AUTHOR: MICKEY JORDAN

DATE: 26/12/2023

Introduction

In the intricate web of personal finance[1], managing debts can be a challenging task. As technology continues to reshape the financial landscape, payment gateways emerge as pivotal tools, especially in the context of debt consolidation in India.

Understanding Payment Gateways

Payment gateways[2] serve as virtual bridges between consumers, financial institutions, and creditors. They facilitate secure and seamless transactions, ensuring the flow of funds is efficient and protected. Various types of payment gateways cater to different needs, from traditional bank transfers to modern e-wallets.

Role of Payment Gateways in Debt Consolidation

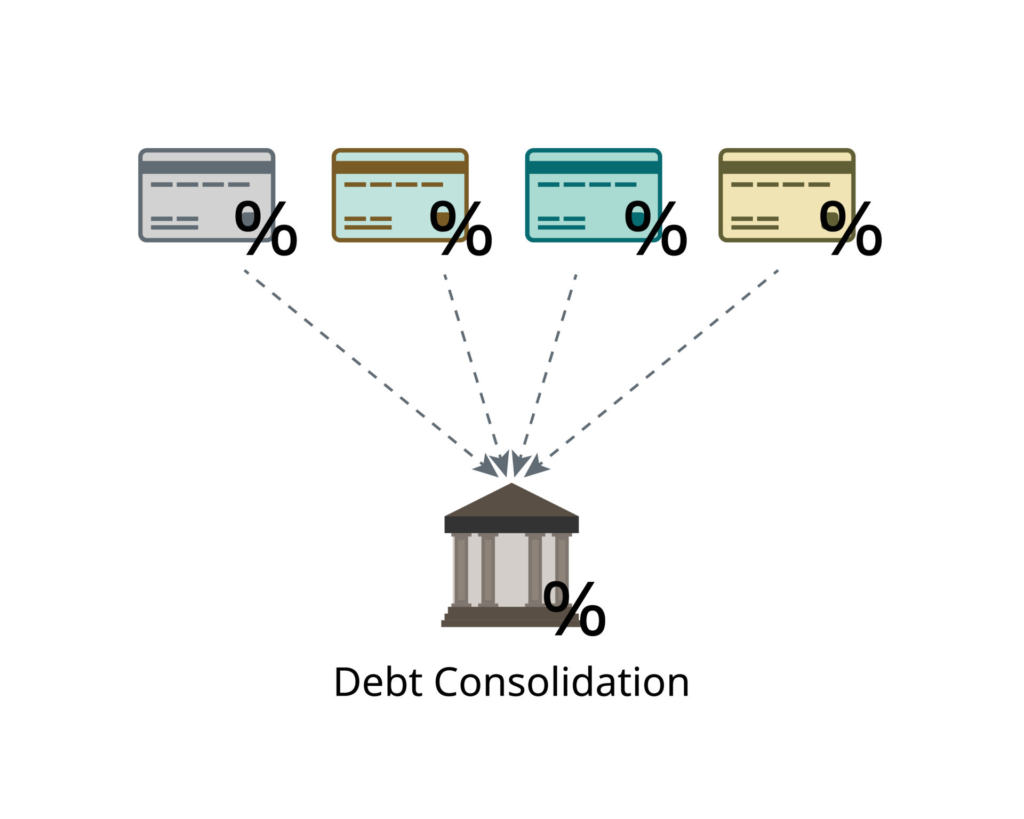

In the realm of debt consolidation[3], payment gateways play a crucial role in streamlining payments. By offering a centralized platform for transactions, they enhance financial security, safeguarding sensitive information during the debt repayment process.

Challenges in Debt Consolidation in India

The diverse financial landscape in India poses unique challenges to debt consolidation efforts. Navigating through various financial instruments and regulations requires careful consideration. Regulatory hurdles further complicate the process, demanding tailored solutions.

Choosing the Right Payment Gateway for Debt Consolidation

Selecting an appropriate payment gateway is pivotal for successful debt consolidation. Security features, such as encryption and two-factor authentication, are paramount. Integration capabilities with existing debt consolidation systems ensure a seamless user experience.

Benefits of Efficient Payment Gateways in Debt Consolidation

Efficient payment gateways contribute to an improved user experience, fostering trust and reliability. Timely transactions are vital in debt consolidation, preventing delays that could exacerbate financial stress.

Popular Payment Gateways for Debt Consolidation in India

Analyzing the top payment gateways for debt consolidation reveals nuances in their advantages. Comparative assessments help individuals make informed choices that align with their financial goals.

Steps to Integrate Payment Gateways into Debt Consolidation Systems

Technical considerations play a significant role in the integration process. User-friendly interfaces ensure that individuals, regardless of technical proficiency, can the payment gateway seamlessly.

The Future of Payment Gateways in Indian Debt Consolidation

Technological and evolving market trends point towards a promising future for payment gateways in Indian debt consolidation. Continuous innovation is expected to enhance user experiences and provide more tailored solutions.

User Testimonials

Real-world experiences highlight the positive impact of efficient payment gateways on debt consolidation. These offer insights into how individuals have successfully completed the process

Common Misconceptions About Payment Gateways in Debt Consolidation

Addressing concerns and clarifying doubts regarding payment gateways dispels common doubts. Educating individuals on the benefits and security measures can build confidence in utilizing these tools.

Importance of Financial Literacy in Debt Consolidation

Empowering consumers with financial literacy is crucial for effective debt management[4]. Educational initiatives aimed at financial understanding contribute to long-term financial literacy, which is crucial for effective debt consolidation. Educational initiatives aimed at financial understanding contribute to long-term financial well-being.

Case Studies: Successful Debt Consolidation Through Payment Gateways

Real-life examples of successful debt management through payment gateways provide inspiration and practical insights for individuals seeking financial freedom[5].

Expert Insights and Recommendations

Understanding the perspectives of financial experts in the field provides valuable guidance for individuals navigating the complexities of debt management through payment gateways.

Insights from Financial Guru, Dr. Meera Sharma Dr. Sharma emphasizes the importance of selecting payment gateways that align with individual financial goals. According to her, an approach to debt is crucial. Payment gateways should not be viewed as mere tools but as strategic partners in achieving financial well-being.”

Recommendations from Leading Financial Advisor, Rajiv Kapoor Mr. Kapoor suggests that users explore payment gateways with advanced analytics features. “Insights into spending patterns and debt behaviors empower individuals to make informed financial decisions,” he advises, underscoring the significance of strategies.

Conclusion

In conclusion, the integration of payments into debt consolidation processes in India signifies a transformative approach to personal finance. By understanding the nuances and selecting the right tools, individuals can embark on a journey towards financial freedom.

FAQS

- Are payment gateways safe for debt consolidation in India?

- Addressing concerns about the security of payment gateways.

- How do payment gateways streamline the debt consolidation process?

- Explaining the role of payment gateways in simplifying transactions.

- What are the key features to look for in a payment gateway for debt consolidation?

- Discussing the crucial elements that ensure a reliable payment gateway.

- Can payment gateways be integrated into existing debt consolidation systems?

- Understanding the technical aspects of integrating payment gateways.

- How can financial literacy contribute to successful debt consolidation through payment gateways?

- Exploring the link between financial education and effective debt management.