Author : Sweetie

Date : 28/12/2023

Introduction

In the dynamic landscape of financial transactions, payment gateways[1] have emerged as a pivotal element facilitating seamless electronic transactions. This article delves into the synergy between payment gateways and electronic media in the vibrant context of India, exploring the evolution, challenges, and future trends in this crucial domain.

Evolution of Payment Gateways in India

Early Challenges

In the nascent stages, payment gateways faced hurdles in gaining acceptance due to technological limitations and apprehensions about online security[2]. However, advancements in technology and increased internet penetration have paved the way for widespread adoption.

Technological Advancements

The continual evolution of technology has played a significant role in transforming payment gateways. From basic online transactions to advanced features like real-time processing and multi-currency support, the landscape has evolved to meet the demands of a digital economy[3].

Rise of Digital Transactions

The surge in digital transactions, especially post-demonetization, has accelerated the prominence of payment gateways. The convenience and speed offered by electronic media[4] have led to a paradigm shift in the way financial transactions are conducted.

Unveiling the protagonists shaping the narrative in the Indian Payment Gateway Industry.

Overview of Leading Companies

India boasts a competitive payment gateway market, with key players such as Paytm, Razorpay, and CCAvenue dominating the space. Understanding the market dynamics and the competitive landscape is crucial for merchants seeking the right payment solution.

Market Share and Competition

Analyzing the market share of prominent players and the competitive landscape helps in making informed decisions. As new entrants continually disrupt the market, staying updated on emerging trends is essential.

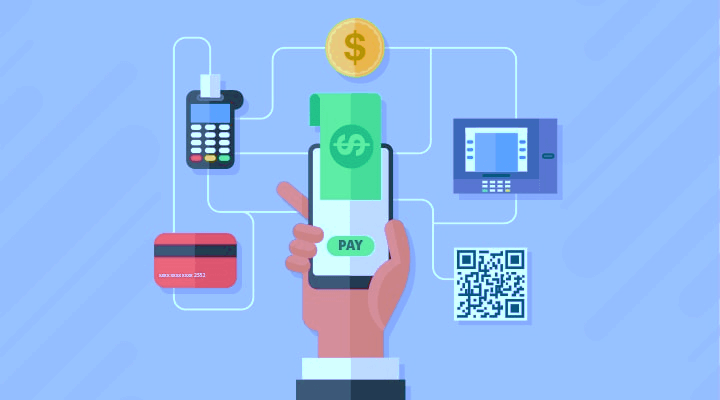

Advantages of Electronic Media in Payment Processing

Speed and Efficiency

One of the primary advantages of electronic payments is the speed and efficiency they offer. Transactions can be completed in real-time, providing a seamless experience for both consumers and merchants.

Security Features

Payment gateways prioritize security, employing encryption and authentication measures to protect sensitive information. Understanding these security features builds trust among users, fostering a secure digital payment environment.

Accessibility and Convenience

Electronic payments offer unparalleled accessibility and convenience. Whether it’s online shopping, bill payments, or fund transfers, users can conduct transactions from the comfort of their homes, fostering a cashless economy.

Challenges Faced by Payment Gateways in India

Security Concerns

Despite robust security measures, concerns about data breaches and cyber threats persist. Addressing these concerns through continuous innovation and collaboration with cybersecurity experts is imperative.

Regulatory Landscape

Navigating the regulatory landscape is a challenge for payment gateways. Changes in regulations impact operations, making it crucial for companies to stay compliant and proactive in adapting to evolving norms.

Consumer Trust

Building and maintaining consumer trust is pivotal. Transparent policies, effective customer support, and regular communication on security measures contribute to establishing and retaining trust.

Future Trends in Payment Gateways

Integration of Advanced Technologies

The future of payment gateways lies in the integration of advanced technologies such as artificial intelligence and machine learning. These technologies enhance security, fraud detection, and user experience.

Mobile Wallets and Contactless Payments

The convenience of mobile wallets and contactless payments is expected to grow exponentially. The ease of use and quick transactions make these methods increasingly popular among users.

Blockchain in Payment Processing

Blockchain technology is poised to revolutionize payment processing by enhancing transparency and security. As blockchain matures, its integration into payment gateways is likely to reshape the industry.

