AUTHOR : PUMPKIN KORE

DATE : 22/12/2023

Introduction

Self-employment is on the rise in India, with a growing number of individuals opting for entrepreneurial ventures or freelance opportunities. In this dynamic landscape, efficient financial transactions play a pivotal role in the success of self-employed professionals. “This article, therefore, explores the significance of payment gateways specifically tailored for self-employment options in India. Furthermore, it delves into their critical role in facilitating smooth transactions and, additionally, provides valuable insights into choosing the most suitable payment solution for individual needs.”. Payment Gateway For Self-Employment Options In India

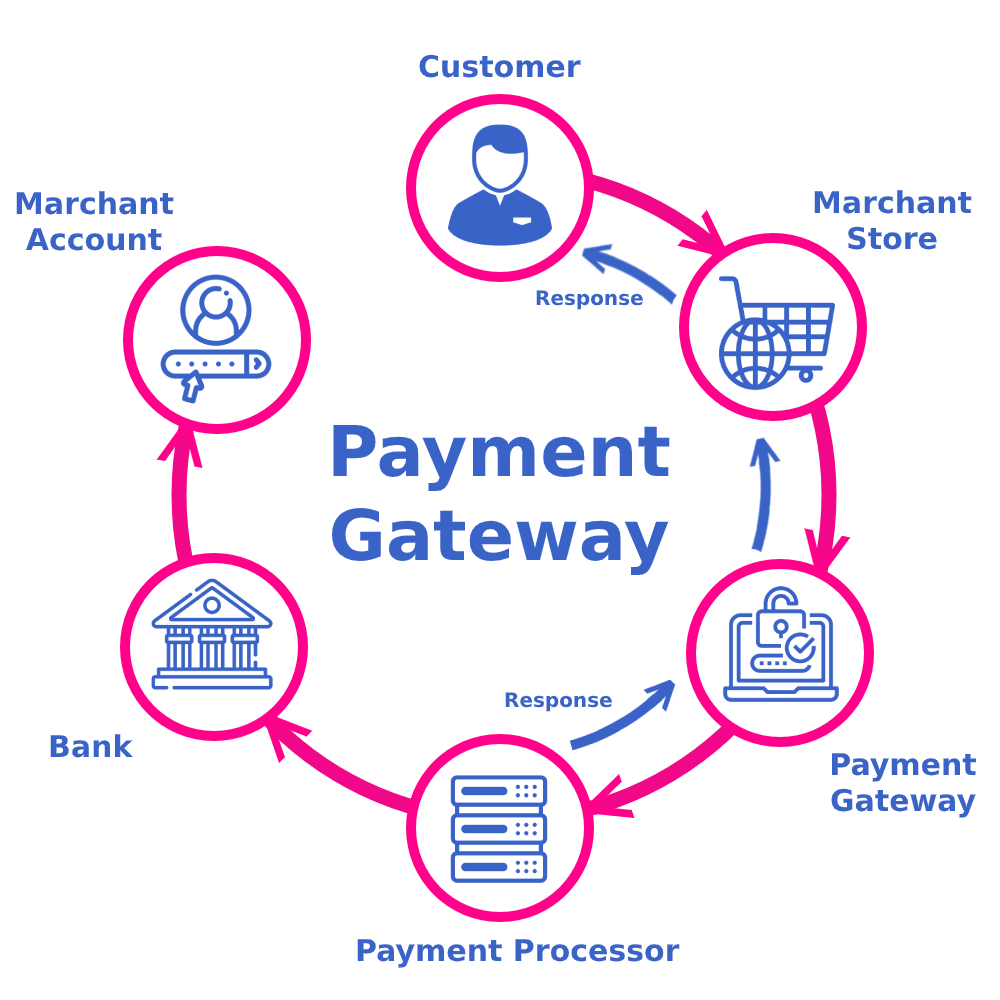

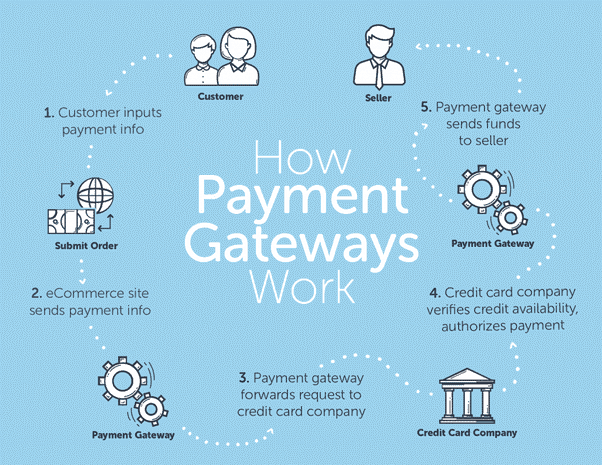

Definition of Payment Gateway

To begin, let’s understand what a payment gateway is. In simple terms, a payment gateway is a technology that facilitates online transactions by securely connecting a merchant’s website and the customer’s bank. “For self-employed individuals, this means not only a seamless but also a secure and reliable way to receive payments for their products or services. Moreover, it ensures convenience while, at the same time, fostering trust and efficiency in their financial transactions.” Payment Gateway For Self-Employment Options In India

The self-employment landscape in India is diverse, ranging from freelancers to small business owners. Unlike traditional employment, self-employed individuals often face unique challenges in managing finances and receiving payments. A dedicated payment gateway designed for their needs can be a game-changer, providing convenience and reliability.

Brief Overview of the Self-Employment Landscape in India

Before diving into payment gateways, Example[1] to recognize the scope of self-employment in India. With the gig economy flourishing and more people opting for flexible work arrangements, the need for efficient payment solutions tailored for self-employed professionals has never been more critical.

Self-employed individuals[2] often grapple with irregular income streams and the need for a robust financial system. Traditional banking solutions may not cater to their specific needs, leading to challenges in managing cash flow and securing timely payments.

This is where specialized payment solutions[3] come into play. A payment gateway designed for self-employment options addresses the unique challenges faced by freelancers and small business owners. It ensures a smooth and efficient payment process, allowing individuals to focus on their work rather than navigating complex financial systems.

Popular Payment Gateways in India

India boasts a vibrant of payment ecosystem explained[4], each offering unique features and advantages. From industry giants to innovative startups, self-employed individuals have a plethora of options to choose from.

In this section, we’ll delve into the features and benefits offered by popular payment gateways in the Indian market. From secure transactions to user-friendly interfaces, understanding these aspects is crucial for making an informed choice.

