AUTHOR: LUCKY MARTINS

DATE: 21/12/2024

Introduction:

Online education[1] has rapidly become a popular choice for students in India, offering flexibility and accessibility to individuals across the country. However, financing online degree programs can be a significant challenge for many students. Financial aid programs are available, but the payment process often remains a barrier due to the complexity and lack of accessibility. Payment gateways[2], however, offer a streamlined, secure, and efficient way to handle these payments. This article explores how payment gateways can facilitate financial aid for online degree [3]programs in India, providing students with easy access to funding and simplifying the entire financial process.

What is a Payment Gateway?

A payment gateway is a technology that securely processes financial transactions online[4]. In the context of online education, a payment gateway enables students to make payments for tuition fees, application fees, and other educational[5] expenses over the internet. Payment gateways are designed to ensure that all transactions are encrypted and secure, offering peace of mind to both students and educational institutions.

How Payment Gateways Facilitate Financial Aid for Online Degree Programs

For students pursuing online degrees, payment gateways offer several key advantages that make accessing financial aid more straightforward. These include:

1. Simplified Payment Processes

Payment gateways simplify the payment process for students applying for financial aid. With just a few clicks, students can make secure payments for their online degree programs. This is particularly beneficial for students who may be receiving financial aid in the form of scholarships, government grants, or loans.

2. Security and Transparency

Security is a top concern when dealing with financial transactions. Payment gateways provide encryption to ensure that personal and financial details are protected. Additionally, students can track their payments through the gateway’s system, ensuring complete transparency regarding fees,Payment gateway Financial aid for online degree programs in India

3. Access to Multiple Payment Methods

Different students may have varying preferences for how they want to make payments. Payment gateways support a wide range of payment methods, including credit/debit cards, net banking, mobile wallets, and UPI (Unified Payments Interface). This flexibility ensures that students from different regions and with different financial habits can choose the most suitable payment method for them.

4. Easy Refunds and Adjustments

In cases where a student is eligible for a refund due to program changes or overpayments, payment gateways provide a smooth process for adjustments. Refunds can be processed quickly and directly to the student’s account, saving time and reducing administrative burden for both students and educational institutions.

Challenges Faced by Students in Accessing Financial Aid for Online Education

Despite the availability of financial aid, many students face challenges when it comes to paying for their online degrees. These challenges include:

1. Lack of Awareness

Many students are unaware of the financial aid options available to them. Scholarships, grants, and loans may be offered by both the government and private institutions, but without proper guidance, students may miss out on these opportunities.

2. Complicated Application Processes

The process of applying for financial aid can be tedious, requiring multiple forms, documentation, and eligibility checks. Many students struggle to complete the paperwork correctly, leading to delays in receiving financial aid.

3. Financial Constraints

Even with financial aid, some students may still find it difficult to pay for their online degree programs due to limited financial resources. In such cases, payment gateways that allow for easy installment payments can be beneficial, enabling students to pay in manageable amounts over time.

4. Limited Access to Digital Payment Methods

While digital payments are becoming more common, some students, particularly those in rural areas, may face challenges accessing the internet or using digital payment methods. This can make it difficult for them to avail of financial aid and pay for their education online.

The Benefits of Payment Gateways for Students in India

Integrating payment gateways into the financial aid process for online education in India has a variety of benefits for students:

1. Streamlined Access to Financial Aid

Students applying for financial aid can complete the payment process quickly and easily through payment gateways. This makes the application process more efficient, allowing students to focus on their studies rather than worrying about payment logistics.

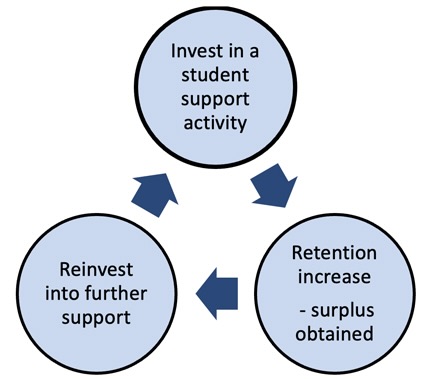

2. Cost-Effective for Educational Institutions

Educational institutions can benefit from the efficiency of payment gateways by reducing administrative overhead. Automated payments and real-time transaction tracking can help institutions save time and money, which can be reinvested into improving the quality of education they offer.

3. Support for Installation Payments

Payment gateways also enable students to pay in installments, a feature that makes it easier for students from low-income backgrounds to manage their finances. This flexibility allows students to continue their education without facing overwhelming financial pressure.

4. Wide Accessibility

As online education continues to grow in India, payment gateways make it possible for students from every corner of the country to access the financial aid they need. Whether they are in urban or rural areas, students can easily make payments online, ensuring no one is left behind due to logistical barriers.

Why Students Should Consider Payment Gateways for Financial Aid

Financial aid is essential for many students who are unable to afford the full cost of an online degree program. Payment gateways provide a convenient, secure, and efficient way to access and manage these funds. They allow students to:

- Make secure payments for tuition, application fees, and other charges.

- Track payments and ensure that they are on schedule.

- Access flexible payment methods such as credit cards, debit cards, and UPI.

- Receive refunds and other adjustments smoothly.

Conclusion:

As online education continues to expand in India, payment gateways are playing a crucial role in ensuring that students can access financial aid and make payments securely and efficiently. With the ability to pay in installments, track payments, and use multiple payment methods, students are empowered to focus on their education without the burden of complex financial transactions. Payment gateways are a key component in modernizing the education sector and ensuring that every student, regardless of their financial situation or location, has the opportunity to succeed in their academic pursuits.

FAQ:

Q1: What is a payment gateway?

A payment gateway is a secure online system that processes transactions, such as tuition payments, application fees, and other financial aid-related expenses.

Q2: How does a payment gateway help in financial aid for online degrees?

Payment gateways streamline the process of making payments for tuition, scholarships, and loan repayments. They also ensure that these payments are secure and efficient.

Q3: What payment methods are supported by payment gateways for online education?

Payment gateways typically support various methods such as credit/debit cards, net banking, UPI, and mobile wallets, making payments convenient for students.

Q4: Can payment gateways help students who have financial constraints?

Yes, many payment gateways offer installment payment options, which allow students to pay for their education in manageable amounts over time.

Q5: Are payment gateways safe to use for financial transactions?

Yes, payment gateways use encryption and other security measures to ensure that all financial transactions are secure, protecting both students and educational institutions.