AUTHOR : SOFI PARK

DATE : 27/12/2023

Introduction

In today’s economic landscape, where debt has become a common challenge for many individuals, the integration of payment gateways into debt relief options in India is proving to be a game-changer. As we navigate through this article, we will delve into the significance of payment gateway[1], the current

debt scenario in India, and how these gateways offer innovative solutions for debt relief.

Understanding Payment Gateways

Payment gateways serve as digital bridges in financial transactions, ensuring the secure and smooth transfer of funds. When applied to the context of debt relief[2], these gateways play a pivotal role in streamlining the payment process, making it more accessible and efficient for those seeking relief from financial burdens.

Current Debt Scenario in India

India is witnessing a surge in debt levels, affecting both individuals and the overall economy. With statistics pointing to a concerning increase in debt, it becomes imperative to explore advanced solutions that can address this issue effectively.

The Need for Innovative Solutions

Traditional debt relief methods often fall short in providing comprehensive solutions. Payment gateways emerge as innovative tools that can overcome the limitations of conventional approaches, offering a more dynamic and user-friendly way to manage debt.

Key Features of Payment Gateways for Debt Relief

Security, integration, and accessibility stand out as key features of payment gateways designed for debt relief. These gateways employ robust security measures, seamlessly integrate with debt relief platforms, and provide user-friendly interfaces for a hassle-free experience.

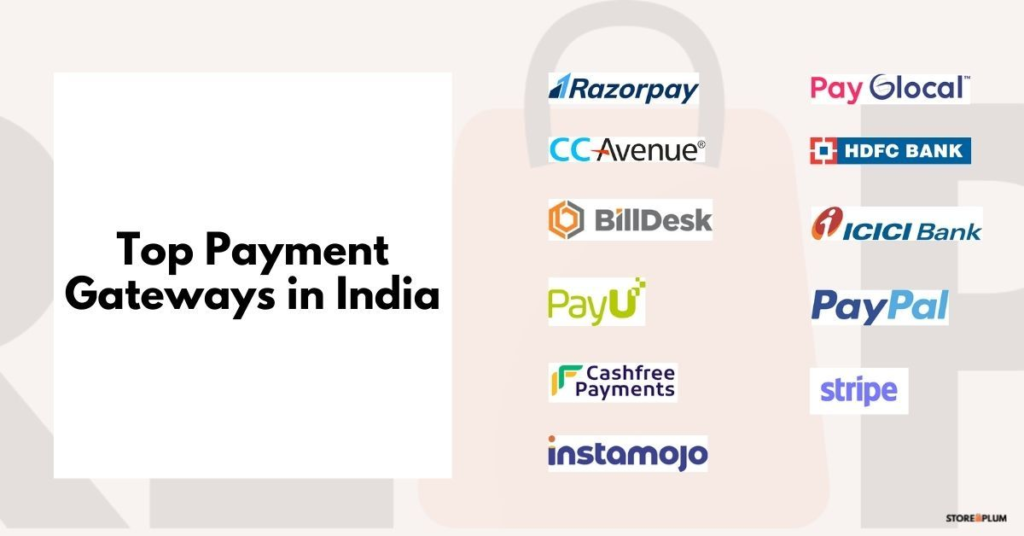

Popular Payment Gateways in India

Several payment gateways have gained prominence in India, each offering unique advantages for

debt relief programs. Understanding the specifics of these gateways is crucial for organizations aiming to enhance their debt management[3] strategies.

Advantages of Integrating Payment Gateways in Debt Relief

The integration of payment gateways brings forth several advantages, including faster and secure

debt transactions, an improved user experience, and real-time tracking and reporting capabilities. These benefits contribute significantly to the efficiency of debt relief programs[4].

Challenges and Solutions

While implementing payment gateways in debt relief, organizations may face challenges. This section explores potential obstacles and provides strategic solutions to ensure a seamless integration process.

Future Trends in Payment Gateways for Debt Relief

Technological advancements continue to shape the future of payment gateways in debt management. This section discusses emerging trends and predicts the evolving landscape of these gateways in the context of debt relief.

User Testimonials

Hearing from individuals who have benefited from payment gateways in their debt relief journey adds a personal touch to the article. Real-life experiences provide insights into the practical impact of these gateways on people’s lives.

Tips for Choosing the Right Payment Gateway

Selecting the appropriate payment gateway is crucial for the success of debt relief initiatives. This section offers practical tips and a comparison of available options to guide organizations in making informed choices.

Regulatory Compliance

Ensuring compliance with financial regulations is paramount when implementing payment gateways for debt relief. This section explores the importance of adherence to regulations and how payment gateways facilitate regulatory compliance.

Collaborations and Partnerships

Exploring collaborations between debt relief organizations and payment gateway providers[5] can lead to synergies that benefit both parties. This section examines the potential for partnerships and the positive outcomes they can yield.

Conclusion

the integration of payment gateways into debt relief options in India marks a significant advancement in financial management. The transformative impact of these gateways is evident in their ability to make debt transactions more secure, accessible, and user-friendly.

FAQs

- How do payment gateways enhance the security of debt transactions?

- Payment gateways employ encryption and secure protocols to safeguard financial transactions during debt relief processes.

- Are there specific regulations governing the use of payment gateways in debt relief programs?

- Yes, organizations must adhere to financial regulations to ensure the legality and ethicality of using payment gateways in debt management.

- Can payment gateways be integrated into existing debt relief platforms?

- Yes, payment gateways are designed to seamlessly integrate with various debt relief platforms, enhancing their functionality.

- What role do user testimonials play in showcasing the effectiveness of payment gateways in debt relief?

- User testimonials provide real-life evidence of the positive impact of payment gateways, building trust and credibility.

- How can organizations choose the right payment gateway for their debt relief initiatives?

- Organizations should consider factors such as security measures, integration capabilities, and user-friendliness when selecting a payment gateway for debt relief.