AUTHOR : JENNY

DATE : MARCH, 9 2024

Introduction

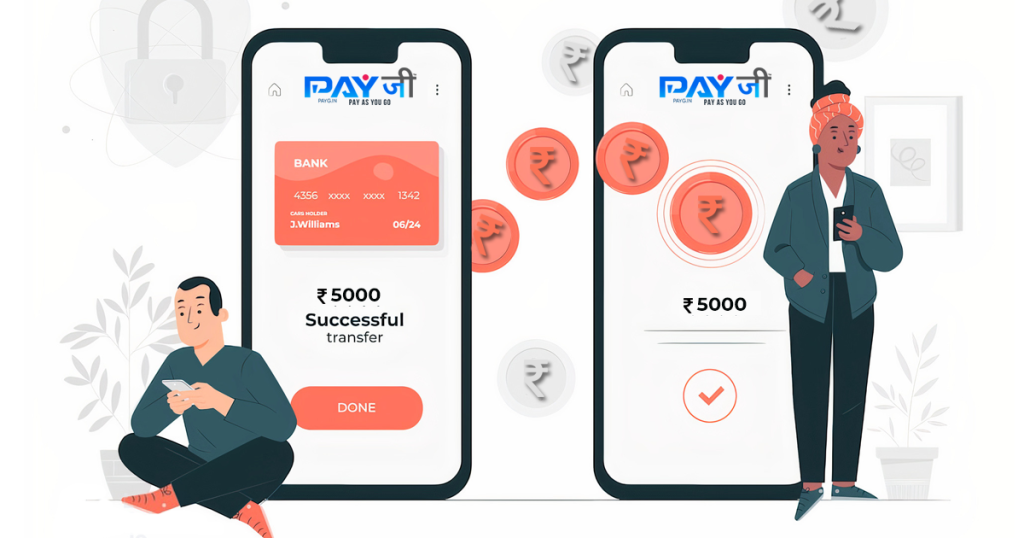

Definition of Payment Gateway

A payment gateway is technology that facilitates the seamless transfer of funds between a customer and a business, ensuring secure online transactions. It acts as a bridge between the merchant’s website and the financial institution, encrypting sensitive information for a secure exchange

Importance of Payment Gateway Integration

The integration of payment gateways is crucial for businesses in the digital age, providing a convenient and secure platform for customers to make purchases online. It enhances the overall shopping experience and contributes to the growth of e-commerce.

Evolution of Payment Gateway Integration in India

Early Challenges

In the nascent stages, businesses in India faced challenges such as limited technology infrastructure and apprehensions regarding online security. However, advancements in technology and a growing digital landscape have paved the way for widespread acceptance.

Technological Advancements

The evolution of payment gateway integration in India has been marked by technological advancements, making transactions faster, more secure, and more user-friendly. The advent of mobile wallets and UPI has further revolutionized the payment ecosystem.

Key Players in the Indian Payment Gateway Market

Popular International Gateways

International payment gateways like PayPal and Stripe have gained popularity among Indian businesses for their global reach and advanced features. They provide a secure and streamlined payment process for both domestic and international transactions.

Leading Domestic Payment Solutions

Domestic players like Razorpay, PayU, and Instamojo have emerged as strong contenders, offering tailored solutions to meet the unique needs of integrated marketing in the Indian market. Their local expertise and understanding of the regulatory landscape contribute to their success.

Benefits of Payment Gateway Integration for Businesses

Enhanced Customer Convenience

Payment gateway integration[1] enhances customer convenience by providing multiple payment options, including credit/debit cards, net banking, and digital wallets. This variety accommodates diverse consumer preferences.

Improved Transaction Security

One of the primary advantages of multiple payment gateway[2] integration is the heightened security it offers. Advanced encryption technologies ensure the protection of sensitive customer data, fostering trust and credibility.

Expansion of Customer Base

Businesses with integrated payment gateways can tap into a broader customer base, reaching individuals who prefer online transactions over traditional payment methods[3].

Future Trends in Payment Gateway Integration

Blockchain Technology

The integration[4] of blockchain technology is poised to revolutionize payment gateways, offering enhanced security, transparency, and decentralized control. Businesses are exploring the potential of blockchain to further strengthen the integrity of financial transactions.

Artificial Intelligence in Payment Processing

Artificial intelligence (AI) is making significant strides in optimizing payment processes.[5] From fraud detection to personalized customer experiences, AI is set to play a pivotal role in the future of payment gateway integration, providing more efficient and tailored services.

Common Misconceptions About Payment Gateway Integration

It’s Only for Large Enterprises

Contrary to popular belief, payment gateway integration is not exclusive to large enterprises. Many solutions cater to small and medium-sized businesses, offering scalability and affordability.

Integration is Complicated and Time-Consuming

Advancements in technology have simplified the integration process. With user-friendly interfaces and comprehensive support, businesses can seamlessly integrate payment gateways without significant disruptions.

All Payment Gateways Are the Same

Different payment gateways offer unique features and benefits. It’s crucial for businesses to recognize their specific requirements and choose a gateway that aligns with their goals and customer needs.

Challenges in Payment Gateway Integration

Regulatory Challenges

Adhering to regulatory frameworks can pose challenges for businesses. Staying informed about changing regulations and collaborating with reliable payment gateways helps navigate these complexities.

Technical Issues

Technical glitches can disrupt the payment process. Businesses must have robust technical support and troubleshooting mechanisms in place to address issues promptly and minimize downtime.

Customer Resistance

Some customers may be skeptical about online transactions. Clear communication about security measures and transparent policies can help alleviate customer concerns and build trust.

Best Practices for Payment Gateway Integration

Regularly Update Security Protocols

Security is an ongoing concern. Regularly updating and reinforcing security measures ensures that businesses stay ahead of potential threats and maintain customer trust.

Monitor Transaction Trends

Monitoring transaction trends provides valuable insights into customer behavior and preferences. Businesses can use this data to optimize their payment processes and enhance the overall customer experience.

Provide Customer Support

Accessible and responsive customer support is crucial. Businesses should offer multiple channels for customer assistance to address queries and concerns promptly.

Conclusion

In conclusion, the integration of payment gateways has become integral to the success of businesses in India’s evolving digital landscape. From enhancing customer convenience to ensuring transaction security, the benefits are evident. As technology continues to advance, businesses must stay attuned to emerging trends and continuously optimize their payment processes for sustained success.

FAQs

How do payment gateways work?

Payment gateways facilitate secure online transactions by encrypting sensitive information, ensuring a seamless transfer of funds between customers and businesses.

Are there any hidden fees with payment gateway integration?

It’s essential to thoroughly review the terms and conditions of payment gateways to understand any potential hidden fees, ensuring transparency in transaction costs.

What is the typical timeframe for integrating a payment gateway?

The timeframe for integration varies but can generally range from a few days to a couple of weeks, depending on the complexity of the integration process and the chosen payment gateway.

Can businesses change their payment gateway provider easily?

While it’s possible to change payment gateway providers, the process may involve some technical adjustments. Choosing the right provider initially minimizes the need for frequent changes.

How secure are transactions through payment gateways?

Transactions through reputable payment gateways are highly secure, employing advanced encryption technologies to protect sensitive customer information and ensure data integrity.