AUTHOR : SELENA GIL

DATE : 20/12/2023

Introduction

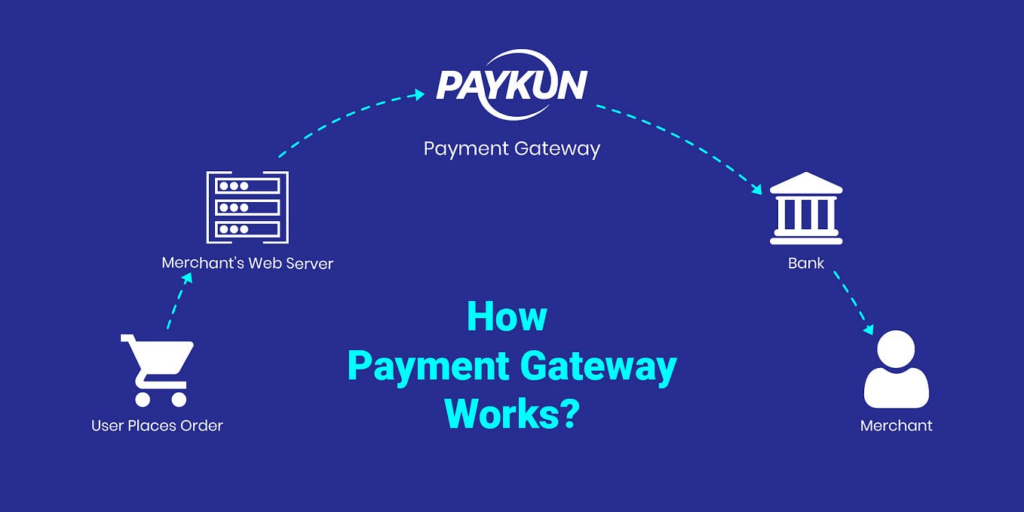

The evolution of India’s industrial trade has been significantly influenced by the integration of robust payment gateway systems. These gateways act as crucial intermediaries, facilitating secure online transactions between buyers and sellers. Let’s delve into the pivotal role these gateways play in revolutionizing the landscape of industrial trade in India.

Evolution of Payment Gateways in India

In the past decade, Trade in India has witnessed a remarkable evolution in its payment gateway ecosystem. Initially, the landscape was dominated by traditional banking systems Industrial Trade , limiting the scope of digital transactions in industrial trade. However, with technological advancements and government initiatives like Digital India, the payment gateway scenario has experienced rampant growth.

Historical Overview

Historically, the inception of payment for Industrial in India dates back to the early 2000s, when the internet started strong commercial sectors. The exposure of settler like Bill Desk and CC Avenue laid the foundation for digital payment infrastructures. Gradually, Contactless payment[1] these gateways expanded their services to cater specifically to industrial trade, offering secure and seamless transactions.

Growth Factors

Several factors contributed to the rapid growth of Payment Gateway API[2] in industrial trade. Government initiatives to assist digital transactions, increased internet penetration, and the growth of smartphones played pivotal roles. Furthermore, the ease of overseeing business online and the convenience offered by these gateways propelled their adoption in the industrial sector.

Key Payment Gateways in Indian Industrial Trade

India boasts a diverse landscape of payment gateways catering specifically to industrial trade. Cross-Border Payments[3] Entities like Razorpay, Paytm, and Instamojo have emerged as pioneer, offering changeolutions for businesses. Let’s explore these major players and conduct a relative analysis to understand their unique propositions.

Listing Major Players

- Razorpay: Known for its user-friendly interface and custom solutions.

- Paytm: Offers an extensive range of services, including QR code-based transactions.

- Instamojo: Focuses on warrant smaller businesses with easy-to-use payment solutions.

Comparative Analysis

Each gateway has its own distinct features, pricing structures, and target demographics. While Razorpay is favored for its developer-friendly approach, Ecommerce Payment Processing[4] Paytm stands out for its widespread consumer base. Instamojo, on the other hand, caters adeptly to smaller activities with its untangle solutions.

Challenges Faced by Payment Gateways in Industrial Trade

Despite the stature, payment gateways encounter several challenges in the industrial trade landscape. Payment gateway APIs allow Centralized payments[5] businesses to add payment processing functionalities directly into their applications or websites

Regulatory Issues

Navigating through regulatory frameworks poses a significant challenge. Adhering to continued policies and compliance standards demands continuous adaptation from these gateways Because they permit businesses and financial institutions to integrate with innovative third-party payment solutions instead of developing these capabilities in-house.

Security Concerns

Because they permit businesses and financial institutions to integrate with innovative third-party payment solutions instead of developing these capabilities in-house Ensuring foolproof security measures to safeguard financial transactions remains a prime concern. Maintaining robust encryption and fraud awareness mechanisms is crucial to gain trust.

Integration Challenges

Compatibility issues while combined with diverse business platforms and systems often hinder seamless operations for payment gateways. This guide covers the basics on payment gateway APIs to help you understand their uses, benefits, and common features

Impact of Payment Gateways on Industrial Trade

The integration of efficient payment gateways has produced significant transformations in India’s industrial trade scenario. A payment gateway API is a set of protocols, tools, and definitions that allow software applications to integrate and communicate with a payment gateway.

Efficiency Enhancement

A payment gateway API is a set of protocols, tools, and definitions that allow software applications to integrate and communicate with a payment gateway. Streamlining payment processes has enhanced operational efficiency for businesses. Quick and secure transactions have reduced manual intervention and enhanced time and resources.

Market Access Expansion

The advent of digital payment gateways has market access for businesses. Small-scale ventures can now tap into a global customer base and growth opportunities. It is a service that facilitates transactions by authorizing and securely processing online payments.

Future Trends and Innovations

The future of payment gateways in Indian industrial trade is poised for further improvement and innovations. It is a service that facilitates transactions by authorizing and securely processing online payments.

Technological Advancements

The integration of AI, blockchain, and biometric authentication promises enhanced security and more seamless transactions Simply put, a payment gateway API allows for seamless integration with the solution your business uses to process payments.

Emerging Practices

Integrating with third-party payment APIs can provide more advanced payment features and a better experience than what businesses do outside of the payments Expectations revolve around instant settlements, payment experiences, and a shift towards contactless payments, shaping the future landscape of industrial trade.

Conclusion

In conclusion, payment gateways have emerged as pivotal tools to change the industrial trade in India. While facing challenges, their contributions in raising efficiency, expanding market access, and driving innovations are undeniable. Integrating with third-party payment APIs can provide more advanced payment features and a better experience than what businesses do outside of the payments

FAQs

- Are payment gateways secure for industrial transactions?

- Most payment gateways employ robust security measures like encryption to ensure secure transactions.

- How do payment gateways benefit small businesses in industrial trade?

- Payment gateways enable smaller enterprises to access a wider customer base, streamline their payment processes, and proceed with growth.

- What are the major challenges hindering payment gateway operations?

- Regulatory compliance, security concerns, and integration issues pose significant challenges to payment gateways.

- What future innovations can we expect in payment gateways?

- Advancements in AI, blockchain, and contactless payment methods are anticipated to shape the future of payment gateways.

- How do payment gateways contribute to the digital transformation of industrial trade?

- Payment gateways streamline transactions, reduce manual processes, and enable businesses to expand their market reach, smooth the digital transformation of industrial trade.