AUTHOR : ZOYA SHAH

DATE : 25-12-2023

Introduction

In the digital era, payment portal have become the linchpin of online transactions, providing a seamless bridge between consumers, businesses, and financial institutions. Simultaneously, credit management plays a pivotal role in shaping the financial behavior of individuals and businesses in India.

The Landscape of Payment Gateways in India

Role in facilitating online transactions

India boasts a vibrant market with several prominent payment portal like Paytm, Razorpay, and Instamojo dominating the scene.

Payment portal play a crucial role in facilitating secure and swift online transactions, fostering the growth of e-commerce and digital payments.

Credit Management in India

Understanding the credit ecosystem

Navigating the intricate credit ecosystem in India involves considering factors like credit scores, credit bureaus, and lending practices.

Despite the potential benefits, challenges such as credit accessibility and financial literacy persist, presenting opportunities for innovative solutions.

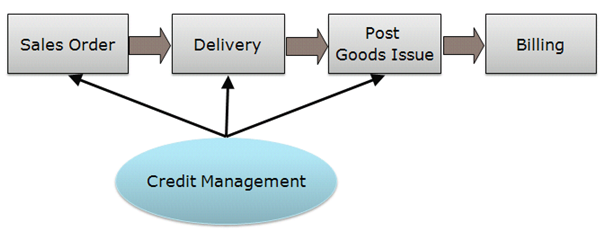

Integration of Payment Gateways with Credit Management

Benefits of seamless integration

The seamless integration of payment portal with credit management [1] offers enhanced efficiency, reducing transaction friction and enhancing user experiences.

Users benefit from streamlined processes, quick approvals, and a more personalized approach to credit, thanks to the integration of these two essential components.

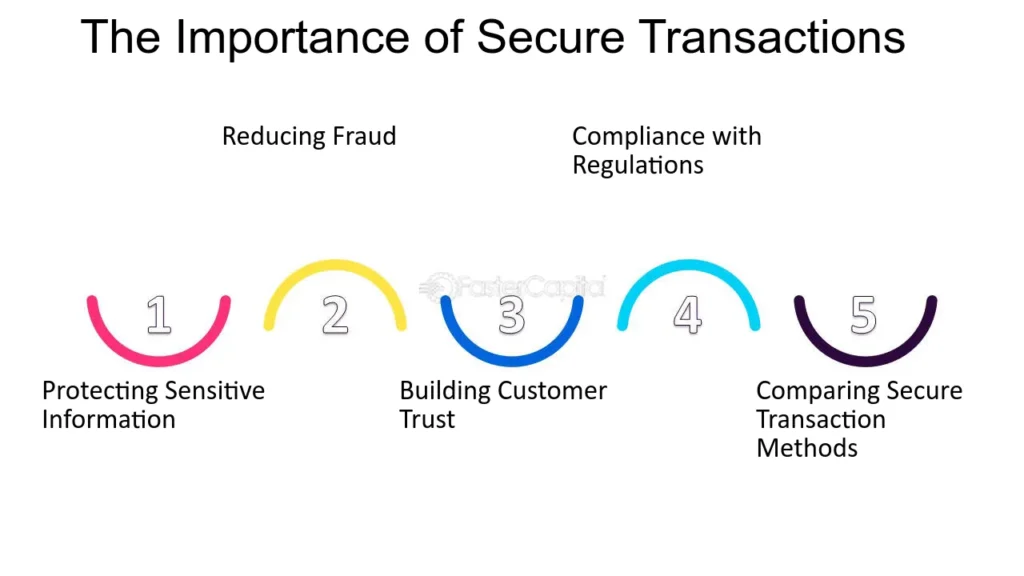

Security Measures in Payment Gateways

Technologies ensuring data protection

Security remains a paramount concern, and payment portal employ advanced encryption and authentication measures to ensure secure transactions.

Payment Gateways[2] From tokenization to biometric authentication, cutting-edge technologies are deployed to safeguard sensitive financial information.

Impact on E-Commerce

Boost in online sales

The symbiotic relationship between payment gateways and Credit score[3] management has significantly boosted online sales, providing consumers with flexible payment options. Secure transactions and efficient credit management contribute to building trust among online consumers, fostering loyalty and repeat business.

Challenges in Credit Management through Payment Gateways

Strategies for mitigating challenges

The integration of payment portal with credit management is not without risks, including fraud, default, and data breaches. Proactive measures, including advanced fraud detection algorithms and stringent authentication protocols, Credit history[4] are crucial for mitigating these risks.

Innovations in payment technologies

Evolving credit management practices

The future holds exciting innovations, from blockchain-based transactions to the integration of artificial intelligence in credit decision-making processes. Continuous evolution in credit management practices, such as real-time credit scoring[5], is on the horizon, reshaping the lending landscape.

Successful implementations

Lessons learned

Examining case studies of businesses successfully integrating payment portal with credit management provides valuable insights into best practices. Understanding the lessons learned from these implementations can guide other businesses in navigating similar integrations.

Tips for Businesses

Optimizing credit management processes

Choosing a payment gateway that aligns with the business model and credit management requirements is critical for success. Businesses should focus on optimizing credit management processes to ensure a seamless and secure experience for their customers.

Regulatory Framework

Compliance requirements

Navigating the regulatory landscape is crucial, with compliance requirements influencing how payment gateways and credit management systems operate.

Understanding the regulatory impact is essential for payment portal to adapt and thrive in a dynamic and evolving environment.

Customer Education

Importance of educating users

Promoting responsible credit behavior

Educating users about the intricacies of credit management and the security features of payment gateways fosters responsible financial behavior. Encouraging responsible credit behavior through educational initiatives contributes to a healthier credit ecosystem.

Interviews with industry experts

Their views on the integration of payment gateways with credit management

Gaining insights from industry experts sheds light on the future trajectory of payment gateways and credit management integration.Payment Gateway On Credit Management In India.

Experts offer perspectives on the challenges, benefits, and potential innovations in the integration of payment gateways with credit management.

Predictions for the future

Evolving trends in credit and payment technologies

Experts predict a future where payment gateways and credit management become even more entwined, offering unprecedented convenience and security.

Trends such as decentralized finance (DeFi) and contactless payments will likely shape the future landscape of credit and payment technologies.

Conclusion

In conclusion, the integration of payment door with credit management in India marks a significant milestone in the financial technology landscape. As we navigate the complexities of a digital era, this symbiotic relationship is reshaping how transactions are conducted, laying the foundation. Payment Gateway On Credit Management In India.

FAQs

- How does the integration of payment portal with credit management benefit businesses?

- The integration enhances efficiency, reduces transaction friction, and provides businesses with tools for seamless credit management, fostering growth and customer trust.

- What security measures are in place to protect user information in payment gateways?

- Payment portal employ advanced encryption, tokenization, and biometric authentication to ensure secure transactions and protect sensitive financial information.

- What challenges are associated with credit management through payment portal?

- Risks include fraud, default, and data breaches. Proactive measures such as fraud detection algorithms and stringent authentication protocols are essential for mitigation.

- How can businesses optimize credit management processes in the integration with payment gateways?

- Businesses should focus on selecting the right payment gateway aligned with their model and optimizing credit management processes to ensure a seamless and secure customer experience.

- What are the future trends in payment portal and credit management integration?

- The future holds innovations like blockchain-based transactions and artificial intelligence in credit decision-making, shaping a more advanced financial landscape.