AUTHOR:AYAKA SHAIKH

DATE:26/12/2023

INTRODUCTION

In the bustling financial landscape of India, debt consolidation[1] has emerged as a viable solution for individuals grappling with multiple debts. As we delve deeper into this realm, one cannot overlook the pivotal role of payment gateways. payment gateway on Debt consolidation services in india.

However, what precisely do they entail, and what makes them indispensable?

Let’s embark on this journey together.

Debt Consolidation Services in India

What is Debt Consolidation?

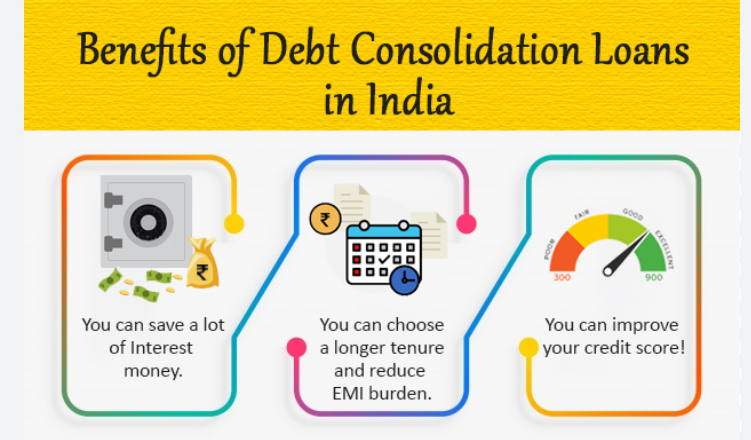

Imagine you have multiple loans from different lenders, each with varying interest rates and Refund terms. Debt consolidation Simplifying this complexity by merging these loans into one. This means one monthly payment, a potentially lower interest rate, and a clearer path to becoming debt-free. payment gateway on Debt consolidation services in india.

Importance in the Indian Context

With the rising middle class in India and easy access to credit facilities, many find themselves ensnared in multiple debts. Debt consolidation emerges as a beacon, offering Organized Refund and financial freedom[2]

Role of Payment Gateways

Secure Transactions

Debt consolidation isn’t just about combining debts; it’s also about facilitating smooth transactions. Payment gateways serve as the link, guaranteeing that these transactions are encrypted, secure, and free from breaches. After all, no one wants their hard-earned money ending up in the wrong hands.

Convenience for Users

Recall the most recent instance when you completed an online transaction.

? The ease with which you transacted was courtesy of payment gateways. In the realm of debt consolidation, these gateways provide users with multiple payment options, timely reminders, and a hassle-free experience.

Popular Payment Gateways in India

Overview of Top Gateways

From Razorpay to PayU, India boasts several payment gateways renowned for their efficiency and reliability. Each comes with its unique features, catering to the diverse needs of debt consolidation services.

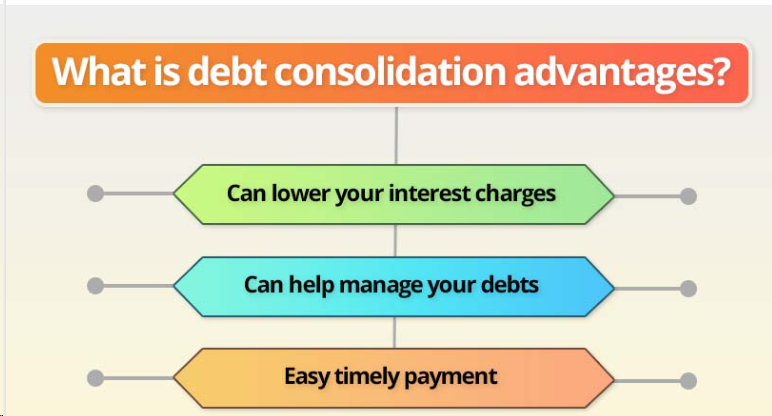

Advantages and Disadvantages

Although these gateways Simplifying transactions, it’s important to evaluate their advantages and drawbacks. Some may boast lower transaction fees, while others prioritize robust security features.

It’s a game of balancing priorities and choosing what aligns best with your needs.

Ensuring Safety in Transactions

Security Protocols

In an era dominated by cyber threats, ensuring transactional security is paramount. Payment gateways employ advanced encryption techniques, two-factor authentication, and regular security audits to safeguard user data and funds.

Consumer Trust and Reliability

Would you entrust your financial details[3] to a gateway with a dubious reputation? Neither would anyone else. Therefore, establishing and upholding consumer trust is central to payment gateway operations, promoting both reliability and credibility..

