AUTHOR = DORA

DATE= 20/12/24

In today’s rapidly evolving financial[1] landscape, individuals and businesses[2] in India face increasing complexity when it comes to managing their financial goals. With a wide variety of financial products, investment[3] opportunities, and regulatory[4] changes, it can be difficult to know where to turn for guidance. This is where personalized financial aid consulting plans come in, offering tailored advice and strategies[5] that are unique to each client’s needs.

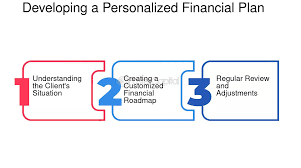

1. What is Personalized Financial Aid Consulting?

Personalized financial aid consulting is a service that provides custom financial strategies and advice based on an individual’s or business’s specific goals, challenges, and financial situation. Unlike generic financial advice, personalized consulting takes into account the unique needs of each client, including their income, expenses, long-term goals, risk tolerance, and investment preferences.

2. The Growing Demand for Personalized Financial Aid Consulting in India

India’s financial ecosystem has grown tremendously in recent years, with a wide array of financial products and services available. However, this rapid expansion has led to increased complexity, making it difficult for many people to choose the right financial solutions. Here are a few key reasons why personalized financial aid consulting is becoming essential:

a) Diverse Financial Needs Across India

India is a vast and diverse country, with varying economic conditions, cultural preferences, and financial goals. A universal approach to financial planning is not effective for everyone. Whether it’s a salaried professional looking for tax optimization or a small business seeking capital, personalized financial aid consulting ensures that individuals and businesses receive tailored financial strategies that suit their needs.

3. The Role of Payment Gateways in Personalized Financial Aid Consulting

Payment gateways play an essential role in modern financial services, especially in the context of personalized financial aid consulting. These platforms facilitate secure, digital transactions, making it easier for clients to access financial services and pay for consultations. Here are a few ways payment gateways enhance the personalized financial consulting experience:

a) Convenient and Secure Payments

In an increasingly digital world, payment gateways allow clients to make payments for financial consulting services quickly and securely. Whether it’s paying for a one-time consultation or subscribing to a long-term advisory service, payment gateways provide a seamless way to complete transactions. This is particularly important for clients who prefer online payments via debit/credit cards, bank transfers, or mobile wallets. Payment gateway Personalized financial aid consulting plans in India

b) Real-Time Payment Processing

Payment gateways enable real-time processing of transactions, ensuring that payments are instantly reflected in the consultant’s system. This facilitates quick, hassle-free payments and allows consultants to focus on providing value to their clients rather than dealing with administrative tasks related to payments. Payment gateway Personalized financial aid consulting plans in India

4. Key Areas of Personalized Financial Aid Consulting in India

a) Education Loan Consultation

Education in India has become a significant financial burden for many families. Personalized financial aid consultants can help students and parents navigate the complex world of education loans. They provide guidance on loan options, eligibility, interest rates, repayment plans, and other factors. Consultants can also assist students in managing their loan repayment strategies after graduation. Payment gateway Personalized financial aid consulting plans in India

b) Business Loan Consultation

Small and medium-sized enterprises (SMEs) often face challenges in securing business loans. Financial consultants help entrepreneurs identify the best loan options available, including government schemes, private financing, and venture capital. Consultants also guide business owners on the documentation and application process, increasing their chances of securing funding.

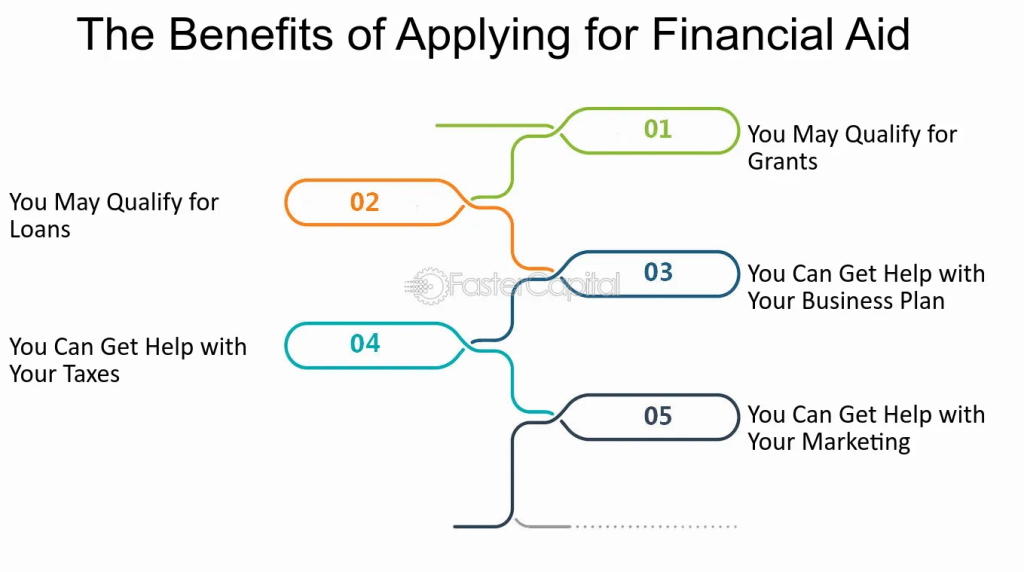

5. The Benefits of Personalized Financial Aid Consulting

The advantages of opting for personalized financial aid consulting in India are numerous:

