Author : Sweetie

Date : 25/12/2023

Introduction

Payment gateways have become the backbone of financial transactions , revolutionizing the businesses across various sectors. In this article, we’ll explore the evolution features, challenges, and benefits associated with payment gateways in the context of collections in India.

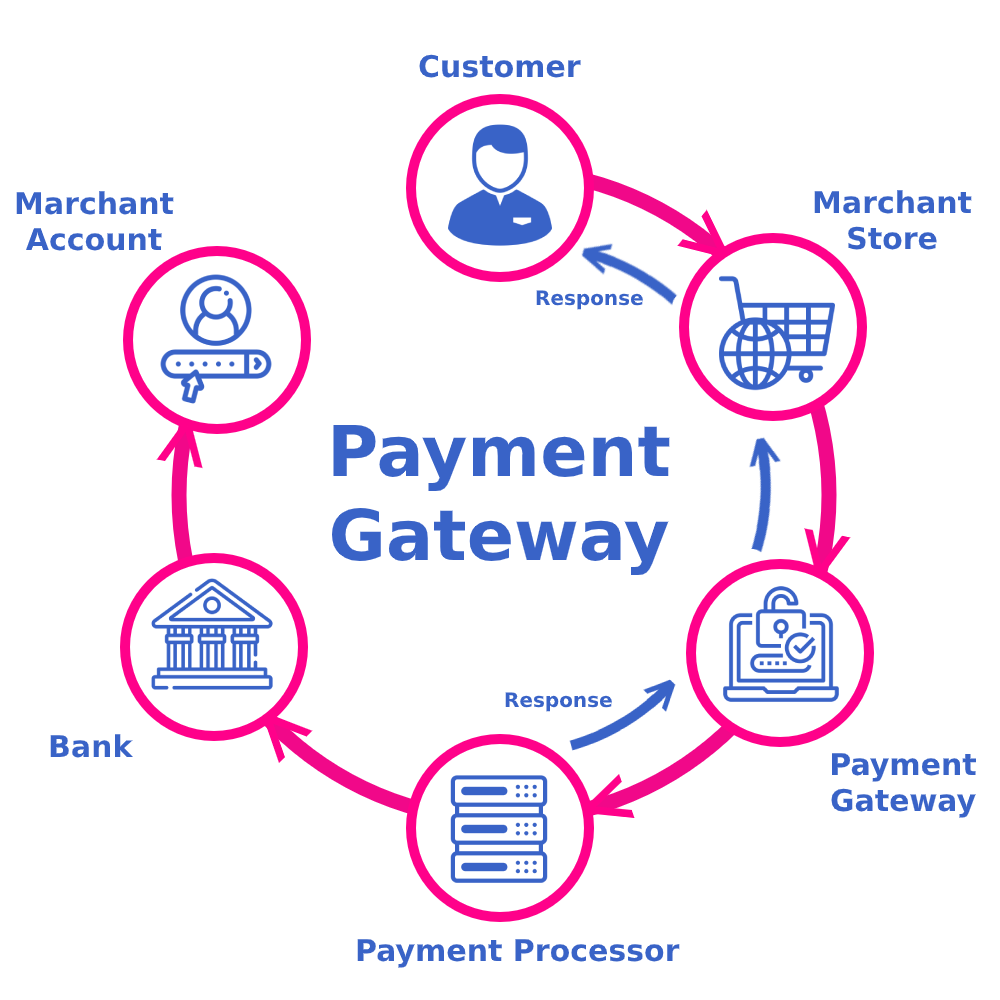

Brief Overview of Payment Gateways

In the digital payment gateways act as intermediaries that facilitate secure online transactions between buyers and sellers. Their significance goes beyond simple transactions, especially in the realm of collections. Payment Gateway on Collections Process in India.

Significance in Collections Process in India

Evolution of Payment Gateways in India

The witnessed a transformative shift with the integration payment gateways. From easing payment acceptance to ensuring timely collections, these gateways play a pivotal role in enhancing operational efficiency. In the initial stages, payment gateways faced challenges related to security and infrastructure. However, continuous technological advancements paved the way for their evolution.

Technological Advancements

The integration of cutting-edge technologies, such as blockchain and artificial intelligence, has not only enhanced the security of transactions but has also made payment gateways more robust and efficient. As of today, the payment gateway landscape in India is diverse, with numerous providers offering tailored solutions for businesses of all sizes.

