AUTHOR : NORA

DATE : 25-12-23

Introduction

Payment gateways, the unsung heroes of digital transactions[1] play a pivotal role in ensuring the seamless transfer of funds. In the realm of debt consolidation solutions in India, where individuals seek to simplify their financial obligations, the efficiency of payment gateways becomes even more pronounced.

Debt Consolidation Explained

Debt consolidation[2] involves combining multiple debts into a single, manageable payment This financial strategy aims to simplify the repayment process making it easier for individuals to regain control over their finances. The challenge lies in the coordination of payments, and also

this is where effective payment gateways come into play.

The Need for Effective Payment Gateways in Debt Consolidation

Streamlining payment processes is a key component of successful debt consolidation. A robust payment gateway[3] ensures that funds are transferred accurately and also promptly, contributing to the overall effectiveness of debt consolidation solutions.

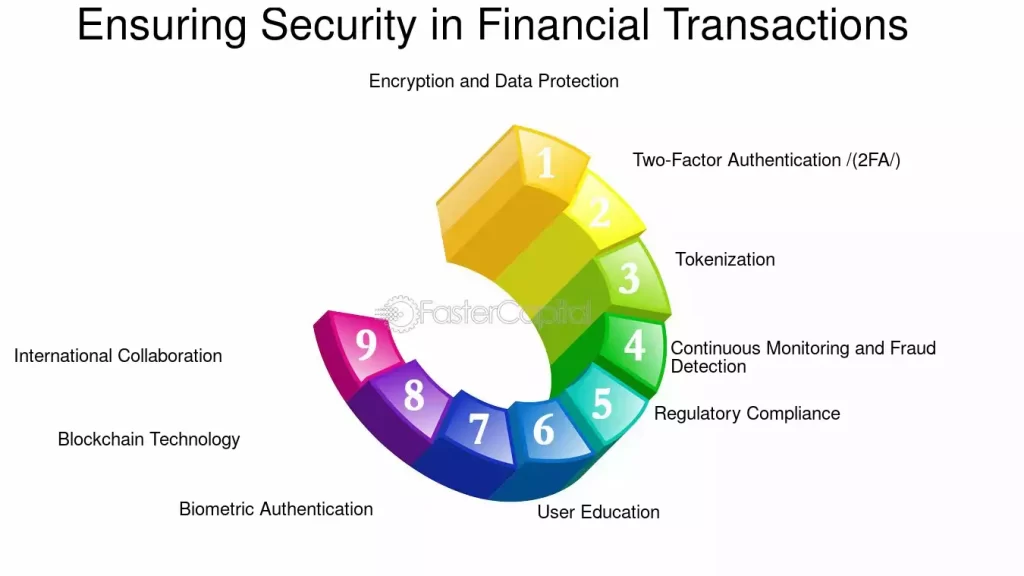

Ensuring Security in Financial Transactions

Security is paramount in the world of digital finance[4]. Individuals entrust payment gateway with sensitive financial information, necessitating stringent security measures to safeguard against fraud and unauthorized access.

Overview of Payment Gateways in India

India has witnessed a rapid evolution in its payment gateway landscape. With the advent of digitalization and also the push towards a cashless economy, the country has seen a surge in the adoption of various payment gateways Payment Gateway On Debt Consolidation Solutions In India

Growth and Adoption Trends

The growth of payment gateways in India is evident in the widespread acceptance of digital payment methods From small businesses to large enterprises, the convenience offered by these gateways has transformed the financial landscape.

Challenges in Implementing Payment Gateways for Debt Consolidation

Despite the benefits, the implementation of payment gateways in debt consolidation solutions is not without challenges. Regulatory hurdles and user concerns pose significant obstacles.

