AUTHOR : BABLI

DATE : 25/12/23

In the ever-evolving landscape of financial transactions, the role of payment gateways in shaping collection strategies in India cannot be overstated. As we navigate through the intricacies of the payment ecosystem, it’s imperative to understand the evolution of these gateways and how businesses can leverage them for effective collection.

Introduction

In the fast-paced world of digital transactions payment gateways have become the backbone of financial interactions. This article explores the dynamic relationship between payment gateways and collection strategies in the context of India, a country with a diverse and evolving economic landscape.

Evolution of Payment Gateways

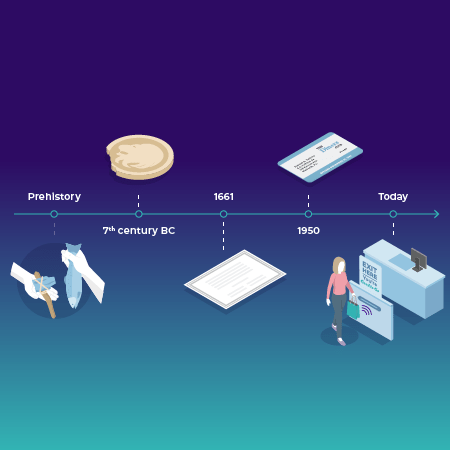

Payment gateways have come a long way from their inception. Initially designed to facilitate online purchases, they have evolved to cater to a myriad of financial transactions. The integration of advanced technologies has played a pivotal role in shaping the modern payment gateway ecosystem.

Current Payment Landscape in India

India, with its burgeoning digital economy, boasts a plethora of payment gateways[1]. From traditional banking channels to innovative fintech solutions, the options are diverse. However, the market is not without its challenges, including issues related to security and regulatory compliance.

The Role of Payment Gateways in Collection Strategy

A robust collection strategy[2] is indispensable for businesses, and payment gateways play a pivotal role in ensuring its effectiveness. By enabling seamless transactions and providing top-notch security features, payment gateways contribute significantly to the success of collection initiatives.

Challenges in Collection Strategy

Innovations in Payment Gateway Technologies

Late payments and high default rates are common challenges businesses face in the collection process. This section delves into these challenges and Strategic management[3] to mitigate them.

Mobile wallets and UPI payments have revolutionized the way transactions occur in India. This part of the article explores these innovations and their impact on the payment landscape.

Adapting to the Indian Market

Importance of a Robust Collection Strategy

Understanding the unique cultural and regional nuances of the Indian market is crucial for the success of any payment gateway. This section sheds light on the considerations that businesses must keep in mind to thrive in this diverse landscape.

A collection strategy goes beyond Payment Security Strategies[4] ; it is a critical component of financial stability. This section emphasizes the importance of a robust strategy and its role in mitigating financial risks.

Choosing the Right Payment Gateway

Integration of Technology in Collection Strategy

Selecting the appropriate payment gateway is a decision that requires careful consideration. This section provides insights into the factors businesses should weigh and includes case studies illustrating successful implementations.

Automation and data analytics have become indispensable tools for businesses. This part explores how technology integration can Debt Collection Strategies[5], leading to more informed decision-making.

Regulatory Landscape

Customer Experience in Payments

Navigating the regulatory landscape is paramount for businesses using payment gateways. This section outlines compliance requirements and highlights government initiatives shaping the industry.

User-friendly interfaces and continuous improvement based on user feedback are key aspects of a positive customer experience. This section explores strategies to enhance the user experience in payments.

Future Trends in Payment Gateways

Case Studies of Successful Collection Strategies

The payment gateway landscape is ever-evolving. This section delves into emerging technologies and predictions for the future, offering a glimpse into what the next decade holds.

Real-world examples of companies with effective collection strategies are examined in this section. Key takeaways provide valuable insights for businesses looking to optimize their own collection processes.

Conclusion

In conclusion, the symbiotic relationship between payment gateways and collection strategies is pivotal in the dynamic Indian market. As technology continues to advance, businesses must adapt and innovate to stay ahead. A proactive approach to payment gateways and collection strategies will be instrumental in achieving long-term financial success.

FAQs

- How do payment gateways contribute to a robust collection strategy?

- Payment gateways facilitate seamless transactions and provide security features, enhancing the effectiveness of collection strategies.

- What challenges do businesses face in the collection process in India?

- Late payments and high default rates are common challenges, requiring thoughtful strategies for mitigation.

- How can businesses choose the right payment gateway for their needs?

- Consideration of factors such as security, ease of use, and case studies of successful implementations are crucial in the decision-making process.

- What role does technology play in improving collection strategies?

- Automation and data analytics play a vital role in enhancing decision-making and overall efficiency in collection processes.

- What are the emerging trends in payment gateways for the future?

- The future holds promise with emerging technologies that focus on making transactions more secure, efficient, and user-friendly