a) Tailored Financial Solutions

Personalized financial consulting provides customized solutions based on an individual’s or business’s financial situation. This increases the likelihood of achieving financial goals and ensures that the chosen solutions align with the client’s objectives.

b) Enhanced Financial Literacy

Clients gain a better understanding of their financial options and learn how to make informed decisions. This improved financial literacy empowers clients to manage their finances more effectively.

6. Conclusion

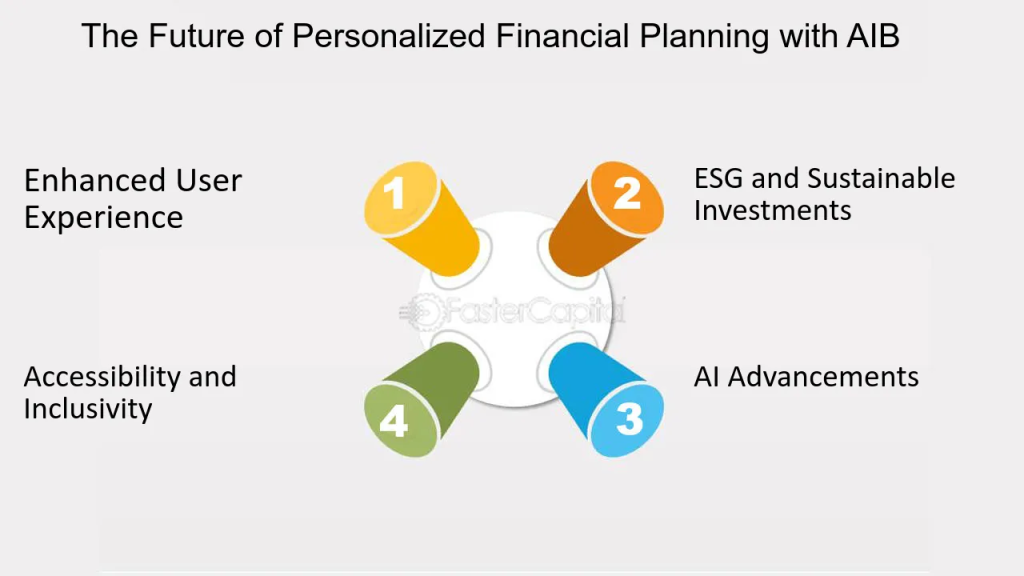

Personalized financial aid consulting plans offer immense value to individuals and businesses in India. By providing tailored financial advice and strategies, these consulting services help clients navigate the complexities of loans, investments, taxes, and more. Through the integration of payment gateways, these services become even more accessible, secure, and convenient. As India’s financial landscape continues to evolve, personalized financial consulting will remain an essential tool for achieving long-term financial success.

(FAQs) –

1. What is personalized financial aid consulting?

Personalized financial aid consulting refers to customized financial advice and strategies designed to meet an individual’s or business’s unique financial needs. Unlike generic financial planning services, personalized consulting takes into account specific financial goals, challenges, risk profiles, and personal circumstances, offering tailored solutions in areas such as investment, tax planning, debt management, loans, and wealth management.

2. How can personalized financial aid consulting benefit me?

Personalized financial consulting helps you make informed decisions about your financial future. By tailoring strategies to your unique goals—whether it’s securing a loan, managing taxes, investing, or planning for retirement—financial consultants help ensure that you’re on the right path to financial success.

3. What role do payment gateways play in personalized financial aid consulting?

Payment gateways facilitate secure, seamless, and convenient online payments for financial consulting services. They allow clients to pay for consultations, subscriptions, or long-term advisory services through various methods, including credit/debit cards, mobile wallets, and UPI.

4. Why should I choose personalized financial aid consulting in India?

India’s financial landscape is complex, with a variety of financial products, regulatory changes, and market conditions. Personalized consulting helps you navigate these complexities by offering advice that is specifically tailored to your financial goals, whether you’re managing debt, investing, saving for retirement, or planning for education.

5. Can I pay for personalized financial aid consulting services online?

Yes, payment gateways allow clients to pay for financial aid consulting services online, ensuring convenience and security. Clients can use credit/debit cards, bank transfers, mobile wallets, or UPI to complete their transactions.

GET IN TOUCH ____