AUTHOR : LISA WEBB

DATE : 21-12-2023

Introduction to Payment Gateways and Mobile Payment Apps

payment gateways and mobile payment apps have revolutionised the financial landscape in India, offering convenient and secure methods for transactions. In this article, we’ll delve into the evolution, functionalities, security measures, impacts, and future trends of payment portals and mobile payment apps in the Indian market.

Importance of Payment Gateways

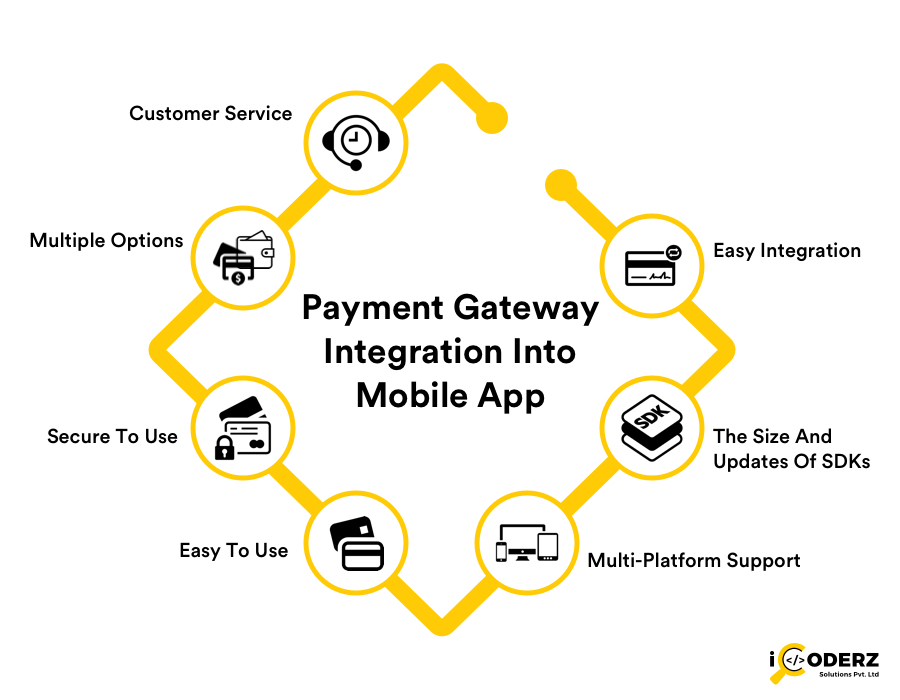

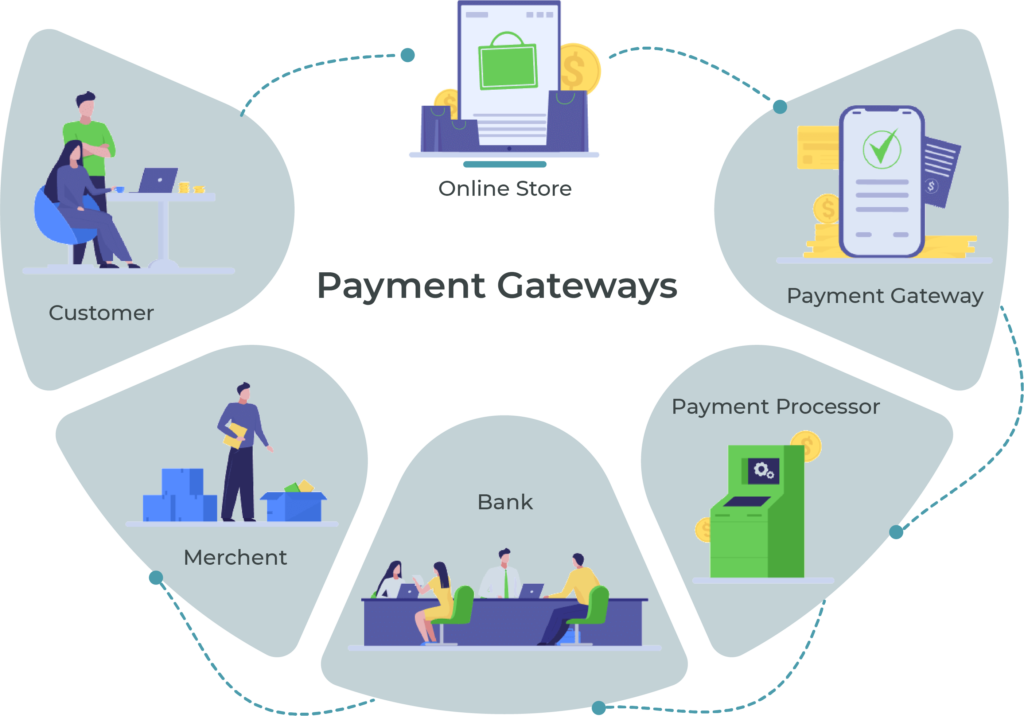

Payment Gateway Mobile Payment Apps In India Payment gateways act as a bridge between merchants and customers, facilitating seamless online transactions. They ensure secure and swift payment processing, enabling businesses to accept payments through various channels.

