AUTHOR: JIVI SCOTT

DATE: 27/12/2024

Introduction

In the ever-evolving landscape of e-commerce[1], the jewelry industry in India has seen a remarkable shift. As more jewelry businesses expand their online presence, one of the most crucial aspects they must address is payment solutions. A Payment Gateway Multi-Currency Jewelry Payment Gateway[2] in India is becoming a must-have for businesses aiming to cater to a global audience, especially in a diverse and culturally rich market like India.

Understanding the Importance of Payment Gateways for Jewelry Businesses

A payment gateway acts as an intermediary between the customer’s bank and the merchant’s bank, ensuring secure processing of online payments[3]. For the jewelry industry, which is characterized by high-value products, ensuring smooth, secure, and convenient payment processes is of paramount importance.

As jewelry businesses in India aim to reach customers both domestically and globally, the need for a payment gateway[4] that supports multi-currency transactions has become a top priority. With India’s growing export market for gold, diamonds, and other precious materials, offering international customers the ability to pay in their local currencies not only increases convenience but also helps boost sales.

What Makes a Multi-Currency Payment Gateway Essential?

The multi-currency functionality in a payment gateway[5] allows businesses to accept payments in a wide variety of currencies. For jewelry retailers, this is particularly important due to the international nature of the market. When offering high-value products like jewelry, the ability to accept payments in different currencies can significantly enhance customer satisfaction and minimize friction during the buying process.

Key Features of a Multi-Currency Jewelry Payment Gateway

- Currency Conversion

A major advantage of a multi-currency payment gateway is its ability to automatically convert foreign currencies into the merchant’s home currency. This ensures that international customers can see the price of the jewelry in their native currency without needing to manually convert it. - Secure Transactions

Jewelry transactions often involve high ticket sizes. Therefore, a trustworthy and robust payment gateway is crucial for safeguarding sensitive financial information during transactions. Multi-currency gateways are built with robust encryption and security standards to ensure the safety of all financial transactions. - International Reach

A multi-currency gateway ensures that jewelry businesses can cater to an international market without the need for separate banking arrangements. This helps in boosting the business’s reach and attracting customers from various parts of the world. - Integrated Payment Solutions

With multi-currency support, businesses can offer integrated payment solutions across multiple platforms, including websites, mobile apps, and in-store POS systems, thus streamlining the entire purchasing process for customers. - Lower Transaction Fees

By offering multi-currency processing, businesses can often reduce additional charges that occur when transactions are converted into local currencies manually. This feature provides cost savings for both businesses and customers.

The Growing Trend of Multi-Currency Payment Gateways in India

India has one of the world’s largest and most diverse jewelry markets, with the demand for online shopping in the sector increasing significantly. As more consumers turn to the internet to purchase gold, diamonds, and other luxury jewelry items, having the right payment gateway is critical to expanding a jewelry brand’s presence globally.

Payment Gateway Trends in India

The payment gateway trends in India are rapidly evolving with the growing reliance on digital payments. While traditional payment methods, such as credit and debit cards, continue to dominate, the increasing use of digital wallets, UPI, and now, multi-currency payment solutions is driving the growth of the e-commerce industry. These emerging payment gateway trends are helping businesses in India not only offer convenience but also provide more flexibility for international transactions.

- Increased Use of Digital Payment Solutions

The surge in mobile payment adoption has made it easier for customers to shop online for jewelry. With apps like Paytm, Google Pay, and PhonePe, businesses can seamlessly integrate these solutions into their payment gateways to cater to a tech-savvy audience. - Global Expansion

Payment gateways that support multiple currencies allow jewelry businesses to tap into the global market. With more Indians venturing into the international market and jewelry being one of the country’s biggest exports, these gateways help businesses compete on the global stage. - AI-Powered Fraud Detection

Fraud prevention is another trend that is gaining momentum in the payment gateway industry. Jewelry businesses, particularly those dealing with high-value transactions, need to protect themselves from fraudulent activity. AI and machine learning-powered fraud detection systems help detect suspicious transactions and prevent unauthorized payments. - Seamless Integration Across Platforms

The ability to integrate payment gateways with e-commerce platforms like Shopify, WooCommerce, or Magento allows jewelry businesses to offer a seamless payment experience to customers, whether they are shopping from a desktop, mobile, or tablet.