Key Features of Payment Gateways in Collections

Integration Options

One of the primary concerns in Collection-level security[1]. Payment Portals employ advanced encryption and authentication protocols to ensure the safety of sensitive financial data.

Businesses can seamlessly Payment integration methods[2] Portals into their existing systems, allowing for a smooth collections process without disrupting day-to-day operations.

User-Friendly Interfaces

Popular Payment Gateways Used in Collections

The user interfaces of modern payment Portals are designed with simplicity in mind, ensuring a hassle-free experience for both businesses and their customers.

Razorpay

Known for its versatility, Razorpay offers a range of features suitable for collections, including easy integration, real-time analytics, and support for multiple payment modes.

PayU

PayU has established itself as a reliable payment gateway with a focus on user experience. Its robust features make it a preferred choice for businesses engaged in collections.

Instamojo

Instamojo stands out for its simplicity and flexibility. It caters to small and medium-sized enterprises, providing them with a hassle-free collections Improving[3] .

Benefits for Businesses

Streamlined Transactions

Payment gateways streamline the collections process[4], enabling businesses to receive payments promptly and efficiently. Timely collections through payment gateways contribute to improved cash flow, empowering businesses to meet their financial obligations seamlessly.

Enhanced Customer Experience

Challenges and Solutions

The user-friendly interfaces of Integrate Payment Gateway[5] the overall customer experience, fostering customer trust and loyalty. While security is a paramount concern, payment gateways continuously invest in advanced technologies to stay ahead of potential threats.

Transaction Failures

Customer Support

Addressing transaction failures promptly is crucial. Payment gateways employ robust error detection and resolution mechanisms to minimize disruptions. Effective customer support is vital. Payment gateway providers offer comprehensive support to businesses, ensuring smooth operations.

Regulatory Framework

RBI Guidelines

The Reserve Bank of India (RBI) has laid down guidelines for the operation of payment gateways, ensuring adherence to regulatory standards. Businesses engaging in collections through payment gateways must comply with regulatory requirements to avoid legal complications.

Future Trends

Innovation in Technology

The future holds promises of further technological innovation in payment gateways, enhancing their capabilities and security features. Payment gateways are likely to integrate with emerging platforms, offering businesses more diverse options for collections.

Enhanced Data Analytics

Tips for Choosing the Right Payment Gateway

Advanced data analytics will play a pivotal role, providing businesses with valuable insights into consumer behavior and preferences. Understanding the specific needs of the business is crucial in selecting a payment gateway that aligns with its objectives.

Cost Considerations

Evaluate the cost implications of different payment gateways, considering both transaction fees and subscription costs. Choose a payment gateway that scales with the growth of the business, ensuring continued efficiency in collections.

User Guide for Implementing Payment Gateways

Step-by-Step Integration

A detailed user guide for implementing payment gateways aids businesses in a seamless integration process[ Providing insights into common issues and their resolutions ensures a smooth experience for businesses during and after integration.

Success Stories in Collections Using Payment Gateways

Impact on Small Businesses

Examining success stories of small businesses highlights the democratizing effect of payment gateways on collections. The transformation of revenue streams through effective collections demonstrates the strategic importance of payment gateways.

Expert Opinions

Industry Leaders’ Perspectives

Gaining insights from industry leaders provides a broader perspective on the role of payment gateways in collections. Financial experts offer valuable insights into the economic implications of using payment gateways for collections.

Conclusion

In conclusion, payment gateways have evolved into indispensable tools for businesses engaged in collections in India. Their role in ensuring secure, efficient, and user-friendly transactions is paramount.

FAQs

How secure are payment gateways for collections?

Payment gateways prioritize security, employing advanced encryption and authentication measures to safeguard financial data.

Can I integrate multiple payment gateways for diverse collections?

Yes, businesses have the flexibility to integrate multiple payment gateways to cater to diverse collections.

What challenges do businesses commonly face during implementation?

Common challenges include security concerns, transaction failures, and the need for effective customer support.

Are there any specific compliance requirements for collections through payment gateways?

Yes, businesses must adhere to regulatory guidelines, particularly those set forth by the Reserve Bank of India (RBI).

How can businesses stay updated on the latest trends in payment gateways?

Staying connected with industry updates, attending conferences, and engaging with payment gateway providers can keep businesses informed about the latest trends.