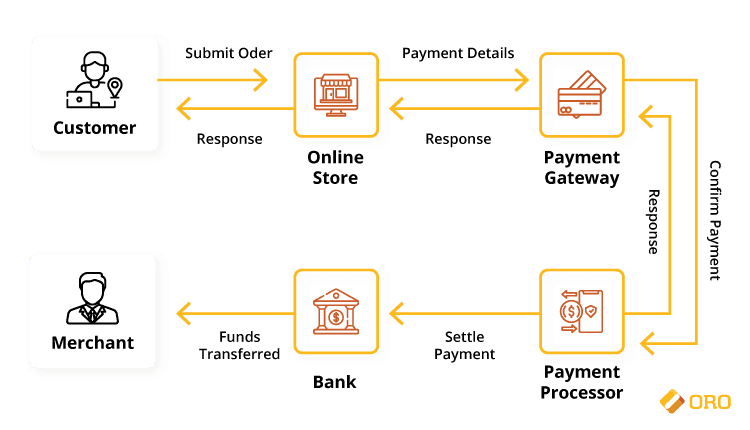

Impact of Payment Gateways on E-commerce

Boosting Online Transactions

The seamless payment experience provided by gateways has significantly boosted online transactions. E-commerce platforms leverage these gateways to offer users a secure and efficient shopping experience.

Building Consumer Confidence

Payment gateways contribute to building consumer confidence in online transactions. The assurance of secure payments encourages more users to embrace online shopping and digital transactions.

Market Expansion

The integration of robust payment gateways has facilitated market expansion for e-commerce businesses. With a broader reach and increased consumer trust, businesses can tap into new markets.

Government Initiatives and Regulations

Regulatory Framework

The Indian government has implemented a regulatory framework to govern digital payments[5]. Understanding these regulations is essential for both payment gateways and merchants to ensure compliance.

Government Support for Digital Payments

Government initiatives, such as Digital India and demonetization, have played a crucial role in promoting digital payments. Incentives and support further encourage businesses and consumers to adopt electronic transactions.

Best Practices for Merchants

Choosing the Right Payment Gateway

Merchants should carefully evaluate and choose a payment gateway that aligns with their business needs. Factors such as transaction fees, security features, and integration capabilities should be considered.

Ensuring Data Security

Prioritizing data security is non-negotiable. Merchants must implement measures to safeguard customer information, including encryption, secure protocols, and regular security audits.

User-friendly Interfaces

A user-friendly interface enhances the overall customer experience. Merchants should prioritize payment gateways with intuitive interfaces, reducing friction in the checkout process.

The Future Landscape of Payment Gateways in India

Innovations and Developments

Anticipating innovations and developments in payment portals is crucial for staying ahead in the market. Continuous adaptation to emerging technologies ensures relevance in the ever-evolving landscape.

Predictions for the Next Decade

The next decade is expected to witness unprecedented growth in the payment gateway sector. Predictions include increased collaboration with fintech startups, enhanced security measures, and the mainstream adoption of futuristic technologies.

Conclusion

In conclusion, the intertwining of payment gateways and electronic media has revolutionized the way financial transactions occur in India. From overcoming early challenges to shaping the future with advanced technologies, the journey has been transformative. As the industry continues to evolve, merchants, consumers, and regulators must collaborate to ensure a secure, efficient, and inclusive digital economy.

FAQs

- How secure are electronic payments in India?

Electronic payments in India are secure, with payment gateways employing robust encryption and authentication measures to protect user information. - How does the government contribute to fostering the adoption of digital transactions?

The government plays a significant role through initiatives like Digital India and demonetization, encouraging the adoption of digital transactions. - Which payment gateway is the most popular in India?

Popular payment gateways in India include Paytm, Razorpay, and CCAvenue, each with its own unique features and market share. - How can merchants safeguard customer data during transactions?

Merchants can safeguard customer data by choosing secure payment gateways, implementing encryption, and conducting regular security audits. - Are there any upcoming regulations that may impact the payment gateway industry?

Staying updated on the regulatory landscape is crucial, as changes may impact operations. Currently, the focus is on ensuring secure and transparent digital transactions.