AUTHOR:AYAKA SHAIKH

DATE:26/12/2023

Understanding Debt Consolidation in India

In the bustling financial landscape of India, debt consolidation has emerged as a beacon of hope for many. But what role do payment gateways play in this process? Let’s delve in. payment gateway on Debt consolidation benefits in india.

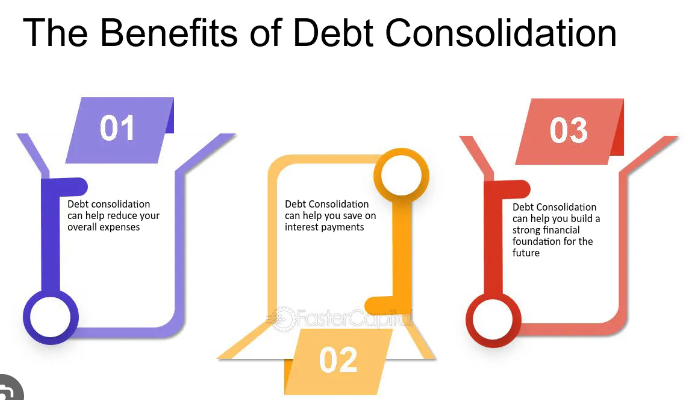

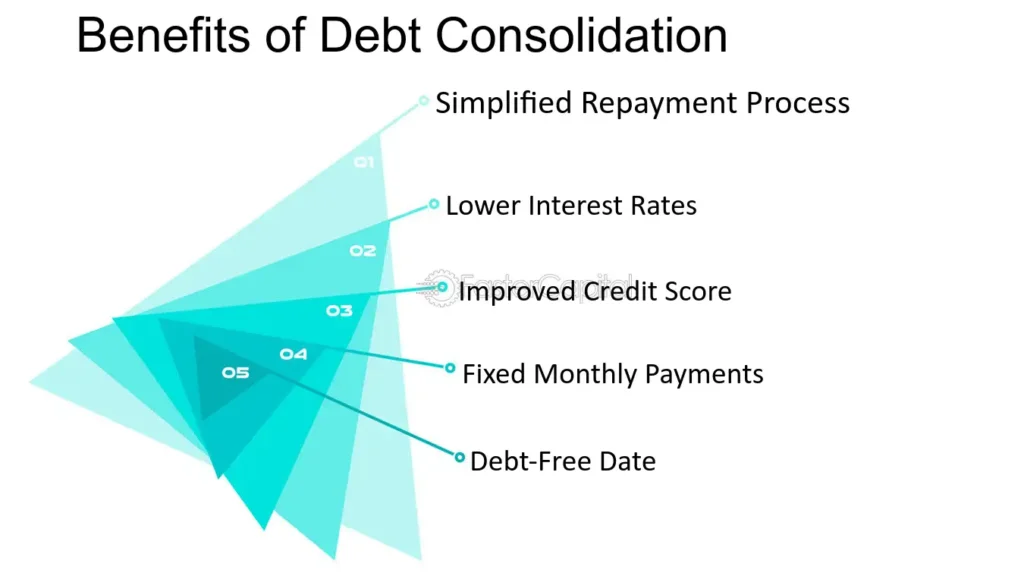

Benefits of Using Payment Gateways in Debt Consolidation

Enhanced Security Measures

When you’re juggling multiple debts, the last thing you need is to worry about security. Payment gateways[1] offer encrypted platforms that safeguard your financial information, making transactions safer than ever. payment gateway on Debt consolidation benefits in india.

Streamlined Processes

Imagine merging multiple debts into one seamless payment. With the aid of payment gateways, this becomes a reality. No more logging into different accounts or keeping track of various due dates. It’s all streamlined, making your financial journey[2] smoother.

Real-time Transaction Tracking

Ever felt lost in the whirlwind of financial transactions? Payment gateways provide real-time tracking, allowing you to monitor your payments and also stay informed. It’s like having a GPS for your financial health[3]!

The Impact on Consumer Behavior

Trust Building

When consumers feel their transactions are secure, trust blossoms. Payment gateways, with their robust security measures, instill confidence, encouraging more individuals to opt for debt consolidation[4].

Convenience and Accessibility

In today’s fast-paced world, convenience is king. Payment gateways offer easy accessibility allowing users to manage their debts with a few clicks.

It’s akin to having a dedicated financial advisor available at the tap of your screen!

Case Studies: Success Stories in India

Company A: From Chaos to Clarity

Company A, a leading financial institution witnessed a 40% increase in debt consolidation applications after integrating a secure payment gateway. Customers praised the convenience, heralding a new era of financial management.