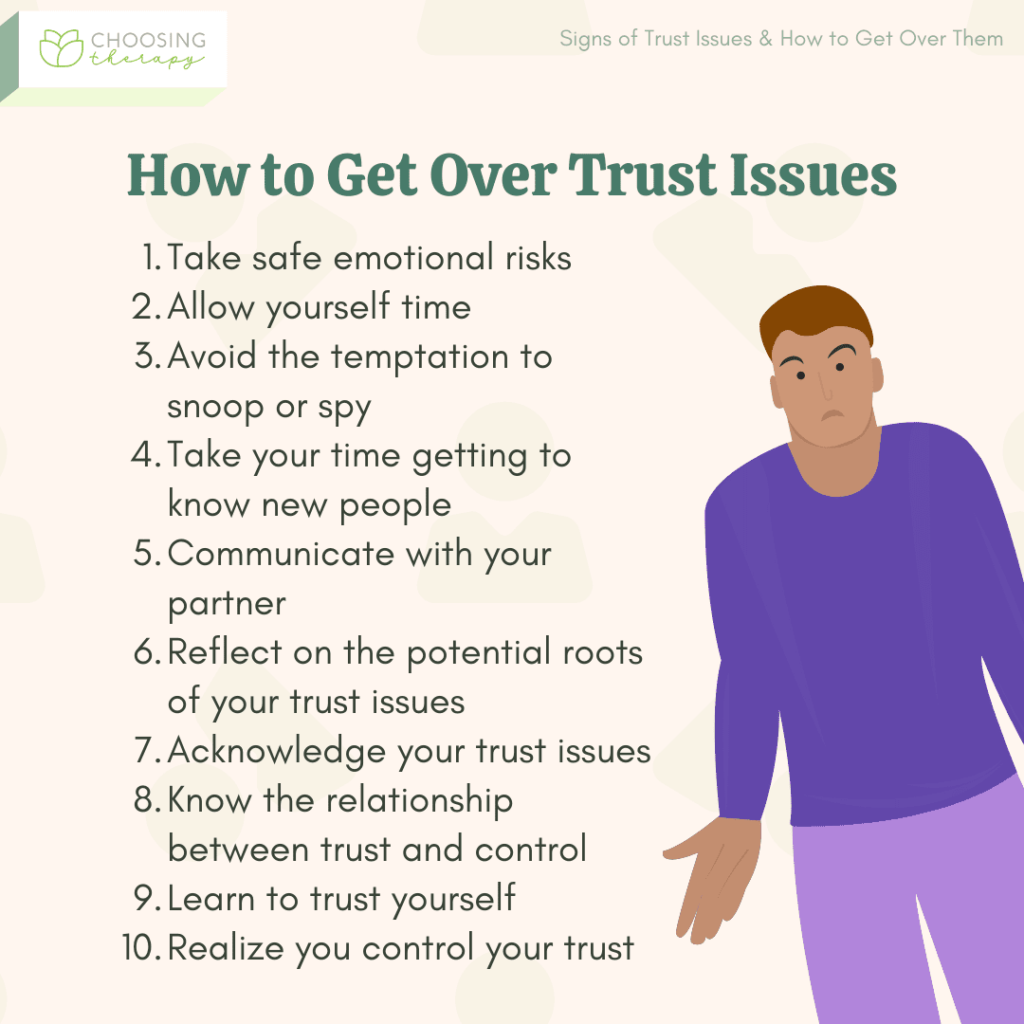

User Concerns and Trust Issues

Individuals navigating the waters of debt consolidation may be apprehensive about the security of online transactions[5]. Building trust through transparent communication and also robust security features is essential for widespread adoption.

Role of Technology in Debt Consolidation Payment Solutions

The synergy between technology and also debt consolidation payment solutions is a game-changer. Integrating artificial intelligence (AI) and also machine learning algorithms enhances the user experience while fortifying security measures.

Enhancing User Experience and Security Measures

A user-friendly interface coupled with advanced security protocols of a reliable payment gateway. Individuals exploring debt consolidation solutions need assurance that their financial information is not only secure but also easily accessible.

Key Features of Payment Gateways for Debt Consolidation

Understanding the specific features of payment gateways catering to debt consolidation is vital. Customized payment plans and also real-time transaction tracking contribute to the effectiveness of these solutions.

Real-time Transaction Tracking

The ability to monitor transactions in real-time empowers individuals to stay informed about their financial status. This transparency is especially valuable in the context of debt consolidation, where clarity is key.

Popular Payment Gateway Providers in India

Choosing the right payment gateway provider is a critical decision. A comparison of leading payment gateway services, along with an assessment of their pros and also cons, can aid individuals in making informed choices.

Pros and Cons of Each Provider

While some payment gateway providers excel in user interface design, others may stand also out for their robust security features. Evaluating the strengths and weaknesses of each option is essential for a tailored debt consolidation experience.

User Experience and Interface Design

The success of a payment gateway is often determined by its user interface. A design that caters to individuals with diverse financial backgrounds ensures inclusivity and accessibility.

