?

- To stay informed about future trends, businesses can actively participate in industry forums, attend relevant conferences, and subscribe to newsletters from reputable sources. Additionally, keeping an eye on technological advancements and consumer behaviors is key to anticipating changes in the payment gateway landscape.