AUTHOR : LISA WEBB

DATE : FEBRUARY 26, 2024

Payment Gateway Software Downloads In India

In today’s rapidly evolving digital landscape, the seamless flow of financial transactions is paramount for businesses. As the e-commerce industry continues to thrive, the need for efficient and secure payment solutions becomes more pronounced. In India, the utilization of payment gateway software has become integral for businesses of all sizes. This article delves into the intricacies of Payment Gateway Software Downloads in India, exploring the evolution, key features, providers, selection criteria, installation process, security measures, benefits, challenges, mobile solutions, government regulations, industry trends, and also real-world case studies.

Evolution of Payment Gateway Software

To comprehend the current state of payment gateway software in India, it’s essential to trace its evolution. The historical journey reveals the influence of technological advancements in shaping these platforms.

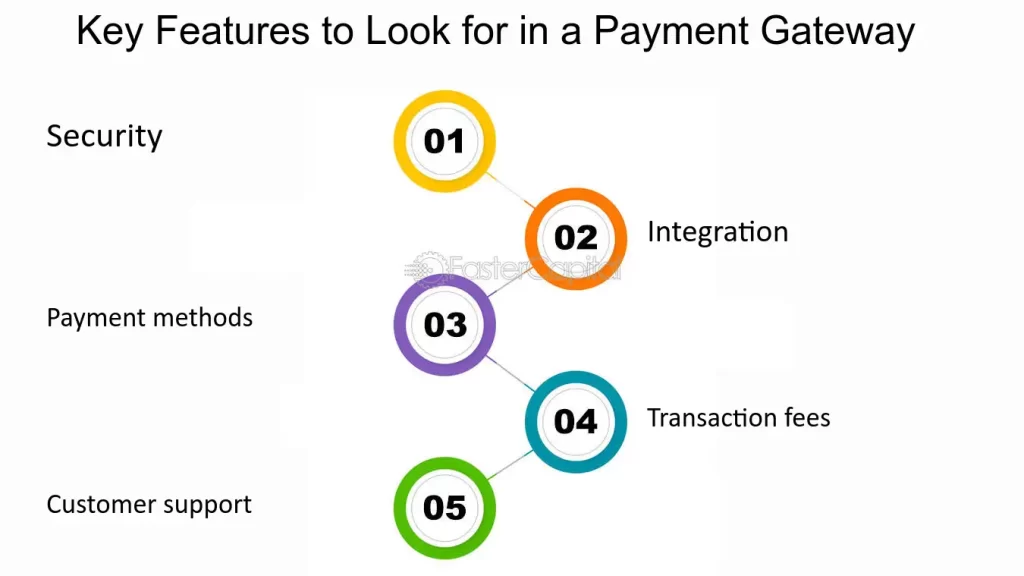

Key Features of Payment Gateway Software

Security, user-friendly interfaces, and also integration capabilities stand out as pivotal features. Robust security protocols ensure the confidentiality and integrity of transactions, while user-friendly interfaces enhance the overall customer experience. The seamless integration capabilities of modern payment gateway software enable businesses to adapt to diverse digital ecosystems effortlessly.

Popular Payment Gateway Software Providers in India

Several providers dominate the payment gateway software landscape in India. Leading the pack are giants like Razorpay, PayU, and Instamojo, each offering unique features and services tailored to different

business [1] requirements.

Choosing the Right Payment Gateway Software

Selecting the most suitable payment gateway software involves considering factors such as transaction fees, supported payment methods [2] , and compatibility with the business model. The importance of aligning the software with specific business needs cannot be overstated.