Enhancing Accessibility for Individuals with Diverse Financial Backgrounds

Not everyone navigating debt consolidation solutions possesses advanced financial literacy. A user-friendly interface, coupled with intuitive design, goes a long way in making these solutions accessible to a broader audience.

Security Measures in Debt Consolidation Payment Gateways

The emphasis on security cannot be overstated. Encryption, data protection, and fraud prevention strategies collectively contribute to building a secure environment for financial transactions.

Fraud Prevention Strategies

As technology advances, so do the tactics of potential fraudsters. Payment gateways must stay ahead by implementing robust fraud prevention measures to safeguard users’ financial interests.

Case Studies: Successful Implementation of Payment Gateways in Debt Consolidation

Real-life examples provide insights into the practical benefits of efficient payment gateways in debt consolidation scenarios. These case studies showcase how organizations or individuals have successfully navigated the challenges of managing multiple debts.

Future Trends in Payment Gateway Technology for Debt Consolidation

The landscape of payment gateway technology is dynamic. Emerging technologies in the financial sector are poised to reshape the future of debt consolidation solutions.

Predictions for the Future of Payment Gateways

From blockchain innovations to biometric authentication, the future holds exciting possibilities for payment gateway technology. Staying informed about these trends is essential for individuals

Consumer Tips for Choosing the Right Payment Gateway in Debt Consolidation

Selecting the right payment gateway is a decision that requires careful consideration. Several factors come into play, and individuals should be aware of red flags that might indicate an unsuitable choice.

Factors to Consider When Selecting a Payment Gateway

- Compatibility: Ensure that the payment gateway is compatible with the debt consolidation solution you are considering. Seamless integration is key to a hassle-free experience.

- Cost Structure: Evaluate the fee structure of the payment gateway. Hidden fees or complex pricing models can impact the overall cost-effectiveness of the debt consolidation process.

- Security Protocols: Prioritize payment gateways with robust security measures. Look for features like two-factor authentication and encryption to safeguard your financial data.

- Customer Support: A responsive and helpful customer support team is invaluable. In the event of issues or queries, prompt assistance can make a significant difference.

Red Flags to Watch Out For

- Lack of Transparency: If a payment gateway provider is not transparent about its services, fees, or security measures, it raises concerns about their credibility.

- Poor User Reviews: Pay attention to user reviews and ratings. Consistent negative feedback may indicate a problematic service that could hinder your debt consolidation efforts.

- Limited Payment Options: A reliable payment gateway should offer a variety of payment options. Limited choices may not cater to the diverse needs of individuals seeking debt consolidation.

The Social Impact of Efficient Debt Consolidation Payment Solutions

Beyond individual financial benefits, efficient debt consolidation payment solutions have a broader social impact. Empowering individuals financially contributes to economic stability and fosters a positive societal environment.

Empowering Individuals Financially

By providing individuals with the tools to effectively manage and consolidate their debts, payment gateways contribute to financial empowerment. This empowerment has a ripple effect on communities, promoting economic resilience at a grassroots level.

Conclusion

In conclusion, the integration of payment gateways into debt consolidation solutions in India marks a significant leap towards financial efficiency and empowerment. From streamlining payment processes to ensuring robust security, these gateways play a pivotal role in reshaping how individuals manage their debts.

As technology continues to advance, the future holds exciting possibilities for payment gateway technology, promising even more tailored and secure solutions. It is essential for individuals to stay informed, considering the evolving landscape and choosing payment gateways that align with their unique financial needs.

Frequently Asked Questions (FAQs)

- Are payment gateways safe for debt consolidation transactions?

- Absolutely. Leading payment gateways employ advanced security measures like encryption and two-factor authentication to ensure the safety of financial transactions.

- How do I choose the right payment gateway for debt consolidation?

- Consider factors such as compatibility, cost structure, security protocols, and customer support. Look out for red flags like a lack of transparency or poor user reviews.

- What role does technology play in the future of payment gateways for debt consolidation?

- Technology, including AI and machine learning, is set to enhance user experience and security measures in payment gateways, making them more efficient and user-friendly.

- Can payment gateways help me manage multiple debts more effectively?

- Yes, payment gateways streamline the payment process, making it easier for individuals to manage and consolidate multiple debts into a single, more manageable payment.

- Where can I get access to efficient debt consolidation solutions?

- For access to reliable debt consolidation solutions, you can explore options at