Evolution of Mobile Payment Apps in India

With the rise of smartphones and digitalization, mobile payment apps have gained immense popularity in India. These apps allow users to make transactions, pay bills, transfer money, and more, all at their fingertips.

Popular Payment Gateways in India

Overview of Leading Payment Gateways

India boasts a diverse range of payment gateways like Razorpay, PayU, Instamojo, and others. Each offers distinct features catering to different business requirements.

Comparison of Features and Services

We’ll analyze the key features transaction fees, user interface, blockchain[1] and customer support a prominent payment portal to help businesses choose the most suitable option.

Top Mobile Payment Apps in India

Introduction to Major Mobile Payment Apps

Apps like Paytm, Google Pay, PhonePe, and others have transformed the way Indians transact digitally. We’ll explore their functionality and ease of use for consumers and businesses.

Features and Benefits of Each App

Detailing the unique features, security protocols[2], rewards, and cashback offers provided by these apps to attract and retain users.

Security Measures in Payment Gateways and Mobile Payment Apps

Importance of Security in Transactions

Discussing the significance of robust security measures in safeguarding sensitive information during transactions, such as encryption protocols[3] and two-factor authentication

Technologies Ensuring Secure Payments

Exploring cutting-edge technologies like tokenization, biometric authentication[4], and AI-driven fraud detection will enhance the security of payment platforms.

Challenges and Advancements in Payment Systems

Common Challenges Faced by Payment Systems

Addressing issues such as network failures, cybersecurity threats, and regulatory compliance hurdles that payment systems[5] encounter.

Innovations and Advancements in Mobile Payments

Highlighting technological improvement and innovative solutions that relieve challenges and improve user experiences in mobile payments.

The Impact of Mobile Payment Apps on Indian Economy

Contribution to Financial Inclusion

Examining how mobile payment apps have empowered the unbanked population, fostering financial inclusion and the availability of banking services.

Economic Influence and Growth

Analyzing the economic impact of these apps on businesses, consumer spending patterns, and the overall growth of the Indian economy.

Future Trends in Payment Gateway and Mobile Payment Apps

Emerging Technologies Shaping the Future

Exploring upcoming trends like blockchain, contactless payments, and IoT and their potential to redefine the payment landscape in India.

Predictions and Potential Developments

Envisioning future scenarios, adoption rates, and also the role of evolving technologies in shaping the trajectory of payment portals and mobile payment apps.

Challenges and Advancements in Payment Systems

Common Challenges Faced by Payment Systems

While the adoption of mobile payment apps has surged, challenges such as network instability, cybersecurity threats, and compliance with stringent regulations persist. Ensuring uninterrupted service and robust security measures remains a continuous battle for payment systems.

Innovations and Advancements in Mobile Payments

In response to these challenges, technological advancements have been pivotal. Innovations like biometric authentication, dynamic QR codes, and real-time fraud detection systems have significantly enhanced the security and reliability of mobile payment apps. Moreover, the integration of artificial intelligence (AI) has improved fraud detection capabilities, providing users with a secure payment environment.

The Impact of Mobile Payment Apps on the Indian Economy

Contribution to Financial Inclusion

Mobile payment apps have played a transformative role in financial inclusion by providing banking services to the unbanked population. With simplified onboarding processes and easy-to-use interfaces, these apps have enabled millions of individuals to access financial services, thereby reducing the gap between the banked and unbanked segments.

Economic Influence and Growth

The widespread adoption of mobile payment apps has not only influenced consumer spending patterns but also facilitated the growth of businesses, especially small and medium enterprises (SMEs). These apps have streamlined transactions, enabling businesses to reach a wider customer base and also flourish in the digital ecosystem.

Future Trends in Payment Gateway and Mobile Payment Apps

Emerging Technologies Shaping the Future

The future of payment gateways and mobile payment apps in India is intertwined with emerging technologies. Innovations such as blockchain for secure and transparent transactions, IoT for seamless connectivity, and contactless payment methods are set to redefine the payment landscape, promising more efficiency and convenience.

Predictions and Potential Developments

Looking ahead, the trajectory of payment gateways and mobile payment apps appears promising. The increasing adoption rates, coupled with advancements in technology, might lead to a cashless society, where digital transactions become the norm, reshaping the traditional banking model.

Conclusion

Payment gateways and mobile payment apps have transformed India’s financial ecosystem, fostering convenience, security, and financial inclusion. The rapid advancements in technology continue to reshape the way transactions are conducted, promising an exciting and innovative future.

FAQs

- Q: Are mobile payment apps safe to use in India? A: Yes, mobile payment apps implement robust security measures to ensure the safety of transactions.

- Q: How can businesses benefit from integrating payment gateways? Integrating payment gateways streamlines transactions, enhances the customer experience, and expands payment options for businesses.

- Q: What role does UPI play in mobile payments? UPI facilitates instant fund transfers between bank accounts, making it a crucial component of mobile payment apps in India.

- Q: What are the upcoming trends in payment gateways? A: Emerging trends include biometric authentication, artificial intelligence, and enhanced user experiences.

- Q: How can users ensure the security of their mobile transactions? A: Users can enhance security by regularly updating apps, using secure Wi-Fi connections, and enabling multi-factor authentication.