Future Trends in Payment Gateways for Debt Consolidation

As technology evolves, so do payment gateways. Expect innovations like AI-driven fraud detection, blockchain-based transactions, and enhanced user interfaces to redefine the debt consolidation landscape in India.

Embracing Technological Advancements

As the digital revolution sweeps across India, payment gateways are not far behind in harnessing its potential. Advanced technologies like machine learning and artificial intelligence are gradually permeating the domain of debt consolidation. These innovations offer improved security alongside predictive analytics, enabling users to forecast and handle their finances with greater efficiency.

Machine Learning in Fraud Detection

One of the significant challenges for payment gateways is detecting fraudulent activities. Machine learning, a branch of AI, focuses on teaching systems to recognize patterns and detect anomalies.

By analyzing vast datasets, machine learning algorithms can pinpoint suspicious transactions, thereby safeguarding users and financial institutions alike.

Artificial Intelligence and Personalized Solutions

Imagine receiving tailored financial advice[4] based on your spending habits, debt structure, and income. Artificial intelligence makes this a reality. By analyzing user data, AI algorithms can offer personalized debt consolidation plans, optimizing interest rates, and Refund strategies to suit individual needs.

The Future of Secure Transactions

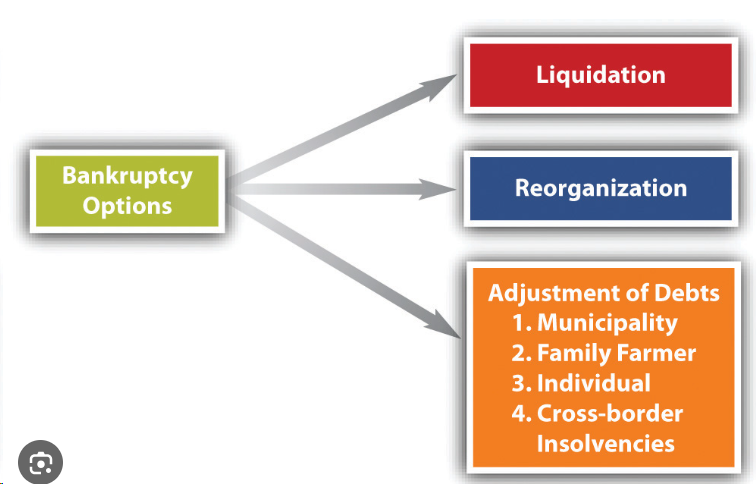

Although payment gateways have advanced secure transactions significantly, blockchain technology has the potential to transform this domain even further. Best known for its connection to cryptocurrencies such as Bitcoin, blockchain’s core attributes—transparency, immutability, and decentralization—position it as a strong player in the field of debt consolidation.

Decentralized Platforms and Trustless Transactions

Traditional payment gateways operate on centralized platforms, making them susceptible to single points of failure. Blockchain, on the other hand, operates on decentralized networks, eliminating the need for intermediaries. This trustless environment ensures that transactions occur directly between parties, reducing costs and enhancing security.

Smart Contracts and Automated Settlements

Another exciting application of Distributed ledger technology[5] in debt consolidation is the use of smart contracts.

These self-operating agreements incorporate predetermined terms and conditions.

Once parties meet these conditions—such as loan Refund—smart contracts automatically execute the agreed-upon terms, Simplifyiny processes and minimizing disputes.

Future Trends

The adoption of advanced technologies like AI and blockchain is set to revolutionize payment gateways in India. Debt consolidation platforms can leverage these innovations to offer more secure, transparent, and efficient payment systems.

Conclusion

Navigating the maze of debt consolidation in India necessitates understanding its intricate facets, with payment gateways emerging as unsung heroes. As we move forward, embracing technological advancements while prioritizing security and convenience will shape the future of this domain.

FAQs

- What is the primary role of payment gateways in debt consolidation?

- Payment gateways facilitate secure and convenient transactions, ensuring users can manage their debts seamlessly.

- Which payment gateways are popular in India for debt consolidation?

- Razorpay, PayU, and several other gateways dominate the Indian market, each offering distinct features.

- How do payment gateways ensure transactional security?

- Through advanced encryption, two-factor authentication, and also regular security audits, payment gateways prioritize user data and fund protection.

- Are there any disadvantages to using payment gateways for debt consolidation?

- While payment gateways simplify transactions, it’s essential to weigh factors like transaction fees, security features, and reliability.

- What future trends can we anticipate in payment gateways for debt consolidation?

- Expect innovations such as AI-driven fraud detection, blockchain-based transactions, and also enhanced user interfaces to revolutionize the debt consolidation landscape.