AUTHOR : BELLA

DATE : 21/12/2023

In a world increasingly dominated by digital transactions, the quest for efficient and also secure payment gateways has become paramount, especially in a country like India, where the digital landscape is rapidly expanding. Businesses aiming for goal achievement need reliable tools to facilitate seamless transactions and also enhance the overall customer experience.

Introduction

Definition of Payment Gateway

A payment gateway is a technological interface that authorizes credit card or other payment transactions by connecting websites with banks. It ensures that online transactions are secure and streamlined.

Importance of Payment Gateways for Goal Achievement

For businesses in India, achieving goals often involves reaching a wider audience, increasing sales, and ensuring customer satisfaction. Payment gateways play a crucial role in this process by providing a secure and efficient means of processing transactions.

The Role of Payment Gateways in India

Overview of the Indian Market

The Indian market is diverse and dynamic, presenting unique challenges for businesses Payment gateways act as facilitators, bridging the gap between sellers and buyers in a vast and varied marketplace.

Challenges Faced by Businesses

Payment Gateway for Goal Achievement in India From navigating different payment preferences to addressing security concerns, businesses in India encounter various challenges. Payment gateways address these issues, enabling smoother transactions.

How Payment Gateways Address These Challenges

Payment gateways for goal achievement in India offer versatile solutions, from supporting multiple payment methods[1] to implementing robust security measures.

Choosing the Right Payment Gateway

Factors to Consider

Selecting the right payment gateway[2] involves evaluating factors such as transaction fees, security features, and compatibility with business platforms.

Popular Payment Gateways in India

Several payment gateways, including Razorpay, Paytm, and Instamojo, have gained popularity in the Indian market. Understanding their features and also benefits is crucial for businesses making an informed choice.

Integration and Ease of Use

Seamless Integration for Businesses

Integration should be a smooth process, allowing businesses to adopt Payment industry Landscape[3] Goal Achievement in India without disruptions.

User-Friendly Features

An intuitive interface and also user-friendly features contribute to a positive experience for both businesses and also customers.

Security Measures in Payment Gateways

Importance of Security

Security is paramount in online transactions, and also payment gateways implement robust measures to protect sensitive information.

Features Ensuring Secure Transactions

From encryption protocols to two-factor authentication, payment[4] gateways employ various features to guarantee secure transactions, fostering trust among users.

Cost and Pricing Models

Different Pricing Structures

Understanding the pricing models, whether transaction-based or subscription-based, helps businesses choose a plan that aligns with their budget and also goals.

Selecting the Optimal Plan for Your Business

Tailoring the Payment Gateway for Goal[5] Achievement in India plan to specific business needs is essential for cost-effectiveness and also maximizing benefits.

Impact on E-commerce and Online Transactions

Facilitating Goal Achievement in E-commerce

For e-commerce businesses, seamless payment processes directly contribute to achieving sales and also growth targets.

Enhancing the User Experience

A smooth payment experience enhances customer satisfaction, encouraging repeat business and also positive reviews.

VIII. Case Studies

A. Success Stories of Businesses Using Payment Gateways

Examining real-world examples of businesses achieving their goals with the help of payment gateways provides valuable insights.

B. Lessons Learned and Best Practices

Identifying lessons and also best practices from successful case studies guides businesses toward effective strategies.

Future Trends in Payment Gateways

Evolving Technologies

Advancements in technology, such as blockchain and also AI, are likely to shape the future of payment gateways.

Anticipated Developments

Keeping abreast of anticipated developments helps businesses stay ahead of the curve and also align their strategies with future trends.

Challenges and Solutions

Common Issues Faced by Businesses

Understanding the challenges businesses commonly encounter ensures proactive solutions can be implemented.

Strategies to Overcome Challenges

Effective strategies, from proactive customer communication to continuous monitoring, help businesses overcome challenges associated with payment gateways.

