Name: Buddy Kim

Date: 20/12/23

Introduction

Payment Gateway In the rapidly evolving landscape of e-commerce and digital transactions, the role of payment access has become increasingly crucial. This article delves into the world of payment gateway services at the enterprise level in India, exploring the features, challenges, and advancements that define this dynamic sector.

The Significance of Payment Access for Enterprises

Payment access act as intermediaries between businesses and financial institutions, facilitating secure online sale. At the enterprise level in India, where large-scale transactions are the norm, the significance of robust payment gateway Services In India cannot be overstated. These services enable businesses to accept payments seamlessly, manage sale efficiently, and enhance the overall customer experience.

Key Features of Enterprise-Level Payment Gateway Services

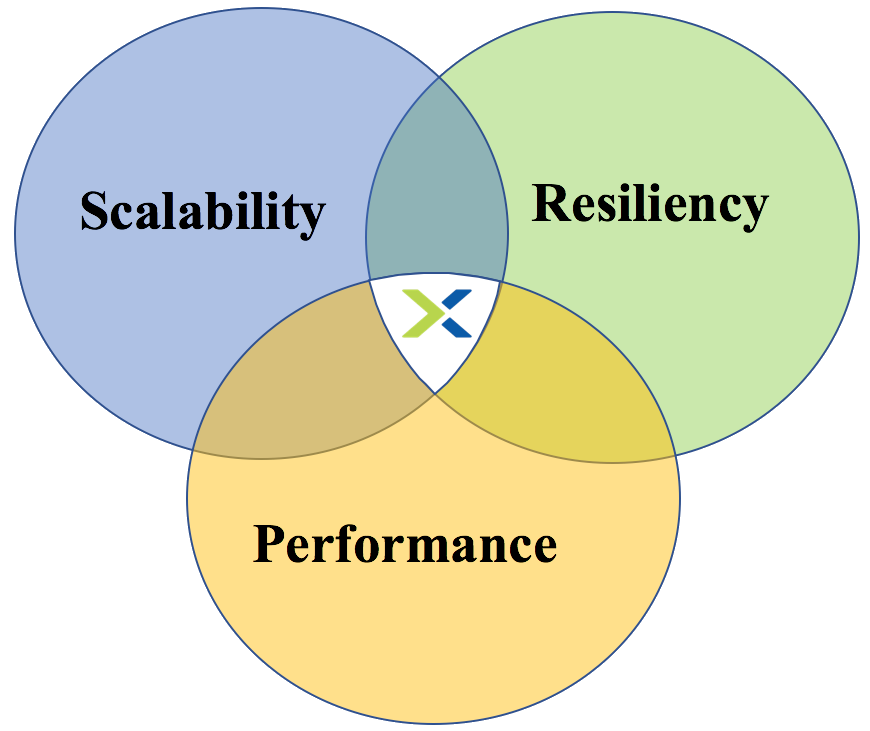

Scalability and Performance

Enterprise-level payment access in India are designed to handle a high volume of transactions without compromising on performance. Scalability ensures that as a business grows, the payment gateway can seamlessly adapt to increased transaction loads, ENTERPRISE PAYMENTS providing a reliable and consistent service.

Multi-Currency Support

Enterprise Level[1] Given the global nature of business, company payment access in India offer multi-currency support. This feature allows firms to sale with customers worldwide, providing a frictionless payment experience regardless of the currency used Enterprise-Level Services In India.

Advanced Security Measures

Security is paramount in enterprise sale. Payment access implement advanced security measures such as code, tokenization, Enterprise Service[2] and two-factor authentication to safeguard sensitive financial information, instilling trust in both businesses and their customers.

Custom Options

Enterprise-level payment[3] access provide custom options to cater to the unique needs of different businesses. This includes branding options, Enterprise resource planning[4] Faster payment expectations, increasing regulatory pressure, the demand for flexible deployment options, and the need to have agile and extensible payments solutions that integrate seamlessly with existing infrastructure tailored reporting features, and the ability to integrate seamlessly with existing enterprise software and systems.

Analytics and Reporting

Detailed analytics and reporting features are essential for firms to gain insights into transaction patterns, customer behavior, and overall financial performance. Contactless payment at the enterprise level in India offer robust analytics tools to aid businesses[5] in making informed decisions.

API Integration

Smooth integration with business applications is critical. company payment access provide Application Programming Interface (API) integration, allowing businesses to incorporate payment processing seamlessly into their websites, mobile apps, and other digital platforms.

Challenges in Implementing Enterprise-Level Payment Gateway Services

Compliance and Regulations

Navigating the complex landscape of financial regulations and compliance standards is a significant challenge for firms. Payment gateway service providers must stay abreast of the ever-changing regulatory environment to ensure seamless and compliant services.

Downtime and Technical Glitches

For enterprises, even a minute of downtime can result in significant financial losses. Secure 24/7 uptime and resolving technical glitches promptly is a challenge that payment gateway services at the enterprise level must address to maintain the trust of businesses and consumers.

Fraud Prevention

Enterprise-level payment access employ sophisticated fraud prevention mechanisms to detect and prevent fraudulent transactions, but staying ahead of evolving fraud tactics remains an ongoing challenge Faster payment expectations, increasing regulatory pressure, the demand for flexible deployment options, and the need to have agile and extensible payments solutions that integrate seamlessly with existing infrastructure.

Advancements in Enterprise-Level Payment Gateway Services

Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are revolutionizing payment gateway services by enhancing fraud detection, personalizing user experiences, and optimizing transaction processes. Enterprise-level payment access leverage these technologies to provide smarter and more secure services.

Contactless Payments

The rise of contactless payments is a game-changer for enterprises. Advanced payment access support contactless transactions, providing a convenient and hygienic payment method, especially in the context of the ongoing global health situation.

Blockchain Integration

Blockchain technology is being explored for its potential to increase transparency and security in financial transactions. Some enterprise-level payment access are experimenting with blockchain integration to offer enhanced services to their clients.

The Future of Enterprise-Level Payment Gateway Services in India

The future of payment gateway services at the enterprise level in India is exciting and full of possibilities. As technology continues to advance, we can expect further innovations, such as the widespread adoption of decentralized finance (DeFi), enhanced biometric authentication, and more seamless integration with emerging technologies.

Conclusion

In conclusion, enterprise-level payment gateway services play a pivotal role in shaping the digital economy of India. As businesses continue to embrace digital transactions, the demand for secure, scalable, and innovative payment gateway solutions will only intensify. With ongoing advancements and a commitment to addressing challenges, payment gateway services in India are poised for a journey.

FAQs

Q1: What sets enterprise-level payment access apart from standard payment access?

Enterprise-level payment access are designed to handle large transaction volumes, offer advanced custom options, and provide features such as multi-currency support and in-depth analytics tailored to the needs of large businesses.

Q2: How do payment access ensure the security of enterprise transactions?

Payment access implement advanced security measures such as code, tokenization, and two-factor authentication to safeguard sensitive financial information, secure a secure transaction environment for secure.

Q3: Can enterprise-level payment access integrate with existing business applications?

Yes, company payment access offer API integration, allowing seamless incorporation into existing business websites, mobile apps, and other digital platforms.

Q4: What role does AI and ML play in enterprise-level payment gateway services?

AI and ML enhance fraud finding, personalize user experiences, and optimize transaction processes in enterprise-level payment access, providing smarter and more secure services.

Q5: How are payment access addressing the challenge of compliance and regulations?

Payment gateway service providers stay updated on financial regulations and compliance standards, implementing measures to ensure ideal and compliant services for enterprises.