Author : Sweetie

Date : 25/12/2023

Introduction

In the dynamic landscape of personal finance, credit counseling has emerged as a crucial tool for individuals seeking to manage their debts and achieve financial stability. In the Indian context, understanding the role of payment gateways in facilitating efficient credit counseling is paramount. This article delves into the nuances of credit counseling, explores the significance of payment gateways, and provides insights into choosing the right payment gateway for optimal results.

Brief Overview of Credit Counseling

Credit counseling serves as a financial advisory service aimed at helping individuals manage their debts and improve their financial well-being. It involves professional guidance to create a sustainable plan for debt repayment and financial planning.

Importance of Payment Gateways in Credit Counseling

The integration of payment gateways enhances the effectiveness of credit counseling services by providing secure and convenient payment options for individuals undergoing debt management programs .In India, credit counseling involves assisting individuals in understanding their financial situation, providing guidance on budgeting, and formulating strategies for debt repayment. The primary purpose is to empower individuals to take control of their financial futures.

Role in Financial Planning

Credit counseling is crucial in financial planning, guiding individuals in making informed decisions about investments, savings, and debt management. The demand for credit counseling[1] in India is on the rise, given the increasing awareness of financial literacy. However, despite ongoing advancements, challenges persist, thereby emphasizing the urgent need for innovative and effective solutions to address these issues comprehensively.

The Significance of Payment Gateways

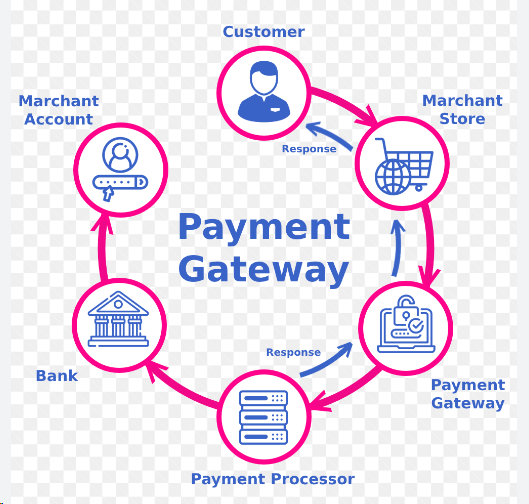

Definition and Role of Payment Gateways

Payment gateways are online tools that facilitate the secure transfer of funds between the payer and the payee. In Credit Counseling and Debtor[2] play a crucial role in enabling individuals to make timely and secure payments towards their debt management plans.

Integration with Credit Counseling Services

The seamless integration of payment gateways with credit counseling Merchant services[3]

services ensures a user-friendly experience for individuals, making the entire process of debt repayment more accessible and efficient. Data security is paramount in credit counseling, and payment gateways employ advanced encryption measures to safeguard sensitive financial information, instilling confidence in users.

Key Features of Payment Gateways for Credit Counseling

User-Friendly Interfaces

Payment gateways designed for credit counseling prioritize user experience, with intuitive interfaces that simplify the Payment processing explained[4] for individuals. To cater to diverse financial preferences, top payment gateways offer multiple payment options, including credit cards, debit cards, net banking, and mobile wallets. Robust security protocols, including SSL encryption and two-factor authentication, are implemented to ensure the confidentiality and integrity of financial transactions.

Top Payment Gateways for Credit Counseling in India

Known for its user-friendly interface and robust security features, XYZ Gateway has gained popularity among credit Counseling psychology[5] service providers and users alike. ABC Payment Solutions stands out for its versatility, offering a wide array of payment options and seamless integration with credit counseling platforms.

PQR Secure Pay

PQR Secure Pay ensures data security, offering a reliable solution for credit counseling services focused on user information confidentiality.

Benefits of Using Payment Gateways in Credit Counseling

Streamlined Payment Processes

The integration of payment gateways streamlines the debt repayment process, allowing individuals to make payments conveniently and consistently. Payment gateways enhance credit counseling by ensuring a hassle-free, efficient payment process, which is essential for a positive user experience.

Data Security and Privacy

Payment gateways ensure data security, fostering trust and encouraging individuals to seek credit counseling services without fear or hesitation. Challenges, including technical glitches, payment failures, and user apprehension, frequently arise in the credit counseling landscape. Furthermore, these obstacles can hinder the overall process and require proactive solutions to ensure a smoother experience.

Innovative Solutions to Overcome Challenges

How Payment Gateways Improve Accessibility

Continuous technological advancements and proactive problem-solving strategies are essential in addressing challenges and ensuring the seamless functioning of payment gateways. Payment gateways help credit counseling services reach remote individuals lacking access to traditional banking, expanding their overall audience significantly.

Reaching a Wider Audience

Empowering Individuals in Remote Areas

In remote areas where physical access to financial institutions is limited, payment gateways bridge the gap, empowering individuals to participate in credit counseling programs. The mobile-friendly nature of payment gateways aligns with the increasing trend of smartphone usage, making credit counseling more accessible to a tech-savvy population.

Future Trends in Payment Gateways for Credit Counseling

Technological Advancements

Advancing technology will enhance payment gateways, optimizing credit counseling. Integrating blockchain and AI could revolutionize the process.

Steps to Integrate Payment Gateways with Credit Counseling Services

Technical Requirements

The successful integration of payment gateways with credit counseling services requires careful consideration of technical requirements and compatibility. Collaborating with financial institutions is crucial in establishing a seamless connection between credit counseling services and payment gateways.

Expert Opinions and Insights

Perspectives on the Role of Payment Gateways

Experts share their perspectives on how payment gateways contribute to the effectiveness of credit counseling and its potential evolution. The article explores anticipated developments in credit counseling, highlighting potential advancements in services and the role of payment gateways. Identifying potential challenges and proposing proactive solutions prepares credit counseling services for future obstacles, ensuring sustained growth.

Conclusion

In conclusion, payment gateways play a pivotal role in enhancing the accessibility, efficiency, and security of credit counseling services, contributing to the overall financial well-being of individuals in India. The article concludes by encouraging individuals to explore credit counseling options and leverage the benefits offered by payment gateways in achieving financial stability.

FAQs

- What is the primary purpose of credit counseling in India?

- Credit counseling in India aims to help individuals manage their debts and improve their financial well-being through professional guidance.

- How do payment gateways enhance credit counseling services?

- Payment gateways facilitate secure and convenient payment options for individuals undergoing debt management programs, improving the overall efficiency of credit counseling services.

- What are the key features to look for in payment gateways for credit counseling?

- User-friendly interfaces, multiple payment options, and robust security measures are essential features to consider when choosing payment gateways for credit counseling.

- How do payment gateways improve accessibility in credit counseling?

- Payment gateways enable credit counseling services to reach a wider audience, including individuals in remote areas, by providing mobile-friendly options and multiple payment choices.

- What are the future trends in payment gateways for credit counseling?

- Anticipated developments include technological advancements and the integration of payment gateways with emerging financial technologies, such as blockchain and artificial intelligence.