AUTHOR : MICKEY JORDAN

DATE : 27/12/2023

Introduction

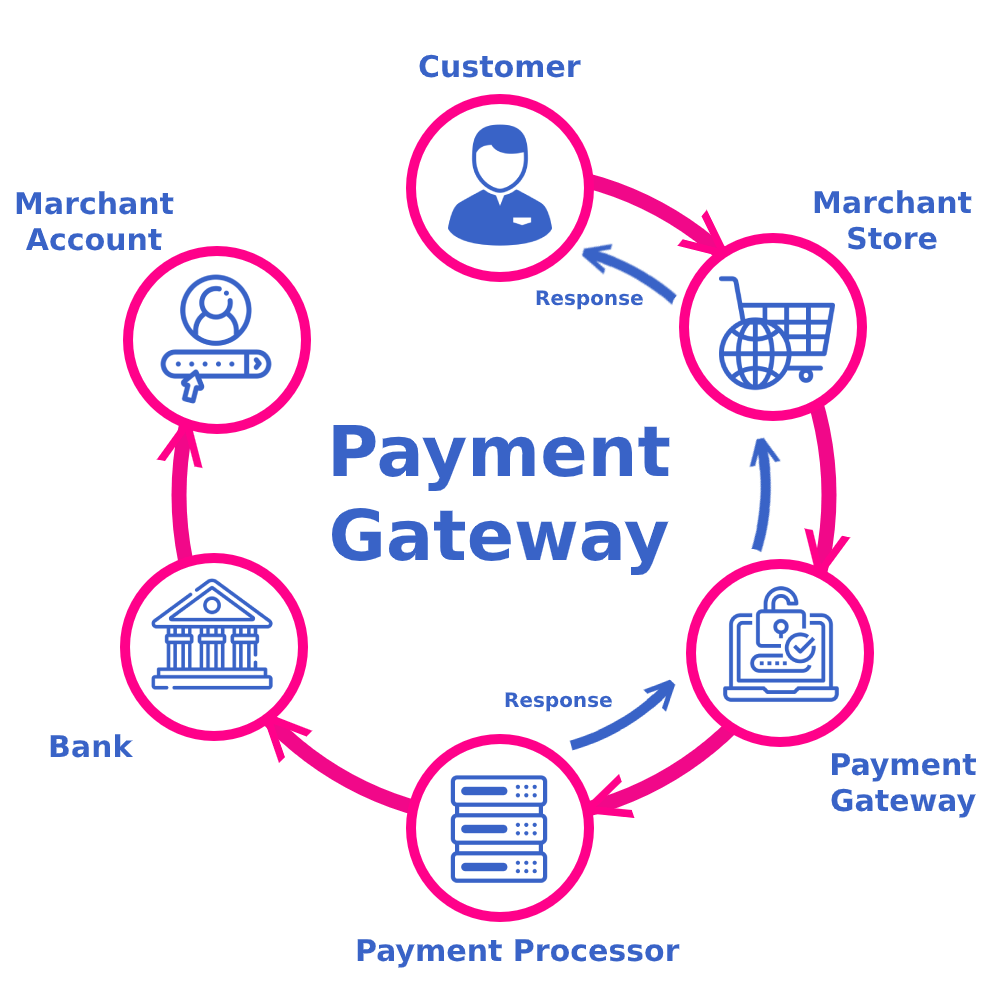

In the fast-paced digital era, where online transactions[1] have become the norm, the role of payment gateways in India has evolved significantly. These gateways serve as the backbone of secure and seamless monetary transactions, making them indispensable for businesses and consumers alike.

Evolution of Payment Gateways in India

In the early stages, payment gateway in India faced challenges related to security and technological limitations. However, with advancements in technology and the advent of digital wallets, the landscape has transformed dramatically. Today, users experience swift and secure transactions, thanks to the continuous evolution of payment gateway[2] software.

Key Features of a Robust Payment Gateway

A robust payment gateway boasts features such as stringent security protocols, a user-friendly interface, and compatibility with various platforms. Security is paramount, with encryption technologies ensuring that sensitive information remains confidential. The interface is designed for easy navigation, enhancing the user experience, while integration options provide flexibility for businesses of all sizes.

Popular Payment Gateways in India

Numerous payment gateways hold a commanding presence in the Indian market, with each presenting distinct and innovative features. From industry giants to emerging players, the competition drives innovation. Leading names include Razorpay, PayU, and Instamojo, each contributing to the growth of online transactions in India.

Advantages of Using Online Payment Gateways

The advantages of utilizing online payment gateways extend beyond mere convenience. For businesses, these gateways streamline transactions, reduce their reliance on cash, and open doors to a broader customer base. Consumers benefit from the ease of making secure transactions from the comfort of their homes.

Challenges Faced by Payment Gateway Users

While the benefits are evident, challenges persist. Security concerns and occasional transaction failures raise eyebrows. The industry constantly addresses these issues, implementing measures to enhance security and minimize disruptions.

How to Choose the Right Payment Gateway for Your Business

Selecting the right payment gateway requires careful consideration. Factors such as security, ease of integration, and cost play pivotal roles. Case studies of successful implementations serve as valuable guides for businesses navigating this decision.

Latest Technological Trends in Payment Gateways

As technology evolves, so do payment gateways. Blockchain technology is making waves, ensuring even greater security and transparency. Biometrics adds an extra layer of protection, heralding a new era in secure transactions[3].

Impact of Payment Gateways on E-commerce Growth in India

E-commerce in India has experienced growth, and payments are integral to this expansion. The statistics speak for themselves, underscoring the pivotal role these gateways play in fostering a thriving online marketplace[4].

Future Prospects and Innovations

Looking ahead, the future of payment gateways is promising. Predictions indicate further innovations, possibly artificial intelligence and machine learning. The industry remains dynamic, adapting to the evolving needs of businesses and consumers.

Case Studies: Successful Implementation Stories

Real-life examples showcase the success stories of businesses that use efficient payment gateways. These case studies provide insights into the transformative impacts on revenue and customer satisfaction.

Security Measures for Online Transactions

The emphasis on security cannot be overstated. SSL and two-factor authentication are among the measures implemented to protect user information, ensuring a secure online payment[5] environment.

Customer Support in Payment Gateway Services

Responsive customer support is crucial for resolving concerns and issues promptly. Examining case studies of customer service in the payment gateway industry highlights the importance of building and maintaining trust.

Comparative Analysis of International Payment Gateways vs. Indian Payment Gateways

On the global stage, Indian payment gateways compete. A comparative analysis reveals the unique strengths of Indians and their ability to cater to diverse market needs.

Conclusion

In conclusion, the significance of payment gateways in India cannot be overstated. They form the basis of secure online transactions, the growth of e-commerce, and enabling businesses to thrive in the digital landscape. As technology continues to advance, the future holds even more exciting possibilities for payment gateways.

FAQs

- Are online payment gateways secure for transactions?

- Yes, online payment gateways use advanced encryption technologies to secure transactions.

- How do I choose the right payment gateway for my business?

- Consider factors such as security, integration options, and cost before selecting a payment gateway.

- Can payment gateways be integrated with e-commerce platforms?

- Yes, most payment gateways offer seamless integration with popular e-commerce platforms.

- What should I do if a transaction fails?

- Contact customer support provided by the payment gateway for assistance in resolving transaction failures.

- Are Indian payment gateways competitive on the global stage?

- Yes, Indian payment gateways compete effectively with their international counterparts, offering unique strengths and features.