AUTHOR: AYAKA SHAIKH

DATE:26/12/2023

Introduction

Debt consolidation[1], a term that’s been buzzing around financial circles, is gaining significant traction in India. As more individuals find themselves entangled in multiple debts online platforms are emerging as a savior. But have you ever paused to think about the backbone of these platforms? That’s right; it’s the payment gateways that make the magic happen.

Understanding Payment Gateways

Payment gateways[2] act as bridges between borrowers and lenders. Think of them as the reliable postman who ensures your money reaches its intended destination securely. In essence, they facilitate online transactions, ensuring seamless flow without hitches. In a diverse market like India, there are various types of premium gateways for online debt consolidation in India, gateways catering to specific needs.

Importance of Secure Payment Gateways in Debt Consolidation

In an era where cyber threats lurk at every corner, security is paramount. Especially when it comes to financial transactions[3] the stakes are high. A robust payment gateway offers not just security but also builds trust. After all, would you entrust your hard-earned money to a platform that doesn’t guarantee safety?

Popular PGs in India

India, with its vast market potential, has witnessed the mushrooming of numerous payment gateways. From Razorpay to Paytm, each offers unique features, benefits, and user experiences. While some prioritize speed, others focus on versatility. But the underlying theme remains the same: facilitating smooth transactions.

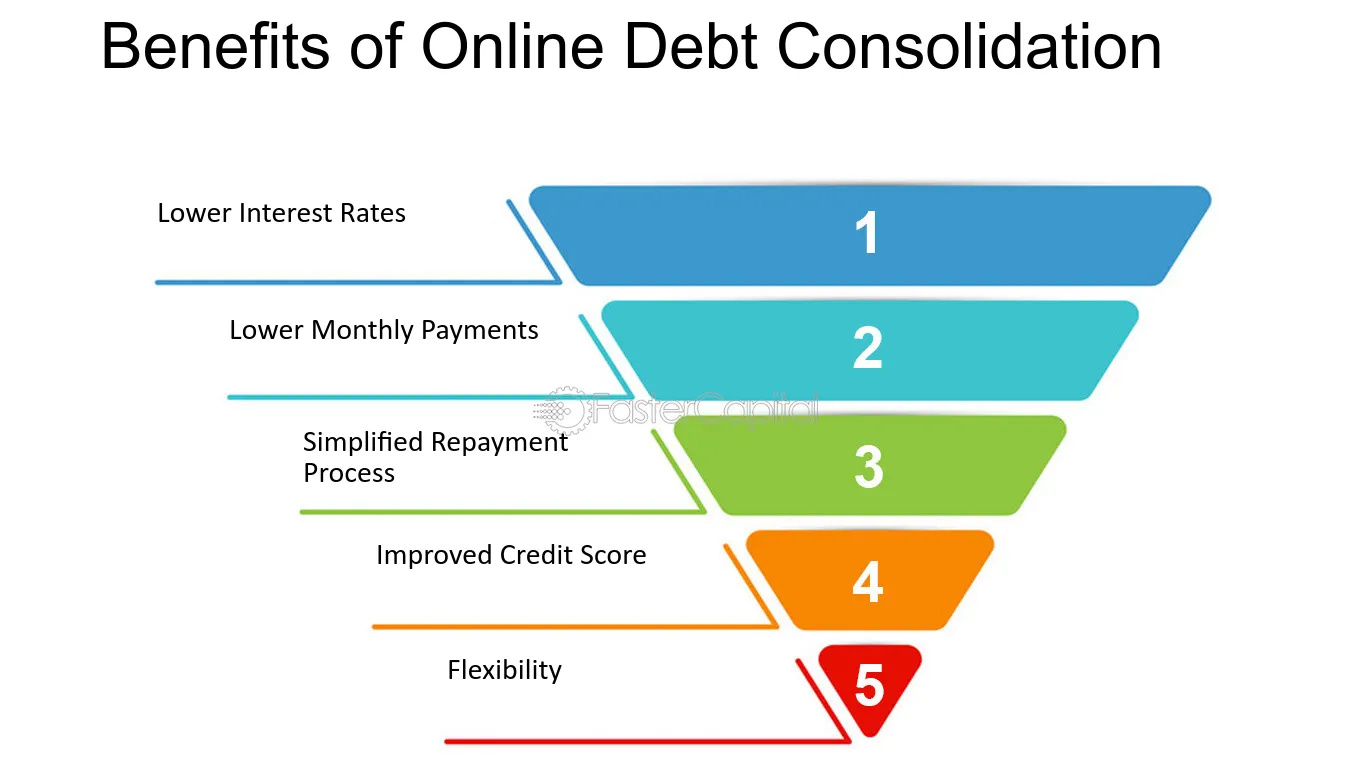

Advantages of Using Payment Gateways in Debt Consolidation

Ever tried juggling multiple balls in the air? That’s precisely what managing multiple debts feels like. Payment gateways simplify this process. They bring all your debts under one umbrella, ensuring you make timely payments without the hassle.

Challenges Faced in Implementing Payment Gateways

However, like any technological marvel, payment gateways come with a set of challenges. Technical glitches, system downtimes, and regulatory hurdles can sometimes throw a spanner in the works. But with advancements in technology and stringent regulations, these challenges are becoming less daunting.

