Author : Sweetie

Date : 23/12/2023

Introduction

Debt consolidation in India has become a pivotal financial strategy for individuals grappling with multiple debts. As the burden of managing various loans and credit card dues grows, people are seeking streamlined solutions to ease their financial journey. In this digital era, payment gateways play a crucial role in facilitating smooth and secure transactions, making debt consolidation a more manageable process.

In the realm of finance, the concept of debt consolidation involves combining multiple debts into a single, more manageable payment. This approach aims to simplify financial obligations, reduce interest rates, and provide individuals with a clearer path to financial freedom. As this trend gains momentum in India, the integration of payment gateways becomes increasingly important.

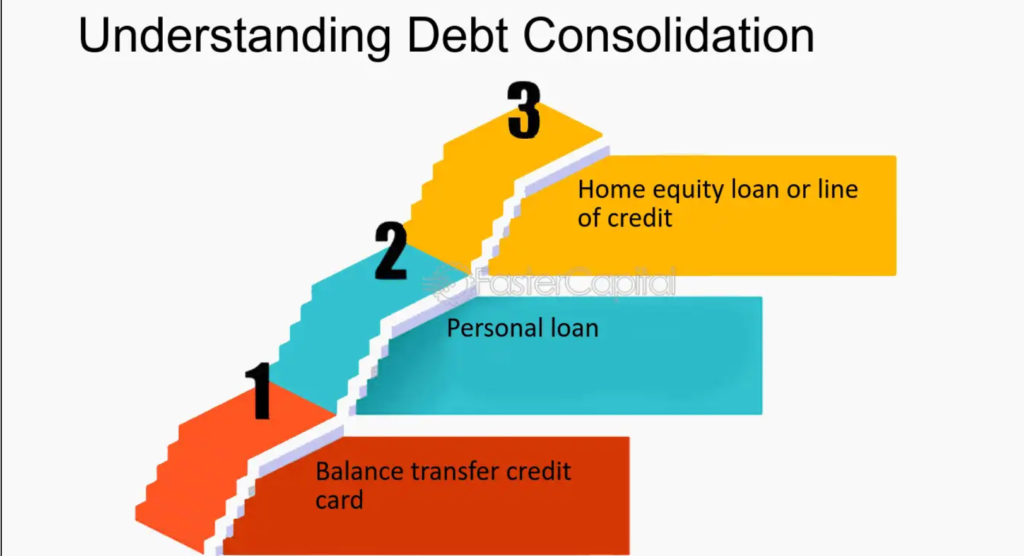

Understanding Debt Consolidation

Debt consolidation strategy not just a financial ; it’s a lifeline for those drowning in a sea of debts. The complexities of managing various loans and credit card bills can be overwhelming, leading many to seek a structured approach to debt repayment. Debt consolidation offers a unified repayment plan, often with lower interest rates, making it an attractive option for those looking to regain control of their finances.

Role of Payment Gateways in Debt Consolidation

The integration of payment gateways in the Debt Consolidation market[1] is Innovative. These gateways act as intermediaries, facilitating secure and efficient transactions between debtors and creditors. By automating payment processes, individuals can focus on their financial recovery without the added stress of managing multiple payments manually.

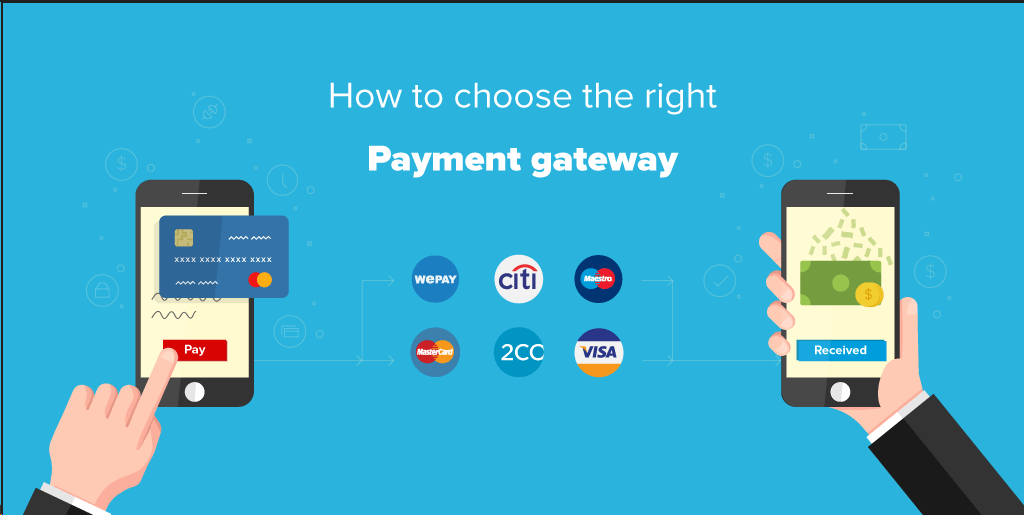

Popular Payment Gateways in India

India boasts a diverse range of payment gateways, each with its unique features and fee structures. From well-established platforms to innovative newcomers, individuals exploring Consider Debt Consolidation[2] have an array of options to choose from. Understanding the differences between these gateways is crucial for making an informed decision that aligns with specific financial needs.