The Intersection of Payment Gateways and Digital India

Contributing to the Digital Transformation

Payment gateways play a pivotal role in the digital transformation of India, aligning with national initiatives like Digital India.

Aligning with National Goals

Supporting broader national goals, payment gateways contribute to financial inclusion and also the growth of the digital economy.

Customer Support and Assistance

Importance of Responsive Customer Service

Accessible and also responsive customer support is crucial for businesses navigating payment gateway challenges.

Support for Businesses

Round-the-clock support ensures that businesses can address issues promptly, minimizing disruptions to transactions.

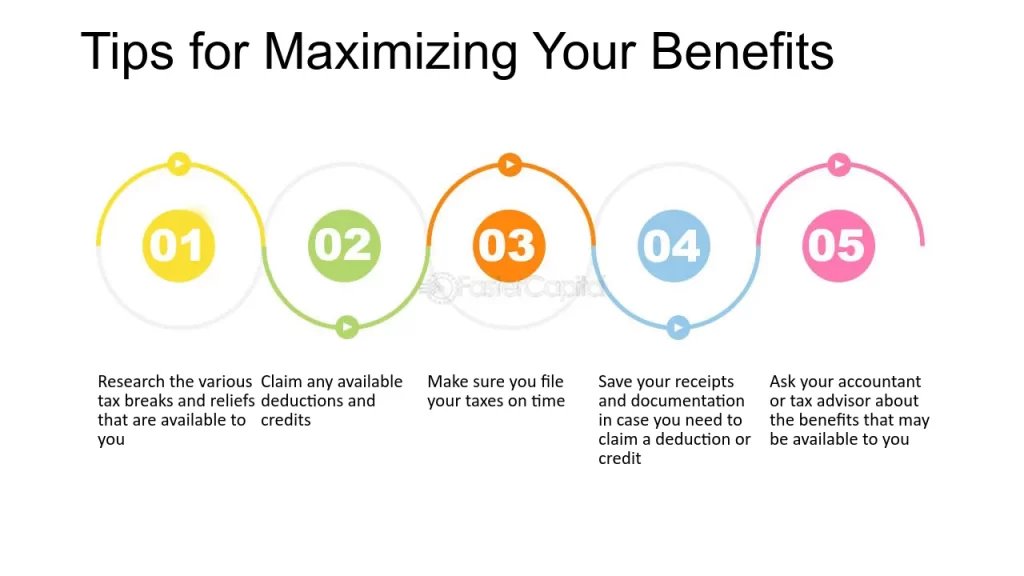

Tips for Maximizing the Benefits

Optimizing Payment Gateway Usage

Regularly reviewing and also optimizing the use of payment gateways helps businesses extract maximum value from these tools.

Staying Informed About Updates and Features

Being informed about updates and also new features ensures businesses stay competitive and also leverage the latest advancements in payment gateway technology.

Conclusion

Recap of Key Points

From enhancing security to facilitating e-commerce goals, payment gateways are indispensable for businesses in India Highlighting the integral role payment gateways play in helping businesses achieve their goals reinforces their significance in the digital landscape.

FAQs

How do payment gateways contribute to goal achievement?

Payment gateways contribute to goal achievement by providing secure and also efficient transactional processes, fostering customer satisfaction, and also supporting growth.

Are there any specific requirements for integrating payment gateways in India?

While requirements may vary, businesses should ensure compatibility with their platforms, consider security standards, and also choose a payment gateway with a reliable track record in the Indian market.

What security measures should businesses prioritize when using payment gateways?

Businesses should prioritize encryption protocols, two-factor authentication, and also regular security audits to ensure the safety of sensitive information during transactions.

Can small businesses benefit from payment gateways?

Absolutely. Payment gateways offer scalable solutions, making them accessible and also beneficial for small businesses seeking secure and also streamlined transaction processes.

What are the future trends in payment gateways?

Future trends may include advancements in blockchain and AI technologies, providing more secure and also efficient transactional processes for businesses.