Future Outlook of Payment Gateways in Debt Consolidation

The future looks promising. With advancements in technology, payment gateways are poised to become more efficient, secure, and user-friendly. Moreover, as the market evolves, we can expect more innovations catering to specific needs and ensuring a hassle-free debt consolidation experience

Embracing Technological Advancements

As the digital landscape of India evolves, so do the payment gateways for online debt consolidation in India. We’re entering an era where artificial intelligence, machine learning, and blockchain are revolutionizing financial transactions. Imagine a scenario where your debt consolidation process becomes automated and decisions are based on real-time data analytics. Sounds futuristic, right? Well, the future is now, and payment gateways are at the forefront of this transformation.

The Role of User Experience

Beyond security and efficiency, user experience stands paramount. In a market as diverse as India, catering to a wide demographic requires intuitive interfaces, multilingual support, and also seamless integration with various platforms. Payment gateways are adapting to these needs, offering customizable solutions that resonate with the masses.

The Economic Implications

From an economic standpoint, the proliferation of payment gateways has broader implications. By streamlining debt consolidation processes, these platforms contribute to financial stability[4], fostering an environment conducive to growth. Moreover, by reducing transactional inefficiencies, they promote economic efficiency, benefiting both borrowers and lenders.

Addressing Skepticism

However, with growth comes skepticism. As the market becomes saturated with numerous payment gateways, discerning the reliable from the unreliable becomes challenging. It’s imperative to conduct due diligence, prioritize security, and opt for platforms with a proven track record. After all, when it comes to financial transactions, trust is non-negotiable.

The Human Element

Amidst the technological jargon and financial intricacies, let’s not forget the human element. At its core, debt consolidation is about providing individuals with a fresh start and a chance to rebuild and reclaim their financial freedom[5]. Payment gateways, in this context, serve as enablers, facilitating this journey with efficiency and empathy.

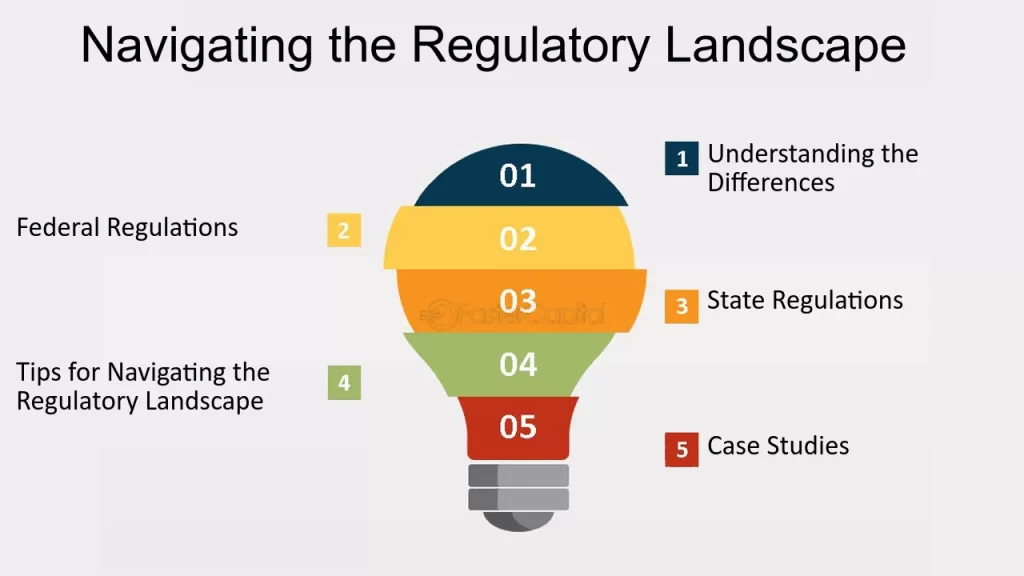

Navigating the Regulatory Landscape

In a country as vast and diverse as India, navigating the regulatory landscape is no mean feat. Payment gateways must adhere to stringent regulations, ensuring compliance while fostering innovation. This delicate balance requires collaboration between policymakers, financial institutions, and tech innovators, laying the foundation for a robust and resilient ecosystem.

The Path Ahead

As we reflect on the evolving landscape of online debt consolidation in India, one thing remains clear: payment gateways are here to stay. They embody the spirit of innovation, resilience, and adaptability, reshaping the financial landscape one transaction at a time. So, the next time you embark on your debt consolidation journey, remember the unsung heroes working tirelessly behind the scenes, ensuring a seamless experience.

Conclusion

In the grand scheme of online debt consolidation in India, payment gateways play a pivotal role. They not only ensure secure transactions but also enhance the user experience, making the process seamless. As we march towards a digital future, their significance will only grow, redefining how we perceive and manage debts.

FAQs

- What are payment gateways?

- Payment gateways are platforms that facilitate online transactions, ensuring secure and seamless payments.

- How do payment gateways enhance security in debt consolidation?

- Payment gateways use advanced encryption and security protocols, ensuring safe and secure transactions.

- Which are the popular payment gateways in India for debt consolidation?

- Popular payment gateways in India include Razorpay, Paytm, and Instamojo, among others.

- What challenges can arise while using payment gateways for debt consolidation?

- Some challenges include technical glitches, system downtimes, and regulatory hurdles.

- How can one ensure a smooth payment process through these gateways?

- By choosing a reliable payment gateway, staying updated with security protocols, and ensuring regular system checks, one can ensure a smooth payment process.