Security Measures in Payment Gateways

Security is Vital in the world of online transactions, especially when dealing with sensitive financial information. Payment gateways[3] employ advanced encryption techniques and security protocols to Secure user data. Exploring these security measures provides individuals with the confidence to engage in debt consolidation without compromising their privacy.

User Experience in Payment Gateway Integration

A seamless user experience is essential for the success of any payment gateway. In the context of debt consolidation[4], an intuitive and user-friendly interface ensures that individuals can navigate the payment process effortlessly. The integration of payment Portals with debt consolidation services aims to enhance user experience, making the journey towards financial recovery smoother.

Challenges in Payment Gateway Integration for Debt Consolidation

While payment Portals offer numerous advantages, challenges may arise during the integration process. Compatibility issues with existing Payment system[5] platforms and concerns about the security of online transactions are common hurdles. Addressing these challenges is crucial to ensure a Continuous and trustworthy payment experience for individuals consolidating their debts.

Trends in Payment Gateway Technology

From Without contact payments to Chain of blocks integration, emerging trends are shaping the future of financial transactions. Understanding these trends provides valuable insights into how payment Portals may further streamline the debt consolidation process.

Case Studies: Successful Debt Consolidation through Payment Gateways

Real-life success stories illustrate the tangible benefits of integrating payment Portals into debt consolidation strategies. From faster debt repayment to improved financial management, these case studies highlight the positive impact of leveraging technology to navigate the complexities of multiple debts.

Tips for Choosing the Right Payment Gateway for Debt Consolidation

Selecting the right payment gateway is a crucial decision in the debt Integration journey. Factors such as transaction fees, security features, and customization options must be carefully considered. Tailoring the choice of payment gateway to individual needs ensures a Effortless and personalized debt consolidation experience.

The Future of Payment Gateways in Debt Consolidation

As technology continues to advance, the future of payment Portals holds exciting possibilities for the world of debt consolidation. Enhanced security measures, artificial intelligence integration, and other innovations may redefine how individuals approach and experience debt consolidation in the years to come.

Expert Opinions on Payment Gateway Integration

Financial experts play a pivotal role in guiding individuals through the debt consolidation process. Their insights into the role of payment Portals provide valuable perspectives on navigating financial challenges effectively. Recommendations from experts contribute to a more informed and empowered approach to debt consolidation.

How Payment Gateways Affect Credit Scores in Debt Consolidation

Maintaining or improving credit scores is a concern for individuals undergoing debt consolidation. Understanding how payment Portals influence credit ratings enables individuals to make informed decisions that align with their long-term financial goals. Strategies for mitigating any potential impact on credit scores are explored.

Common Misconceptions about Payment Gateways in Debt Consolidation

Dispelling myths surrounding payment gateways is crucial for fostering trust in their role within the debt consolidation process. Addressing common misconceptions ensures that individuals can make decisions based on accurate information, empowering them to take control of their financial well-being.

Conclusion

In conclusion, the integration of payment gateways into the debt consolidation landscape in India marks a significant advancement in financial technology. The synergistic relationship between secure and efficient payment processes and the goal of debt consolidation provides individuals with a powerful tool to regain control of their finances.

FAQs

- Q: How does debt consolidation impact credit scores?

- A: Debt consolidation can have varied effects on credit scores. It’s essential to understand the factors involved and take steps to mitigate any potential impact.

- Q: Are all payment gateways equally secure for debt consolidation?

- A: Not all payment gateways offer the same level of security. It’s crucial to choose a reputable and secure gateway to ensure the safety of financial transactions.

- Q: Can payment gateways be customized for specific debt consolidation needs?

- A: Yes, many payment gateways offer customization options to align with the unique requirements of individuals undergoing debt consolidation.

- Q: What trends are shaping the future of payment gateways in debt consolidation?

- A: Emerging trends include advancements in security measures, artificial intelligence integration, and innovations in transaction technologies.

- Q: How can individuals choose the right payment gateway for debt consolidation?

- A: Consider factors such as transaction fees, security features, and customization options when selecting a payment gateway for debt consolidation.