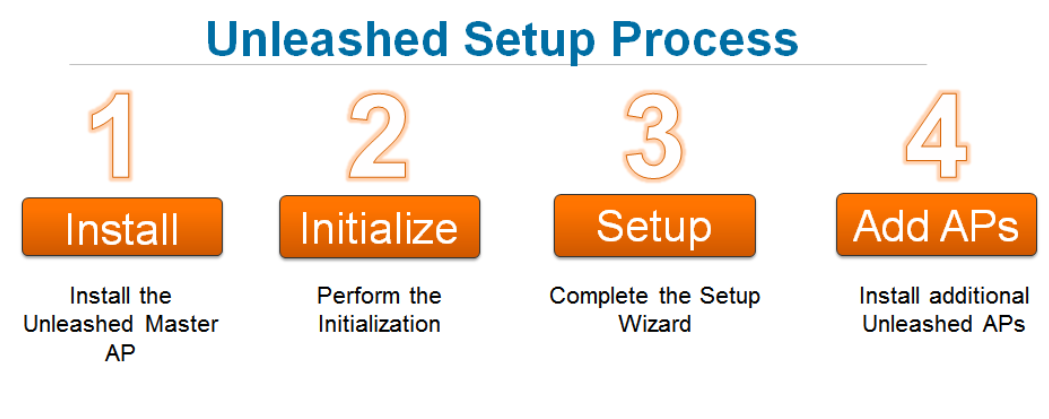

Installation and Setup Process

Ensuring a smooth installation and setup process is crucial for businesses adopting payment gateway software. A step-by-step guide helps navigate through the initial stages, while addressing common challenges and providing troubleshooting solutions ensures a hassle-free experience.

Security Measures in Payment Gateway Software

The backbone of any payment gateway [3] software is its security infrastructure. Implementing SSL certificates and two-factor authentication adds layers of protection, instilling confidence in both businesses and consumers.

Benefits of Using Payment Gateway Software in India

The adoption of payment gateway software translates into streamlined transactions and increased customer [4] trust. Businesses witness a reduction in payment processing time, leading to improved customer satisfaction and loyalty.

Challenges and Solutions

Despite the numerous[5] advantages, challenges such as technical glitches and fraud risks persist. Addressing these issues requires a proactive approach involving continuous monitoring, regular updates, and collaboration with cybersecurity experts.

Mobile Payment Gateway Solutions

The surge in mobile transactions has given rise to mobile-friendly payment gateway solutions. These platforms are designed to cater to the growing number of consumers who prefer to make transactions using their smartphones.

Impact of Government Regulations

Government regulations play a pivotal role in shaping the payment gateway software landscape. Compliance with regulatory requirements is not only essential for legality but also for building trust among consumers and fostering a secure digital environment.

Trends in Payment Gateway Software

Two prominent trends shaping the future of payment gateway software are the rise of contactless payments and the integration of blockchain technology. These innovations are expected to further enhance the efficiency and security of digital transactions.

Case Studies

Examining real-world case studies provides insights into the successful implementation of payment gateway software across diverse industries. These examples serve as inspiration for businesses looking to optimize their financial processes.

User Reviews and Ratings

The significance of user feedback cannot be overstated. Platforms that host reviews and ratings become valuable resources for businesses seeking genuine insights into the performance and reliability of different payment gateway software.

Conclusion

The landscape of payment gateway software downloads in India reflects the dynamic nature of the digital economy. Embracing these solutions is no longer a choice but a necessity for businesses looking to thrive in a competitive market. The evolution, features, providers, selection criteria, security measures, benefits, challenges, mobile solutions, government regulations, industry trends, case studies, and user reviews.

FAQs

- Is payment gateway software essential for small businesses in India?

- Yes, adopting payment gateway software is crucial for small businesses to streamline transactions and gain customer trust.

- How do government regulations impact the choice of payment gateway software?

- Government regulations influence the features and security measures businesses need to adhere to, affecting the selection of payment gateway software.

- What are the key security measures in payment gateway software?

- SSL certificates and two-factor authentication are essential security measures in payment gateway software.

- Can mobile payment gateway solutions be integrated with existing systems?

- Yes, most mobile payment gateway solutions are designed for seamless integration with various business systems.

- How do businesses address challenges in payment gateway software implementation?

- Proactive measures such as continuous monitoring, regular updates, and collaboration with cybersecurity experts help address challenges in implementation.