AUTHOR:AYAKA SHAIKH

DATE:26/12/2023

Introduction

What is Debt Consolidation?

Ever felt trapped with multiple loans? That’s where debt consolidation[1] swoops in like a superhero. Debt consolidation in simple terms means merging all your debts into a single loan, making it easier to manage. payment gateway on Debt consolidation solutions in india.

The Need for Debt Consolidation in India

India, with its growing middle class, witnesses a surge in personal loans and aslo credit card debts. The need for streamlined repayment methods becomes paramount. Debt consolidation offers that much-needed relief.payment gateway on Debt consolidation solutions in india.

Understanding Payment Gateways

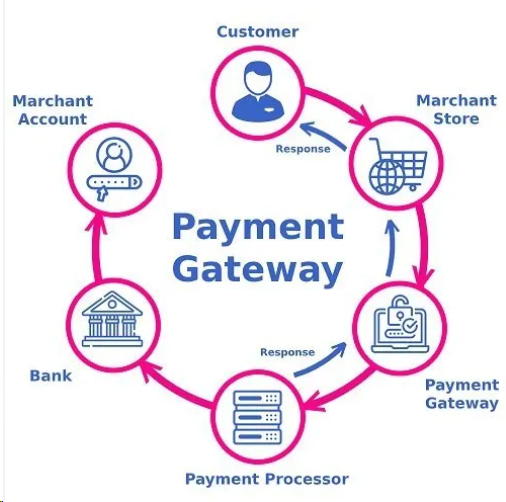

Basics of Payment Gateways

Imagine a bridge that safely carries your money from one end to another, ensuring it doesn’t get lost in the abyss. That’s precisely what a payment gateway[2] does. It acts as a secure bridge between your bank and also the merchant, facilitating smooth transactions.

Importance in Debt Consolidation

In the realm of debt consolidation payment gateways ensure seamless repayment processes. They allow borrowers to make payments without the hassle of multiple platforms, ensuring timely settlements.

Popular Payment Gateways in India

Gateway A

One of the most trusted gateways, offering top-notch security and also user-friendly interfaces, perfect for handling consolidation payments.

Gateway B

Known for its swift transaction speed, this gateway is a favorite among borrowers looking for quick solutions without compromising security.

Advantages of Using Payment Gateways

Security Features

Safety first! Payment gateways come armed with encryption and also fraud detection mechanisms, ensuring your transactions are as safe as a vault.

Transaction Speed and Efficiency

Remember the days of waiting in long queues? Those are gone. With payment gateways, transactions are lightning-fast, ensuring timely debt repayments[3].

Challenges and Concerns

Security Concerns

While gateways prioritize security, the digital world is vast. Always be vigilant and ensure you’re using trusted platforms.

Cost Involved

Every rose has its thorn. While gateways offer convenience, keep an eye on transaction fees.

It’s crucial to evaluate the advantages in comparison to the expenses.

Exploring Integration of Payment Gateways with Debt Consolidation

Seamless Integration for User Experience

Imagine trying to fit a square peg into a round hole – it doesn’t work. Similarly, integrating payment gateways with debt consolidation solutions requires finesse. The goal is to ensure borrowers have a hassle-free experience, from loan approval to repayment.

User-Friendly Interfaces

Gone are the days when financial jargon left borrowers scratching their heads. Modern payment gateways focus on simplicity. They offer intuitive interfaces that even the least tech-savvy individual can navigate with ease. This simplicity is crucial, especially when managing multiple debts

How to Choose the Right Payment Gateway?

Evaluating Security Protocols

In the digital age, security reigns supreme. When selecting a payment gateway for debt consolidation, prioritize platforms with robust encryption and multi-layered security protocols. Your financial data deserves nothing less.

Cost-Effectiveness and Transparency

Hidden fees? No thank you! Opt for payment gateways that offer transparent fee structures. While consolidation aims to simplify payments, unforeseen costs can derail your financial plans[4]. Always read the fine print.

Future Trends in Payment Gateways and Debt Consolidation

Technological Advancements

As the digital landscape advances, payment gateways also undergo continuous enhancement.

. Expect to see innovations like biometric authentication and AI-driven fraud detection become commonplace. These advancements aim to offer borrowers an unparalleled level of security and convenience.

Regulatory Landscape in India

India’s financial sector is dynamic. As the government introduces new regulations, payment gateways and debt consolidation solutions must adapt. Keeping abreast of regulatory changes ensures borrowers continue to enjoy safe and also efficient repayment options.

Real-Life Success Stories

Anecdotes of Financial Freedom

Meet Raj and Meena, a couple drowning in multiple debts. Frustrated with juggling payments, they turned to debt consolidation aided by seamless payment[5] gateways. Today, they enjoy financial freedom, thanks to a structured repayment plan and also user-friendly platforms.

Conclusion

Navigating the world of debt consolidation in India? Payment gateways emerge as a beacon of hope, streamlining repayments and also offering unmatched convenience. However, like all tools, they come with their challenges. Stay informed, stay safe, and tread the path of financial freedom with confidence.

FAQs

- Are all payment gateways in India reliable for debt consolidation?

- While many are trustworthy, always opt for recognized and secure platforms.

- Do payment gateways charge additional fees for debt consolidation transactions?

- Yes, while some may offer competitive rates, always review the fee structure.

- How secure are payment gateways for debt consolidation in India?

- Most gateways prioritize security; however, ensure you follow best practices to safeguard your transactions.

- Can I switch between payment gateways for my debt consolidation needs?

- Yes, but always ensure a smooth transition to avoid missed payments or overlaps.

- Is it advisable to rely solely on payment gateways for debt management?

- While they offer convenience, combining them with financial planning and advice is always beneficial.