Key Considerations for Choosing a Payment Gateway

Security Features

The paramount concern for any online transaction is security Self-employed[5] professionals must prioritize payment gateways with robust security measures to protect their and their clients’ sensitive information.

Cost-effectiveness is a key consideration for self-employed individuals. We’ll explore how transaction fees vary among payment gateways and how to choose an option that aligns with the financial goals of the individual.

Integration Options

For seamless financial management, it’s essential that the chosen payment gateway integrates smoothly with other tools and platforms used by self-employed professionals. This section will guide readers on the importance of integration and how to ensure compatibility.

A complicated payment process can be a deterrent for clients. We’ll discuss the significance of a user-friendly interface in enhancing the overall experience for both the self-employed professional and their clients.

Challenges and Solutions

No system is without challenges. In this section, we’ll address common issues faced by self-employed individuals when using payment gateways and provide practical solutions.

Proactive measures can mitigate potential challenges. We’ll offer tips and strategies to help self-employed professionals navigate and overcome common payment gateway issues.

Future Trends in Payment Gateway Technology

Technology is ever-evolving. We’ll explore the latest innovations in payment gateway technology and how they might shape the future for self-employed individuals in India.

Predicting the future can be challenging, but by analyzing current trends, we can make informed predictions about how the payment gateway industry for self-employment might evolve.

Conclusion

In conclusion, this article has explored the significance of payment gateways for self-employed individuals in India. From addressing challenges to providing practical solutions, choosing the right payment gateway is a crucial step for success.

FAQs

- Q: Are payment gateways only for online businesses? A: While traditionally associated with online transactions, payment gateways can benefit any self-employed professional looking for secure and efficient payment processing.

- Q: How do I choose the right payment gateway for my business? A: Consider factors such as security features, transaction fees, integration options, and user-friendly interfaces. Assess your business needs and choose accordingly.

- Q: Can I use multiple payment gateways for my self-employment venture? A: Yes, depending on your business model, you can integrate multiple payment gateways to offer flexibility to your clients.

- Q: What security measures should I prioritize when selecting a payment gateway? A: Look for payment gateways with SSL encryption, two-factor authentication, and compliance with industry security standards.

- Q: How do payment gateways contribute to business credibility? A: A secure and reliable payment gateway enhances your business’s credibility by providing a trustworthy transaction environment for your clients.