AUTHOR : PUMPKIN KORE

DATE : 07/12/2023

The financial landscape in India has witnessed a revolutionary[1] transformation in recent years, especially in the realm of payment gateways. As the digital era progresses, the focus has shifted towards the convenience and efficiency of mobile payments. Payment Gateway Mobile Payments[2] in India In this article, we’ll delve into the intricacies of Payment Gateway Mobile Payments in India, exploring the evolution, challenges, security measures, and also the impact on e-commerce[3].

Evolution of Payment Gateways

In the not-so-distant past, traditional payment[4] methods dominated the Indian market. However, with technological[5] advancements, payment gateways emerged as a bridge between consumers and also businesses.Payment Gateway Mobile Payments in India This evolution paved the way for the integration of mobile payments, marking a significant turning point in the financial landscape.

Rise of Mobile Payments in India

Mobile payments have experienced a meteoric[1] rise, driven by factors such as smartphone penetration, affordable data plans, and also user-friendly interfaces. From utility bills to online shopping, mobile payments have become the go-to option for many Indians, transforming the way transactions are conducted in the country.

Key Players in the Indian Mobile Payment Scene

Several players have contributed to the mobile payment[2] revolution in India. From established banking institutions to innovative startups, the market is diverse and also competitive.[3] We’ll explore the key players shaping the mobile payment landscape and also the unique features they offer to users.

Advantages of Using Mobile Payment Gateways

Convenience,[4] speed, and also accessibility are among the myriad advantages of mobile payment gateways. We’ll discuss

how these platforms have simplified transactions, eliminated the need for physical currency, and enhanced the overall consumer experience.

Challenges and Concerns

While mobile payments offer numerous benefits, they are not without challenges. Security concerns, technological [5]barriers, and also resistance to change pose significant hurdles. This section will provide insights into the challenges hindering the seamless adoption of mobile payment gateways.

Security Measures in Mobile Payments

Addressing the concerns related to the security of mobile payments is paramount. We’ll explore the robust security measures implemented by payment gateways to safeguard user information and financial transactions, ensuring a secure digital payment environment.

Future Trends in Payment Gateways

The future of payment gateways in India holds exciting possibilities. From the integration of advanced technologies like blockchain to the emergence of innovative payment solutions, we’ll examine the trends that are likely to shape the landscape in the coming years.

Impact on E-commerce

E-commerce has flourished in tandem with the rise of mobile payments. This section will delve into how the seamless integration of payment gateways has fueled the growth of online businesses, providing a boost to the digital economy.

Government Initiatives and Regulations

The Indian government plays a pivotal role in shaping the payment landscape. We’ll discuss the initiatives and regulations that influence the functioning of payment gateways, ensuring transparency, and safeguarding the interests of consumers and businesses alike.

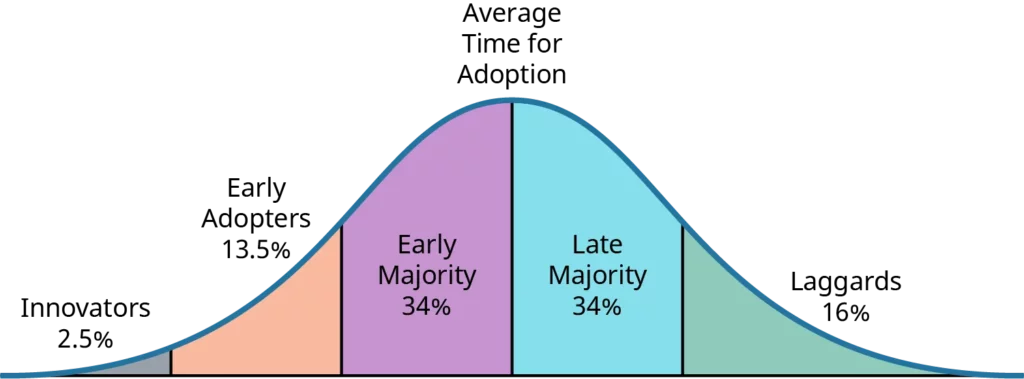

Consumer Adoption and Behavior

Understanding consumer behavior is crucial for the success of mobile payment gateways. We’ll explore the factors influencing consumer adoption, preferences, and the evolving trends in how individuals perceive and use mobile payments in their daily lives.

Case Studies: Successful Implementations

Real-world examples speak volumes. Through case studies, we’ll highlight successful implementations of mobile payment gateways, showcasing how businesses and individuals have benefited from embracing this transformative technology.

Comparison with Global Trends

How does India fare on the global stage concerning mobile payments? This section will provide a comparative analysis, shedding light on how Indian mobile payment trends align with or differ from global counterparts.

Tips for Choosing the Right Payment Gateway

For businesses and consumers alike, choosing the right payment gateway is crucial. We’ll offer practical tips on selecting the most suitable payment gateway based on individual needs, business models, and security considerations.

Conclusion

In conclusion, the landscape of Payment Gateway Mobile Payments in India is dynamic and promising. The fusion of technology and finance has opened new avenues, making transactions more accessible than ever. As we navigate through the evolving trends, challenges, and opportunities, it’s evident that mobile payments are here to stay.

FAQs

- Is it safe to use mobile payment gateways in India?

- Yes, mobile payment gateways in India implement robust security measures to ensure the safety of transactions and user information.

- How do mobile payments impact traditional banking?

- Mobile payments have led to increased digital transactions, influencing the way traditional banking operates and encouraging banks to adopt digital services.

- What role do government regulations play in mobile payments?

- Government regulations are essential for ensuring transparency, security, and fair practices within the mobile payment ecosystem.

- Are mobile payments contributing to the growth of small businesses?

- Yes, mobile payments have provided small businesses with a digital platform to reach a wider audience, contributing to their growth.

- Can mobile payment gateways be used for international transactions?

- Many mobile payment gateways in India offer international transaction capabilities, facilitating seamless global transactions.