AUTHOR : ZOYA SHAH

DATE : 23-12-2023

In the dynamic landscape of financial transactions in India, the role of payment gateways in collection services has become increasingly vital. With the growing need for efficient collection methods, businesses are turning to digital payment solutions to streamline processes and ensure secure and timely payments.

Introduction

Payment gateways serve as the bridge between businesses and customers, facilitating seamless transactions and providing a secure environment for financial exchanges. In the context of collection services in India, the significance of payment gateways Services be overstated.

Importance of Collection Services in India

As India’s economy continues to grow, businesses face the challenge of managing and collecting payments efficiently. Collection services play a crucial role in this scenario, impacting the financial health of businesses and the overall economy.

Role of Payment Gateways in Collection Services

Popular Payment Gateways in India

Payment gateways play a pivotal role in ensuring that transactions between businesses and customers occur smoothly. They offer a secure platform for users to make payments, whether through credit cards, debit cards, or other digital modes. In the vast landscape of payment gateways in India, several major players stand out, each offering unique features and benefits. Businesses must carefully evaluate these options to choose the one that aligns with their specific needs.

Integration of Payment Gateways in Collection Systems

Security Measures in Payment Gateways

Technical integration is a critical aspect of utilizing payment gateways effectively. Seamless integration enhances the user experience and ensures that the collection process[1] is efficient and hassle-free.

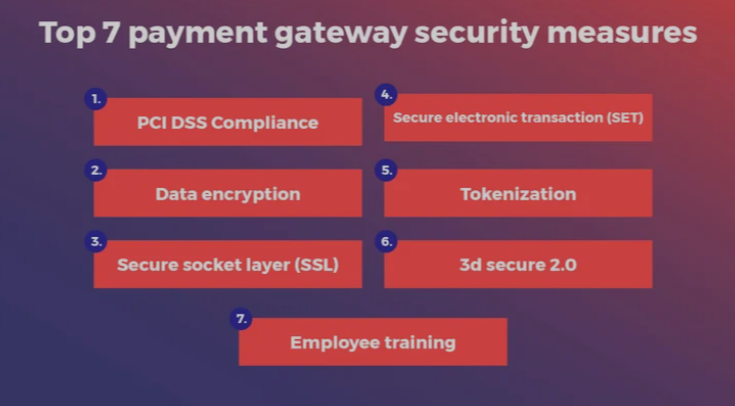

Security is paramount in digital transactions. Payment gateways employ advanced encryption techniques and fraud prevention measures to safeguard user data and financial information, building trust among users.

Despite the advantages, businesses often face challenges in integrating payment gateways. Regulatory hurdles and technical glitches need to be addressed to ensure a smooth and compliant payment process[2].

Future Trends in Payment Gateways for Collection Services

Case Studies: Successful Implementation

The landscape of payment gateways is continually evolving. Innovations in technology, including blockchain and artificial intelligence, are shaping the future of digital payments in India[3].

Real-life examples of businesses successfully implementing payment gateways provide valuable insights. Examining these case studies helps businesses learn from others’ experiences and make informed decisions.

Best Practices for Using Payment Gateways in Collection Services

User Experience and Interface Design

To optimize the benefits of payment gateways[4], businesses must adhere to best practices. Compliance with regulations and efficient payment processes are key to success. User-friendly interfaces contribute significantly to the success of payment gateways. Design elements that enhance the user experience, such as intuitive navigation and clear instructions, are crucial.

Cost Considerations in Payment Gateway Selection

Tips for Selecting the Right Payment Gateway

While evaluating payment gateways, businesses[5] need to consider pricing models. Balancing cost with features ensures that they get optimal value for their investment. Understanding business requirements is essential in selecting the right payment gateway. Factors such as transaction volume, target audience, and industry regulations should be considered in the decision-making process.

Advantages of Digital Payment Solutions in Collection Services

The advantages of digital payment solutions, including speed and efficiency, are driving businesses away from traditional banking systems. Embracing digital payments enhances overall operational efficiency.

Conclusion

In conclusion, payment gateways play a pivotal role in the success of collection services in India. As businesses navigate the complexities of financial transactions, embracing digital payment solutions is key to staying competitive and meeting the evolving needs of customers.

FAQs

- Q: Are payment gateways secure for online transactions in India? A: Yes, payment gateways in India employ advanced security measures, including encryption and fraud prevention, to ensure the safety of online transactions.

- Q: How do businesses benefit from integrating payment gateways? A: Businesses benefit from seamless transactions, improved cash flow, and enhanced customer satisfaction through the integration of payment gateways.

- Q: What are the challenges businesses may face in payment gateway integration? A: Regulatory hurdles and technical glitches are common challenges in payment gateway integration that businesses need to address.

- Q: How can businesses ensure compliance with regulations when using payment gateways? A: Businesses can ensure compliance by staying informed about relevant regulations, regularly updating systems, and working with reputable payment gateway providers.

- Q: What trends can we expect in the future of payment gateways in India? A: Future trends include the adoption of emerging technologies like blockchain and artificial intelligence, shaping the landscape of digital payments.