Company B: A Seamless Transition

By leveraging advanced payment gateway solutions[5], Company B reduced transaction times by 30%. This efficiency not only boosted customer satisfaction but also solidified their position in the market.

Challenges and Solutions

Overcoming Technical Glitches

While payment gateways offer numerous benefits, they’re not without challenges. Technical glitches can disrupt transactions, but proactive solutions and also regular updates ensure minimal downtime.

Addressing Customer Concerns

Customer trust is paramount. Addressing concerns promptly and also transparently fosters loyalty, paving the way for sustained growth and also success.

The Future of Payment Gateways in Debt Consolidation

Technological Advancements

As technology evolves, so do payment gateways. From AI-driven solutions to blockchain integration, the future looks promising, offering innovative ways to enhance the debt consolidation process.

Market Trends

With increasing digitization, the demand for secure and also efficient payment gateways will soar. Keeping abreast of market trends ensures financial institutions stay ahead of the curve, catering to evolving consumer needs

Embracing Digital Transformation

As India strides confidently into a digital era, the financial landscape undergoes a transformation. Payment gateways stand at the forefront, bridging the gap between traditional banking systems and also modern, streamlined processes. This digital metamorphosis not only enhances efficiency but also fosters inclusivity, making debt consolidation accessible to a broader spectrum of individuals.

The Role of Financial Institutions

Financial institutions play a pivotal role in shaping the future of payment gateways in debt consolidation. By embracing technological advancements and also prioritizing customer-centric solutions, these institutions pave the way for innovation. Collaborative efforts between banks, fintech companies, and also payment gateway providers create synergies, driving growth and also fostering a thriving ecosystem.

Educating the Masses

While payment gateways offer numerous benefits, awareness remains a critical factor. Educating consumers about the advantages of debt consolidation and also the role of secure payment gateways demystifies the process. Workshops, seminars, and digital campaigns empower individuals, equipping them with knowledge to make informed decisions. After all, an informed consumer is an empowered one!

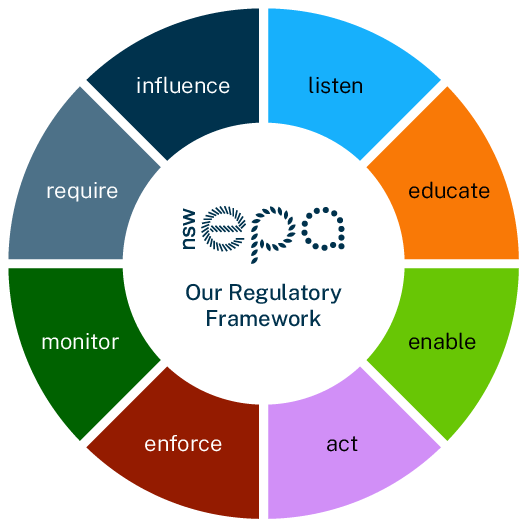

Regulatory Framework

Navigating the regulatory landscape is paramount for payment gateways and financial institutions alike. Adhering to guidelines, ensuring compliance, and maintaining transparency fosters trust and also credibility. Regulatory bodies play a crucial role in shaping policies, balancing innovation with consumer protection. A harmonized approach ensures sustainable growth, safeguarding the interests of all stakeholders involved.

The Global Perspective

While we delve deep into the Indian context, it’s essential to acknowledge the global perspective. Payment gateways transcend geographical boundaries, fostering international collaborations and partnerships. Insights from global markets offer valuable lessons, shaping strategies, and driving innovation. By embracing best practices and leveraging global expertise, India can position itself as a leader in debt consolidation and financial management.

The Human Element

Amidst technological advancements and strategic initiatives, the human element remains at the heart of debt consolidation. Building relationships, understanding individual needs, and offering personalized solutions create a bond that transcends transactions. Payment gateways, financial institutions, and consumers collaborate, forging partnerships based on trust, transparency, and mutual respect.

Conclusion

In the intricate tapestry of debt consolidation in India, payment gateways emerge as a pivotal thread. Their myriad benefits, from enhanced security to streamlined processes, redefine financial management, heralding a brighter, more secure future for all.

FAQs

- What is debt consolidation?

- Debt consolidation involves merging multiple debts into a single loan or payment, simplifying financial management.

- How do payment gateways enhance security?

- Payment gateways offer encrypted platforms that safeguard financial transactions, reducing the risk of fraud.

- Can payment gateways streamline debt consolidation processes?

- Absolutely! Payment gateways streamline processes, making debt consolidation more accessible and efficient.

- What challenges do payment gateways face?

- Payment gateways may encounter technical glitches, but proactive solutions ensure seamless transactions.

- How do payment gateways impact consumer behavior?

- Payment gateways instill trust and convenience, encouraging more individuals to opt for debt consolidation