Benefits of Using a Multi-Currency Payment Gateway for Jewelry Businesses

1. Enhanced Customer Experience

Offering a smooth and transparent payment process is critical to providing a positive customer experience. By allowing international customers to pay in their preferred currency, jewelry businesses can build trust and reduce cart abandonment rates. This is especially true for high-value items like jewelry, where customers are more likely to abandon a purchase if the payment process is complicated.

2. Increase in Global Sales

A multi-currency payment gateway opens doors to customers across the world. It allows jewelry businesses to tap into a broader audience, boosting international sales without worrying about currency conversion or payment difficulties.

3. Real-Time Payment Processing

Multi-currency gateways allow businesses to process payments in real time, ensuring that transactions are completed swiftly and efficiently. This enhances the customer experience while also optimizing the efficiency of business operations.

4. Simplified Accounting

Handling multiple currencies can be tricky when managing your business’s finances. However, multi-currency gateways automatically track and record payments in different currencies, making it easier for jewelry businesses to reconcile accounts and keep their financial records up-to-date.

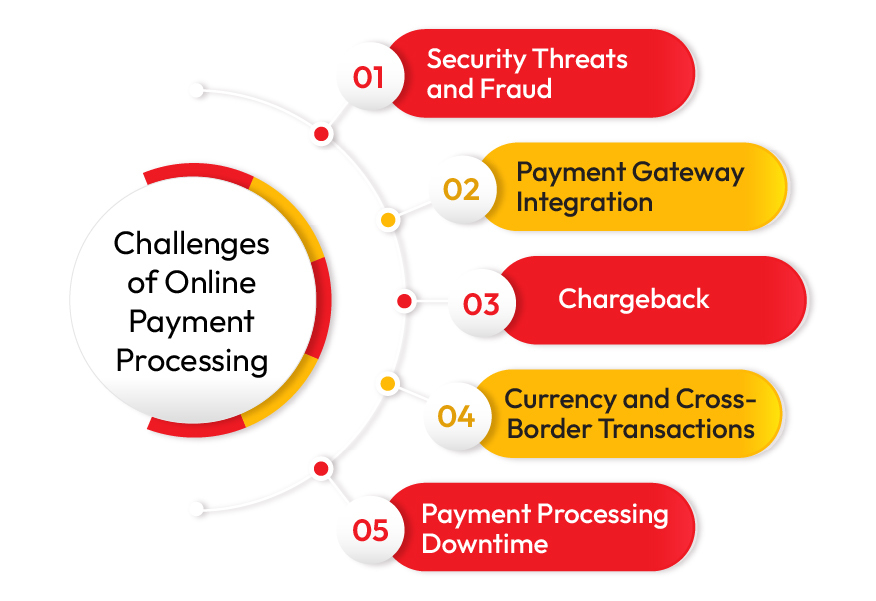

Challenges of Using Multi-Currency Payment Gateways

While the benefits are numerous, integrating a multi-currency payment gateway into a jewelry business’s operations comes with a few challenges:

- Higher Setup Costs

Multi-currency payment gateways may have higher setup fees and transaction costs compared to traditional payment methods. Businesses need to carefully evaluate the long-term benefits versus initial expenses. - Complex Integration

Implementing a multi-currency gateway might require more complex integration, especially for businesses that already use established payment processors. - Currency Fluctuations

While multi-currency gateways offer automatic conversions, the volatility of currency exchange rates can still impact profit margins, especially in the jewelry industry where prices are often tied to the gold or diamond market.

FAQs

1. What is a multi-currency payment gateway?

A multi-currency payment gateway enables businesses to process transactions in various currencies, broadening their payment acceptance options. It automatically converts foreign payments into the merchant’s home currency, enabling international customers to pay in their preferred currency.

2. How does a multi-currency payment gateway benefit jewelry businesses?

A multi-currency payment gateway helps jewelry businesses expand their reach internationally, process payments in real-time, enhance customer satisfaction, and save on transaction fees related to currency conversions.

3. What are the payment gateway trends in India?

Payment gateway trends in India include the rise of mobile payments, the integration of AI-powered fraud detection systems, the growing use of digital wallets and UPI, and the expansion of multi-currency support to cater to global customers.

4. Is a multi-currency payment gateway secure for high-value transactions?

Yes, multi-currency payment gateways use advanced encryption and security protocols to protect sensitive payment data, ensuring that high-value transactions in the jewelry industry remain secure.

5. Are there any challenges in using a multi-currency payment gateway?

Some challenges include higher setup and transaction fees, complex integration with existing systems, and the potential impact of currency fluctuations on profits.